Enlarge image

1350 STATE OF SOUTH CAROLINA I-319

DEPARTMENT OF REVENUE

(Rev. 4/11/23)

dor.sc.gov 2023 TUITION TAX CREDIT 3350

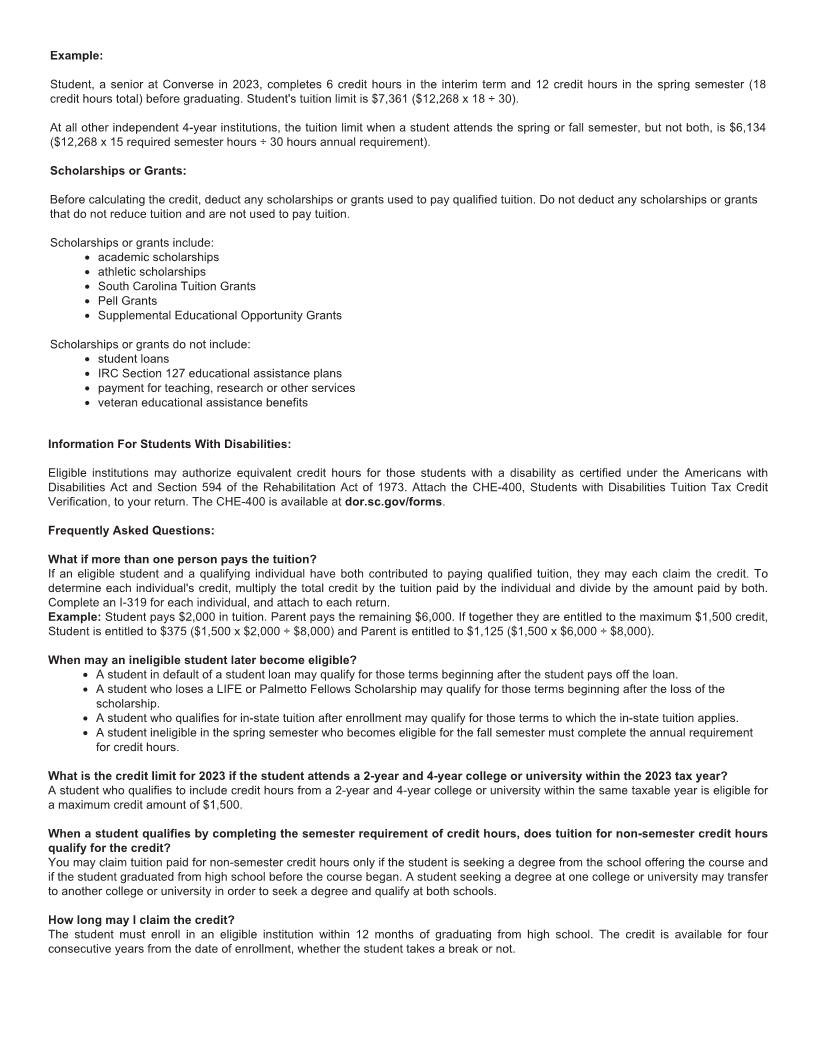

STUDENT ELIGIBILITY FOR TUITION TAX CREDIT

Did the student receive a high school diploma from one of the following?

• an SC high school

• a high school homeschool program in SC in the manner required by law

• a preparatory high school outside SC while being a dependent of a parent or NO NOT

guardian who is a legal SC resident ELIGIBLE

YES

Month and year student received their high school diploma: _______________ NO NOT

Did the student receive this diploma during or after May 2018? ELIGIBLE

YES

Month and year the student first enrolled in a qualifying college or university: _______________

(see instructions for a complete list of qualifying colleges and universities) NO NOT

Was this enrollment within 12 months after graduating from high school? ELIGIBLE

YES

Did the student qualify for in-state tuition during the tax year? NO NOT

ELIGIBLE

YES

Was the student admitted, enrolled, and classified as a degree-seeking undergraduate, or was NO NOT

the student enrolled in an undergraduate certificate or diploma program of at least one year?

ELIGIBLE

YES

How many credit hours did the student complete in 2023? ___________ NO

Is it at least 30 credit hours or 30 equivalent hours?

YES YES Did the student attend one semester, Spring or Fall, but

not both, and complete at least 15 credit hours?

NO

YES Did the student attend one semester, Spring or Fall, but not both at

Converse or Wofford and complete the required equivalent hours?

NO

YES Did the student complete the required equivalent

hours approved by the authorized Disability Service NO NOT

Provider at the qualifying institution? ELIGIBLE

Did the student earn credit hours after four years from the date the student first enrolled in a

qualifying college or university? Answer NO if additional time was granted due to medical YES NOT

necessity. ELIGIBLE

NO

Was the student in default on a student loan? Answer NO if the loan was paid in full. YES NOT

ELIGIBLE

NO

Did the student receive a LIFE or Palmetto Fellows Scholarship for each semester (Spring and YES NOT

Fall) attended? ELIGIBLE

NO

Has the student ever been found guilty of any felonies? Answer NO if the record has been YES NOT

expunged. ELIGIBLE

NO

Was the student found guilty of any alcohol or drug related misdemeanor during the year? YES NOT

ELIGIBLE

NO

ELIGIBLE FOR TUITION TAX CREDIT

33501230