Enlarge image

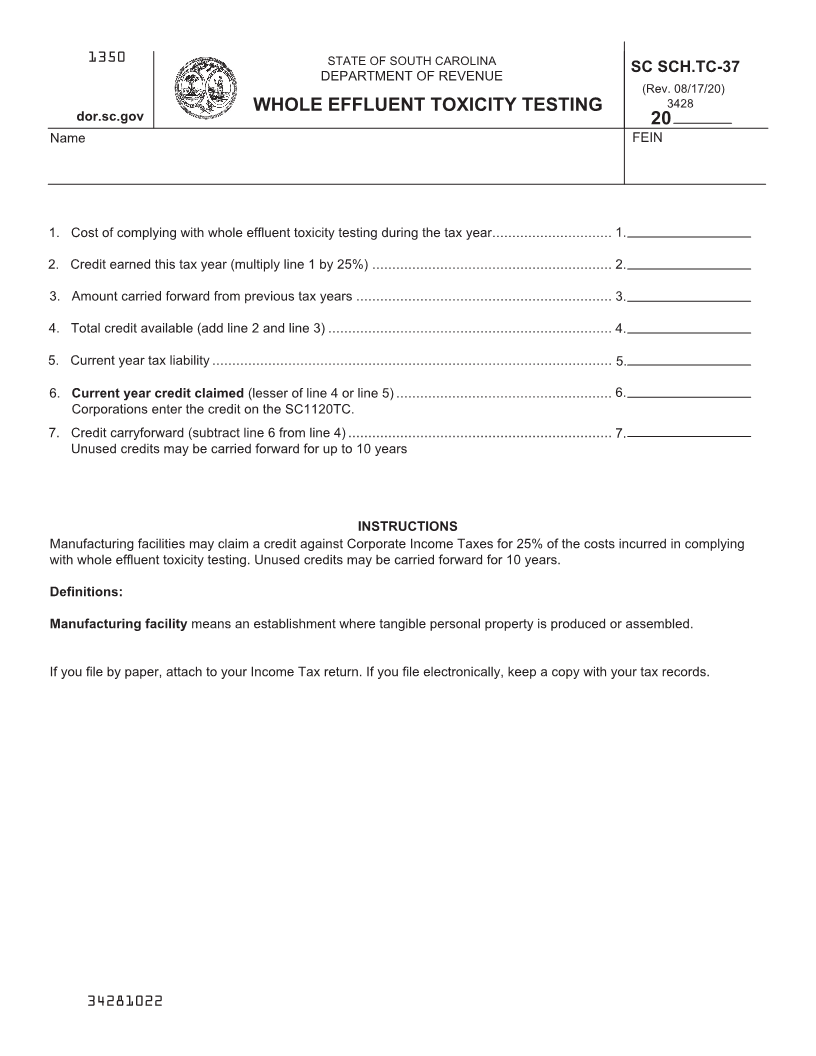

1350 STATE OF SOUTH CAROLINA

SC SCH.TC-37

DEPARTMENT OF REVENUE

(Rev. 08/17/20)

WHOLE EFFLUENT TOXICITY TESTING 3428

dor.sc.gov 20

Name FEIN

1. Cost of complying with whole effluent toxicity testing during the tax year.............................. 1.

2. Credit earned this tax year (multiply line 1 by 25%) ............................................................ 2.

3. Amount carried forward from previous tax years ................................................................ 3.

4. Total credit available (add line 2 and line 3) ....................................................................... 4.

5. Current year tax liability .................................................................................................... 5.

6. Current year credit claimed (lesser of line 4 or line 5) ...................................................... 6.

Corporations enter the credit on the SC1120TC.

7. Credit carryforward (subtract line 6 from line 4) .................................................................. 7.

Unused credits may be carried forward for up to 10 years

INSTRUCTIONS

Manufacturing facilities may claim a credit against Corporate Income Taxes for 25% of the costs incurred in complying

with whole effluent toxicity testing. Unused credits may be carried forward for 10 years.

Definitions:

Manufacturing facility means an establishment where tangible personal property is produced or assembled.

If you file by paper, attach to your Income Tax return. If you file electronically, keep a copy with your tax records.

34281022