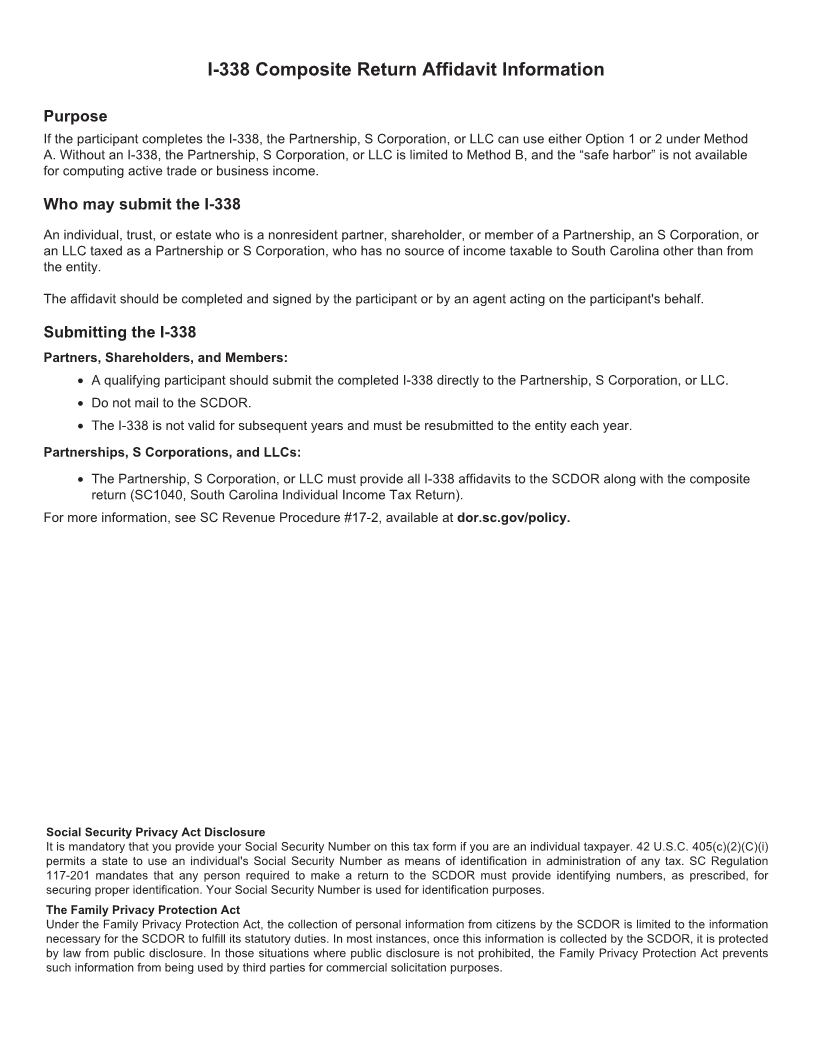

Enlarge image

1350

STATE OF SOUTH CAROLINA I-338

DEPARTMENT OF REVENUE (Rev. 4/18/23)

3418

dor.sc.gov COMPOSITE RETURN AFFIDAVIT

20

I certify and agree to the following:

1. I am a nonresident partner of a Partnership, shareholder of an S Corporation, or member of a Limited Liability

Company (LLC).

2. My name is:

My address is:

Street address

City State ZIP

3. My Social Security Number (SSN) or Federal Identification Number (FEIN) is:

4. The income this affidavit and agreement applies to is:

Distributed or undistributed South Carolina income from a Partnership.

Distributed or undistributed South Carolina income from an S Corporation.

Distributed or undistributed South Carolina income from an LLC taxed as a Partnership.

Distributed or undistributed South Carolina income from an LLC taxed as an S Corporation.

5. Entity's name:

Entity's address:

Street address

City State ZIP

Entity's FEIN:

6. I have no source of income taxable to South Carolina other than income from the entity named above.

7. This affidavit applies for the year January 1 - December 31, _______________ , or for the fiscal tax year

beginning ________________________________ and ending ________________________________ .

I declare under penalty of perjury that I have examined this affidavit and that, to the best of my knowledge and belief, it is true,

correct, and complete.

Under SC Code Section 12-54-44(B)(6)(a), a person who willfully makes and subscribes any return, statement, or other

document that contains, or is verified by, a written declaration made under penalties of perjury that they do not believe to be true

and correct as to every material matter is guilty of a felony and, upon conviction, must be fined not more than $500 or

imprisoned not more than five years, or both, together with the cost of prosecution.

Signature of partner, shareholder, or member Date

Print name of partner, shareholder, or member

34181024