Enlarge image

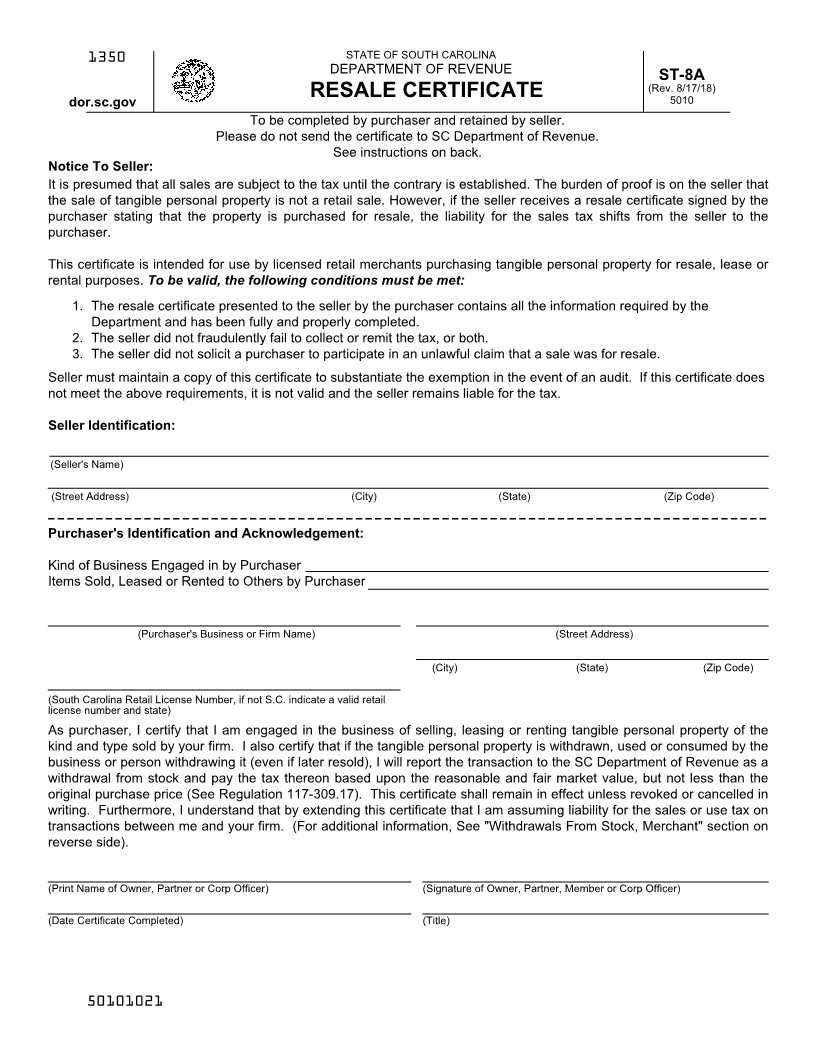

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

ST-8A

(Rev. 8/17/18)

dor.sc.gov RESALE CERTIFICATE 5010

To be completed by purchaser and retained by seller.

Please do not send the certificate to SC Department of Revenue.

See instructions on back.

Notice To Seller:

It is presumed that all sales are subject to the tax until the contrary is established. The burden of proof is on the seller that

the sale of tangible personal property is not a retail sale. However, if the seller receives a resale certificate signed by the

purchaser stating that the property is purchased for resale, the liability for the sales tax shifts from the seller to the

purchaser.

This certificate is intended for use by licensed retail merchants purchasing tangible personal property for resale, lease or

rental purposes. To be valid, the following conditions must be met:

1. The resale certificate presented to the seller by the purchaser contains all the information required by the

Department and has been fully and properly completed.

2. The seller did not fraudulently fail to collect or remit the tax, or both.

3. The seller did not solicit a purchaser to participate in an unlawful claim that a sale was for resale.

Seller must maintain a copy of this certificate to substantiate the exemption in the event of an audit. If this certificate does

not meet the above requirements, it is not valid and the seller remains liable for the tax.

Seller Identification:

(Seller's Name)

(Street Address) (City) (State) (Zip Code)

Purchaser's Identification and Acknowledgement:

Kind of Business Engaged in by Purchaser

Items Sold, Leased or Rented to Others by Purchaser

(Purchaser's Business or Firm Name) (Street Address)

(City) (State) (Zip Code)

(South Carolina Retail License Number, if not S.C. indicate a valid retail

license number and state)

As purchaser, I certify that I am engaged in the business of selling, leasing or renting tangible personal property of the

kind and type sold by your firm. I also certify that if the tangible personal property is withdrawn, used or consumed by the

business or person withdrawing it (even if later resold), I will report the transaction to the SC Department of Revenue as a

withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the

original purchase price (See Regulation 117-309.17). This certificate shall remain in effect unless revoked or cancelled in

writing. Furthermore, I understand that by extending this certificate that I am assuming liability for the sales or use tax on

transactions between me and your firm. (For additional information, See "Withdrawals From Stock, Merchant" section on

reverse side).

(Print Name of Owner, Partner or Corp Officer) (Signature of Owner, Partner, Member or Corp Officer)

(Date Certificate Completed) (Title)

50101021