Enlarge image

INSTRUCTIONS FOR

COMPLETING PA UC

QUARTERLY TAX FORMS

GENERAL INFORMATION

For assistance with these forms, contact Employer Tax Services at 866-403-6163, which is staffed weekly from 7:30 a.m. to 4:00 p.m. Eastern Time

or visit our website at www.uc.pa.gov.

Due dates. If a due date falls on a Saturday, Sunday, or legal holiday, the reports will become due on the next business day. Reports and payment

are due for each quarter as follows:

Quarter covering Jan, Feb, March April, May, June July, Aug, Sep Oct, Nov, Dec

Due on or before April 30 July 31 October 31 January 31

Employer’s contribution rate. The department’s official notification of an employer’s contribution rate is the issuance of the contribution rate

notice, Form UC-657.

Employer’s account number. Use this number in all correspondence with the department regarding PA UC taxes or benefits. If there is no PA

UC account number, leave this box blank and provide Federal Identification Number in item 12. Note that an employer’s PA UC account number

consists of seven numeric digits.

Mail report. Use the enclosed return envelope. If the envelope is missing, mail report to the PA Department of Labor & Industry, Office of

Unemployment Compensation Tax Services, PO Box 68568, Harrisburg, PA 17106-8568.

No wages this quarter. A report must be filed even though there has been no employment and no wages have been paid during the calendar

quarter. In this case, enter zero (0) in items 1, 2 and 4 on Form UC-2; Form UC-2A is not required. Sign Form UC-2 and return. Form UC-2B should

be completed if PA employment has been permanently discontinued or transferred.

NOTE: Do not file a paper copy of Form UC-2 and/or UC-2A if that form is being submitted using an electronic filing method. This action could

result in a duplication of records.

Internet Filing. All employers must file UC reports online and may be required to pay electronically. Visit Pennsylvania’s UC Management System at

www.uctax.pa.gov for more information. Employers who are unable to comply with the electronic filing requirements may request a temporary

waiver to submit paper Forms UC-2 and UC-2A at www.uc.pa.gov.

Payment Methods.

Employers are required to pay UC contributions electronically if the total liability owed equals or exceeds $5,000 for a payment period. Once the

threshold is met, all subsequent payments must also be submitted electronically, even if the amounts due for the subsequent periods are less

than $5,000. To make an electronic payment or for more information, refer to www.uctax.pa.gov. Employers who are unable to comply with the

electronic payment requirements may request a temporary waiver to submit a paper remittance.

PA FORM UC-2, EMPLOYER’S REPORT FOR UNEMPLOYMENT COMPENSATION

Item 1. For each month in the calendar quarter, enter the number of all full-time and part-time workers who worked or received wages for the

payroll period which included the 12th of the month. Enter zero (0) if there is no employment for the payroll period. Wages associated with these

pay periods need not be paid during the calendar quarter being reported on the PA form UC-2. For example, an employer who has a bi-weekly payroll

with pay period of 9/9/2021 – 9/22/2021, the September employment count on the PA Form UC-2 for 3rd quarter 2021 (as well as the BLS Multiple

Worksite Report survey) would be based on the count of full and part time employees who were on the payroll during the 9/9/2021 – 9/22/2021 pay

period, even if the wages for this pay period were paid out on 10/05/2021 (thereby reported on the 4th quarter 2021 PA Form UC-2).

Item 2. Enter the total amount of wages, as defined in the Law, paid in this calendar quarter to all employees. This amount should equal the total of

all entries on the Form UC-2A. If no wages were paid during the quarter, enter zero (0), sign and return Form UC-2.

Item 3. If applicable for the tax year, enter the amount of employee contributions. Calculate the employee contributions by multiplying the

employee contribution rate as shown in item 3 by the amount in item 2 (gross wages).

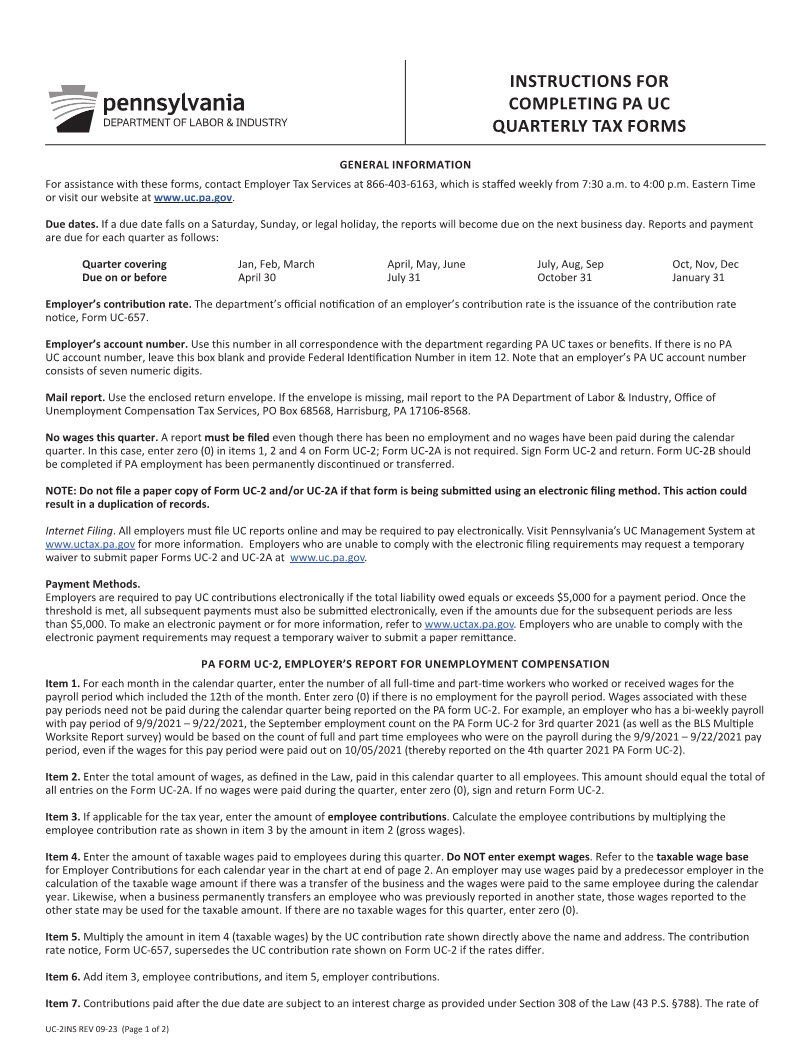

Item 4. Enter the amount of taxable wages paid to employees during this quarter. Do NOT enter exempt wages. Refer to the taxable wage base

for Employer Contributions for each calendar year in the chart at end of page 2. An employer may use wages paid by a predecessor employer in the

calculation of the taxable wage amount if there was a transfer of the business and the wages were paid to the same employee during the calendar

year. Likewise, when a business permanently transfers an employee who was previously reported in another state, those wages reported to the

other state may be used for the taxable amount. If there are no taxable wages for this quarter, enter zero (0).

Item 5. Multiply the amount in item 4 (taxable wages) by the UC contribution rate shown directly above the name and address. The contribution

rate notice, orm UC-657, supersedes the UC contribution rate shown on orm UC-2 if the rates differ. F F

Item 6. Add item 3, employee contributions, and item 5, employer contributions.

Item 7. Contributions paid after the due date are subject to an interest charge as provided under Section 308 of the Law (43 P.S. §788). The rate of

UC-2INS REV 09-23 (Page 1 of 2)