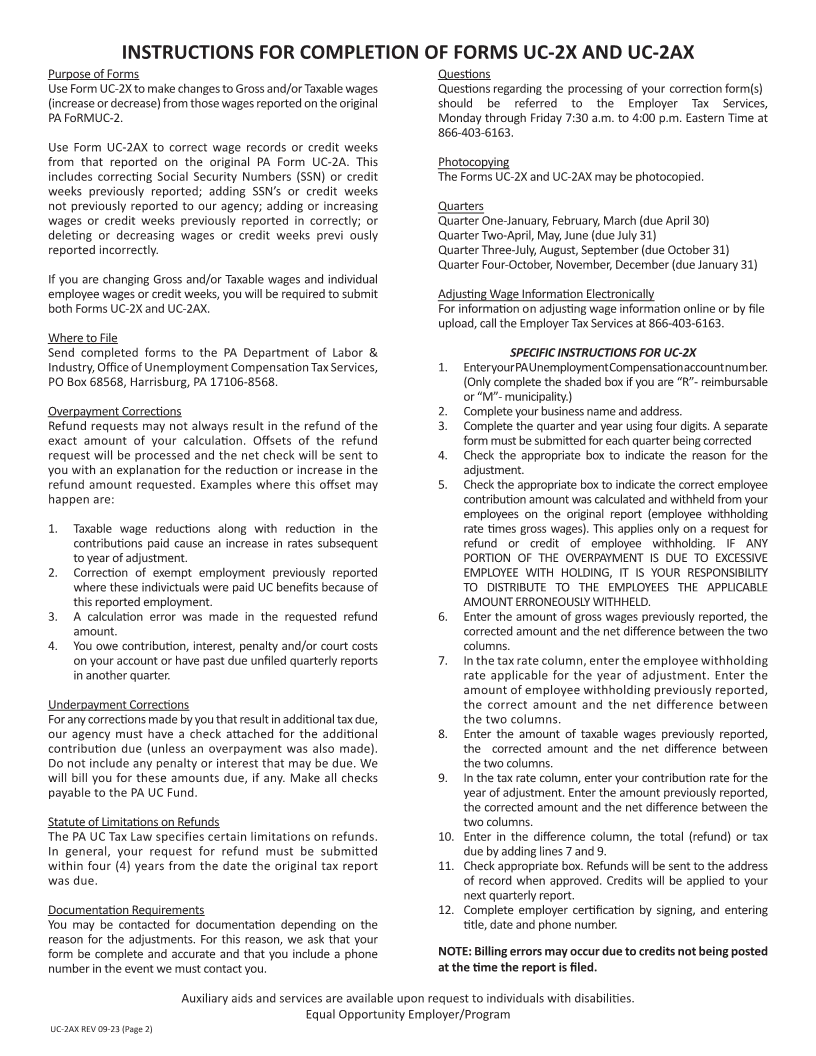

Enlarge image

of

PENNSYLVANIA UNEMPLOYEMENT COMPENSATION CORRECTION REPORT

(To Amend Quarterly UC-2/2A Tax Reports) (A separate form must be submitted for each quarter)

1. EMPLOYER ACCOUNT NUMBER 3. QUARTER/YEAR (A separate form must be submitted for each quarter)

- -

R or M CHECK DIGIT 1, 2,

3 or 4

4. Reason For Correction (Check all that apply):

2. Employer Name and Address: Incorrect Gross Wages. *Please explain: Exempt Wages Reported in Error. *Please explain:

Incorrect Employee Withholding Rate Used Calculation Error. Please explain:

List Rate Used

Incorrect Taxable Wages. Please explain: Other Error. Please explain:

Incorrect Employer Contribution Rate Used

*PROVIDE INDIVIDUAL EMPLOYEE CORRECTION

List Rate Used FORM (UC-2AX). IF NECESSARY.

Wages Reported to wrong State* PLEASE CHECK IF EMPLOYEE WAE DETAIL WAS

CORRECTED ON ELECTRONIC MEDIA

5. Was the employee withholding correctly withheld? Yes No Not applicable (Please see instructions on reverse side.)

TAX RATE AMOUNT PREVIOUSLY CORRECT AMOUNT DIFFERENCE (OVER) UNDER

REPORTED

6. GROSS WAGES

7. EMPLOYEE WITHHOLDING

8. TAXABLE WAGES

9. EMPLOYER CONTRIBUTION

10. TOTAL (REFUND/CREDIT) OR TAX DUE (ADD LINES 7 AND 9) IN THE DIFFERENCE COLUMN REFUNDS/CREDITS SHOULD BE IN PARENTHESE ( )

11. Please check one: Refund Credit Not applicable (Please see instructions on reverse side.)

11. Employer Certification: I certify that the information on this form is true and correct to the best of my knowledge and belief. No part of the amount of employer contributions

reported on taxable wages was deducted or is to be deducted from the employees’ wages.

SIGNATURE OF OWNER, PARTNER, RESPONSIBLE OFFICER OR AUTHORIZED AGENT TITLE DATE PHONE NUMBER PLANT NUMBER

........................................................... DEPARTMENT USE ONLY (DO NOT WRITE BELOW THIS LINE) ......................................................

CORRECTION REPORT JOURNAL VOUCHER

BASIC CONTRIBUTION INTEREST PENALTY A

SY MO YR QTR YR (K) WAGES

RATE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 4

TOTALS

COMMENTS: TOTAL REMITTANCE

Rate Verificaion Certification: Date Contribution Received Date Report Received

B.I. Audit Needed Yes No N/A Benefit Charges Yes No N/A FSD CERTIFICATION/DATE

TAX AGENT DATE TAX TECHNICIAN DATE OTHER REQUIRED SIGNATURE DATE

Year No Charge Rate Revised From to Year No Charge Rate Revised From to

UC-2AX REV 09-23 (Page 1) COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF LABOR & INDUSTRY OFFICE OF UNEMPLOYMENT COMPENSATION TAX SERVICES