Enlarge image

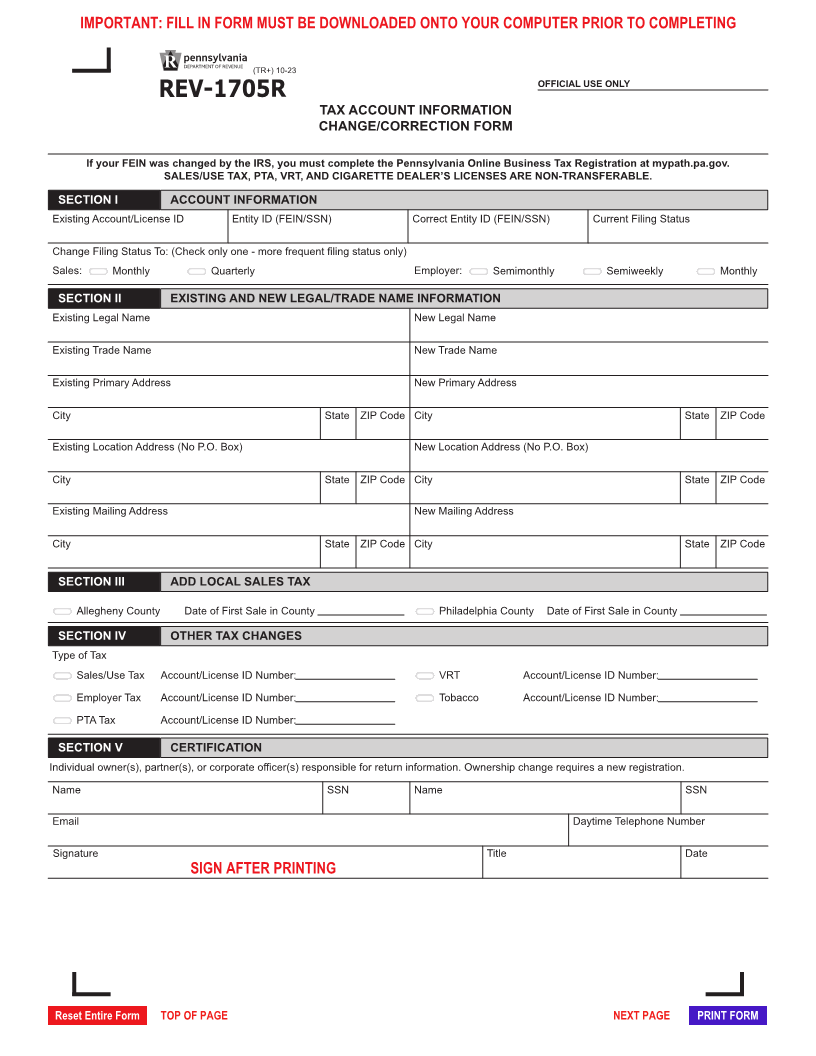

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

(TR+) 10-23

OFFICIAL USE ONLY

REV-1705R

TAX ACCOUNT INFORMATION

CHANGE/CORRECTION FORM

If your FEIN was changed by the IRS, you must complete the Pennsylvania Online Business Tax Registration at mypath.pa.gov.

SALES/USE TAX, PTA, VRT, AND CIGARETTE DEALER’S LICENSES ARE NON-TRANSFERABLE.

SECTION I ACCOUNT INFORMATION

Existing Account/License ID Entity ID (FEIN/SSN) Correct Entity ID (FEIN/SSN) Current Filing Status

Change Filing Status To: (Check only one - more frequent filing status only)

Sales: Monthly Quarterly Employer: Semimonthly Semiweekly Monthly

SECTION II EXISTING AND NEW LEGAL/TRADE NAME INFORMATION

Existing Legal Name New Legal Name

Existing Trade Name New Trade Name

Existing Primary Address New Primary Address

City State ZIP Code City State ZIP Code

Existing Location Address (No P.O. Box) New Location Address (No P.O. Box)

City State ZIP Code City State ZIP Code

Existing Mailing Address New Mailing Address

City State ZIP Code City State ZIP Code

SECTION III ADD LOCAL SALES TAX

Allegheny County Date of First Sale in County Philadelphia County Date of First Sale in County

SECTION IV OTHER TAX CHANGES

Type of Tax

Sales/Use Tax Account/License ID Number: VRT Account/License ID Number:

Employer Tax Account/License ID Number: Tobacco Account/License ID Number:

PTA Tax Account/License ID Number:

SECTION V CERTIFICATION

Individual owner(s), partner(s), or corporate officer(s) responsible for return information. Ownership change requires a new registration.

Name SSN Name SSN

Email Daytime Telephone Number

Signature Title Date

SIGN AFTER PRINTING

Reset Entire Form TOP OF PAGE NEXT PAGE PRINT FORM