Enlarge image

2024

Instructions for Estimating PA Fiduciary Income Tax

REV-413 (F) IN 06-24 For Estates and Trusts Only

• 90 percent of the tax to be shown on the estate or trust’s

WHAT’S NEW

2023 tax return; or

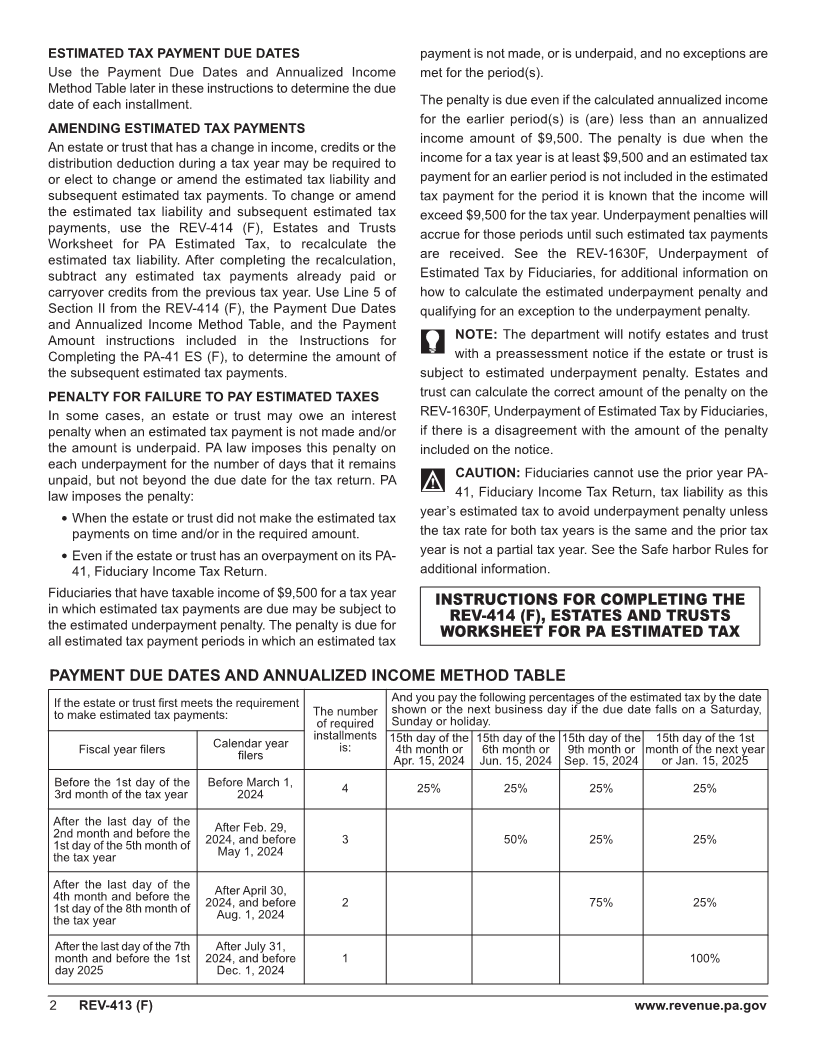

Beginning tax year 2024, the income threshold for when • 100 percent of the product of multiplying the net PA

estimated payments are required to be made has increased taxable income shown on the 2023 PA-41 return by 3.07

from $8,000 to $9,500. This threshold will continue to percent (0.0307).

increase each year per legislation that was passed in 2022.

Fiduciaries may also follow federal rules in determining the

GENERAL INFORMATION amount of quarterly estimated tax payments due based

upon the amount of anticipated income determined using PA

PURPOSE

personal income tax rules. In addition, estates (or trusts that

The REV-413 (F) is used by an estate or trust for receive the residue of a probate estate) are only required to

determining if it is required to make estimated tax payments,

make estimated tax payments beginning with taxable years

the amount of its estimated tax liability, the amount of its

ending two or more years after a decedent's death.

estimated tax payments, and when its estimated tax

payments are due. The REV-413 (F) also provides the Use the Instructions for Completing the REV-414 (F),

instructions for the REV-414 (F), Estates and Trusts Estates and Trusts Worksheet for PA Estimated Tax, to

Worksheet for PA Estimated Tax, and the PA-41 ES (F), determine the estimated tax. Use the PA-41 ES (F) to

Declaration of Estimated Withholding Tax for Fiduciaries. declare and pay the estimated tax for an estate or trust.

FORMS REQUIRED TO MAKE NOTE: An estate or trust that receives its income

ESTIMATED TAX PAYMENTS

unevenly throughout the year may be able to lower or

Fiduciaries of estates and trusts required to make estimated eliminate the amount of its required estimated tax payment

tax payments should obtain and complete the REV-414 (F), for one or more periods by using the annualized income

2024 Estates and Trusts worksheet for PA Estimated Tax, and

installment method. See Annualized Income Method

the PA-41 ES (F). Instructions for both forms are included within

included in the first column of the Payment Due Dates and

this document. The forms may be obtained from the links

provided above or by contacting the department’s Forms Annualized Income Method Table.

Ordering Service at1-800-362-2050. The forms may also be SAFE HARBOR RULES

obtained by sending written requests to: For estates and trusts required to make estimated tax

PA DEPARTMENT OF REVENUE payments, the department will not impose the estimated

TAX FORMS SERVICE UNIT underpayment penalty when:

1854 BROOKWOOD ST

1. The total timely estimated tax payments and credits are

HARRISBURG PA 17104-2244

at least equal to an amount calculated using the current

CAUTION: Do not mail estimated tax payments to this year’s tax rate times the net taxable income on its prior

address. See the “Payment and Mailing Instructions” year’s PA-41, Fiduciary Income Tax Return, (NOTE: This

included in the Instructions for Completing the PA-41 ES (F), exception does not apply if no return or a part-year return

for mailing an estimated tax payment to the department. was filed in the prior year.); or

WHO MUST MAKE ESTIMATED TAX PAYMENTS 2. For each installment period, the timely estimated tax

The estimated tax rules apply to: payments and credits are at least 90 percent of the actual

• Resident estates or trusts; and tax due on the income earned or received for each

installment period.

• Nonresident estates or trusts that expect to have

taxable income from sources within Pennsylvania. ESTIMATED TAX PAYMENT AMOUNT

Fiduciaries of estates and trusts must make PA estimated See the instructions for completing the REV-414 (F), Estates

tax payments if they reasonably expect that the estate or and Trusts Worksheet for PA Estimated Tax, and the

trust will earn, receive, or realize income of $9,500 ($292 in Payment Amount instructions included in the Instructions for

tax) for 2024, and they reasonably expect the estate or trusts Completing the PA-41 ES (F), for determining the amount

total tax credits will be less than the smaller of: of an estate or trusts estimated tax payments.

www.revenue.pa.gov REV-413 (F) 1