Enlarge image

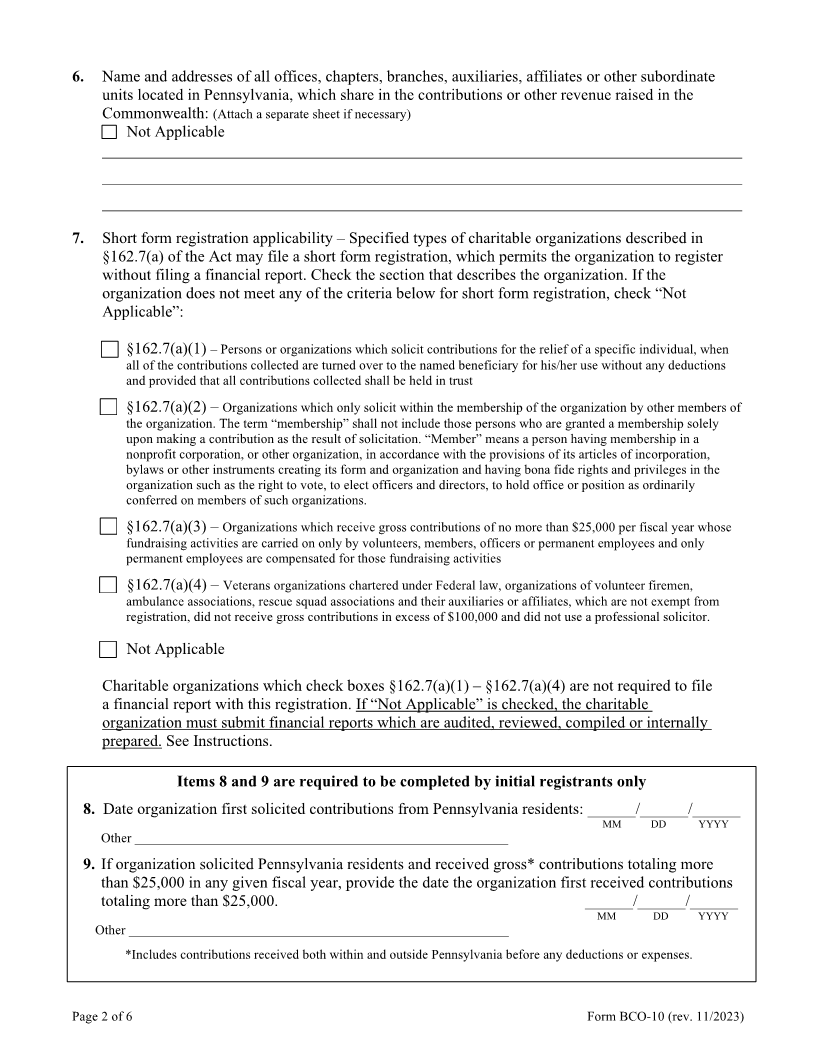

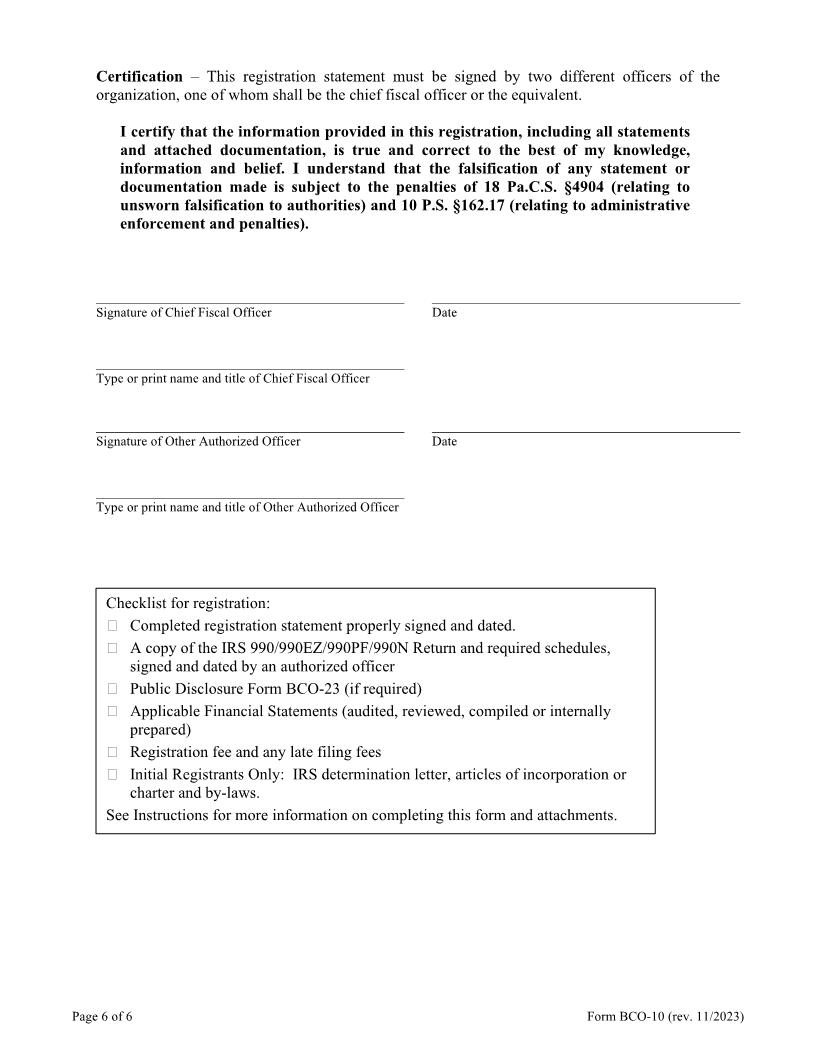

Mail to:

Pennsylvania Department of State Charitable Organization

Bureau of Corporations and Charitable Organizations

Registration Statement

401 North St Rm 207 BCO-10 (rev. 11/2023)

Harrisburg, PA 17120

Fee: See instructions

See www.dos.pa.gov/charities for more information

Read all instructions prior to completing form.

Certificate number: ________________________

(N/A if initial registration) If this is a voluntary registration, check and complete the

applicable box(es). For a registration to be voluntary, at

least one of the following must apply:

Fiscal year ended: _______/________/_________ Organization is exempt from registration because

MM DD YYYY

___________________________________________

Organization does not solicit contributions in

FEIN: ̶

Pennsylvania

1. Legal name of organization: ________________________________________________________

Check if name change and give previous name ________________________________________

2. All other names used to solicit contributions: ___________________________________________

________________________________________________________________________________

________________________________________________________________________________

3. Contact person: ___________________________ Contact’s e-mail: ________________________

4. Principal address of organization: Mailing address (if different than principal address):

_______________________________________ _______________________________________

_______________________________________ _______________________________________

_______________________________________ _______________________________________

County: ________________________________ Phone number: __________________________

800 number: ____________________________ Fax number: ____________________________

Email (if different than Contact’s email): ______________________________________________

Website: ________________________________________________________________________

Item 5 to be completed by initial registrants only

5. Type of organization (e.g. non-profit corporation, unincorporated association, etc.):

________________________________________________________________________________

Where established: ________________________ Date established:* _______________________

*Initial registrants must submit copies of organizational documents such as charter, articles of incorporation,

constitution or other organizational instrument and by-laws.

Page 1 of 6 Form BCO-10 (rev. 11/2023)