Enlarge image

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations Instructions for

207 North Office Building Charitable Organization

Harrisburg, PA 17120 Registration Statement

Phone: (717) 783-1720 or 1-800-732-0999 (within PA)

Web site: www.dos.pa.gov/charities BCO-10 Instructions (rev. 1/202 )4

PLEASE DO NOT STAPLE/BIND ANY PAPERS

Who should file this form: The Pennsylvania Solicitation of Funds for Charitable Purposes Act, 10 P. S. §162.1

et seq., requires organizations soliciting charitable contributions from Pennsylvania residents to register with the

Bureau by filing a Charitable Organization Registration Statement (BCO-10), unless the organization is excluded or

exempted from the Act. For additional information on excluded or exempted organizations, please refer to the

Bureau’s Exclusions and Exemptions Chart at http://www.dos.pa.gov/charities.

This form may be used for both initial registration and renewal of registration.

Initial registration is required prior to any compensated person soliciting contributions on behalf of the charitable

organization or within 30 days of receiving more than $25,000 in gross contributions for those organizations that do

not compensate any person for soliciting contributions.

Renewal of registration must be refiled (postmarked) no later than the 15th day of the eleventh month following

the close of the organization’s fiscal year. The renewal due date is indicated on the certificate of registration sent to

the organization upon the approval of a registration. The Bureau encourages renewal applications to be submitted

prior to the due date to avoid gaps in registration.

Requirement to update information: Charitable organizations are required to notify the Bureau in writing of any

material change in any information filed with the Bureau not more than 30 days after such change occurs.

What should be submitted as part of charitable organization registration:

o A properly completed, signed and dated BCO-10 registration statement with original signatures.

o A completed and signed copy of the organization's IRS 990/990EZ/990PF/990N Return and all applicable

schedules for the immediate preceding fiscal year end. If your IRS 990 return was signed electronically,

you must submit a copy of the electronic signature page filed with the IRS. SCHEDULE B SHOULD

NOT BE SENT UNLESS YOU FILE 990PF. PLEASE DO NOT SEND SCHEDULE B

(An organization that is not required to file an IRS 990 return or an organization that files a 990N, 990EZ

or 990PF must file a Pennsylvania public disclosure form (BCO-23). An affiliate whose parent

organization files a 990 group return must file both a BCO-23 Form and a copy of the parent

organization’s 990 Return. The BCO-23 Form in fillable .pdf format may be found at:

www.dos.state.pa.us/charities.)

o Internally prepared, compiled, reviewed or audited financial statements for the immediate preceding fiscal

year end. (See chart on next page.)

o Initial registrants only: Copies of IRS exemption letter; organizational documents such as charter or

articles of incorporation; and by-laws.

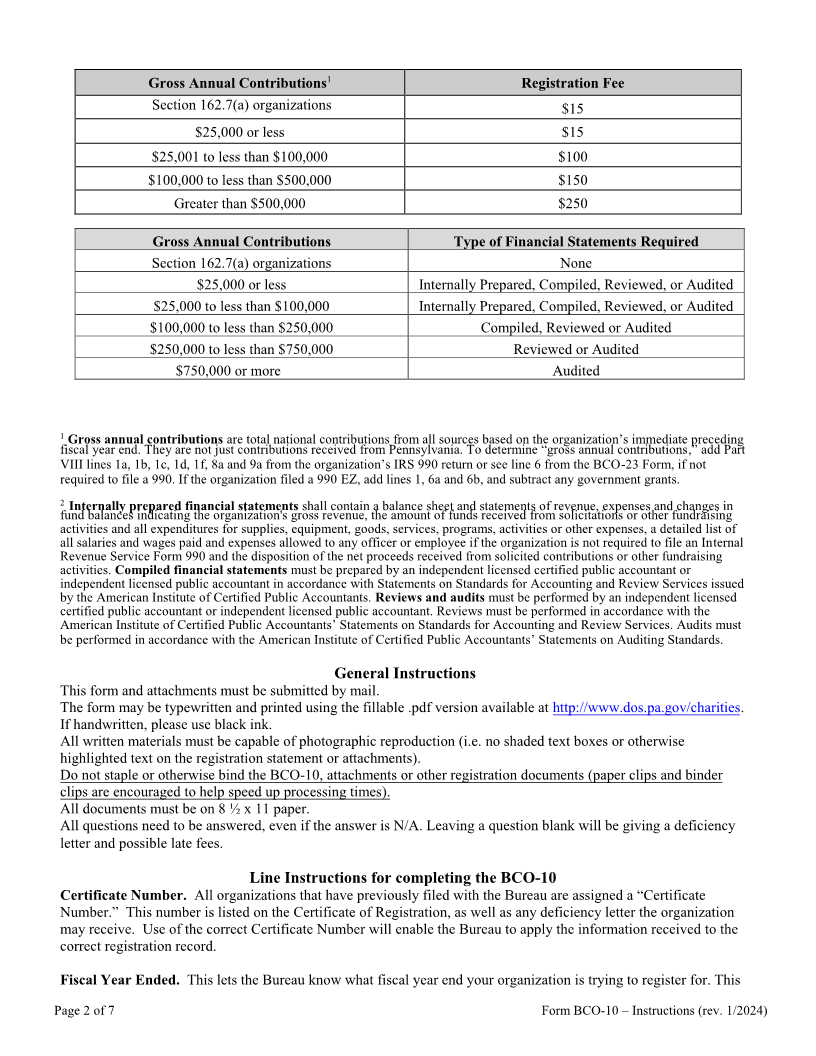

o Registration fee made payable to “Commonwealth of Pennsylvania.” (See chart on next page.) For

renewal registrants, please include your Certificate number on your check or money order.

o Late filing fees (if applicable): An organization failing to file a registration by the due date must pay an

additional fee of $25 for each calendar month or part of a month after the date on which the registration

was due to be filed. Late filing fees are statutorily required and may not be waived under any

circumstances. Organizations electing to voluntarily register are not subject to late filing fees.

Page 1 of 7 Form BCO-10 – Instructions (rev. 1/202 )4