Enlarge image

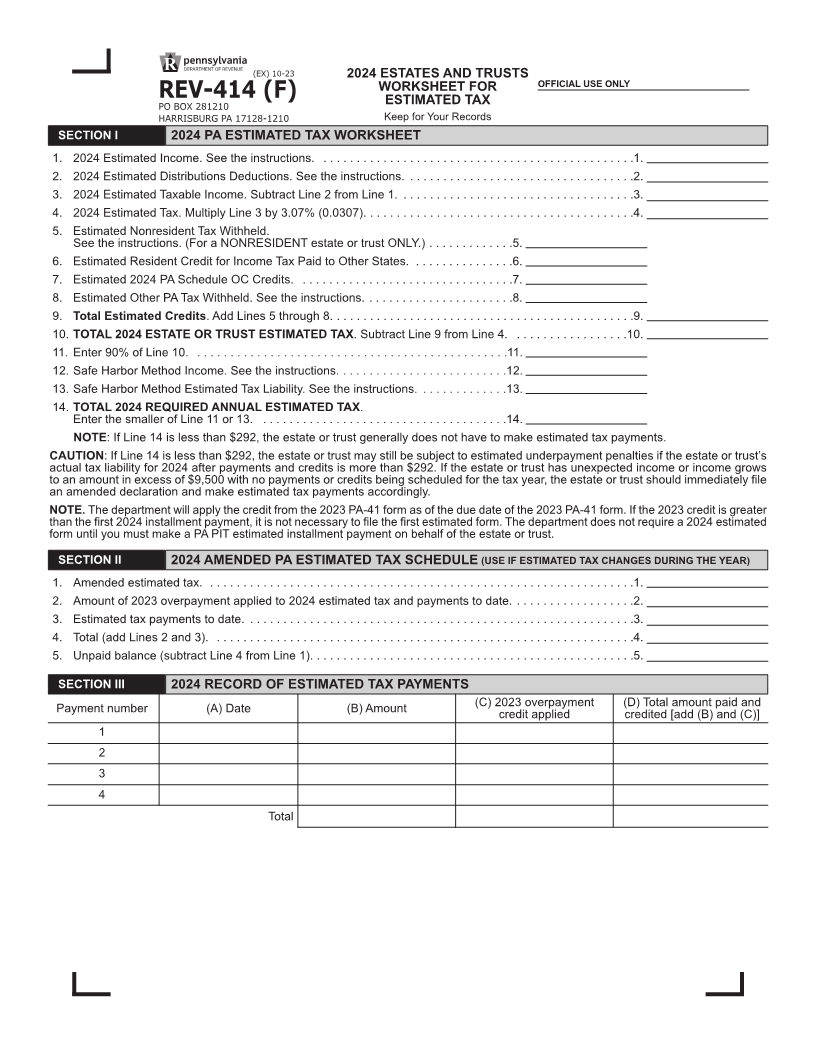

(EX) 10-23 2024 ESTATES AND TRUSTS

WORKSHEET FOR OFFICIAL USE ONLY

REV-414 (F) ESTIMATED TAX

PO BOX 281210

HARRISBURG PA 17128-1210 Keep for Your Records

SECTION I 2024 PA ESTIMATED TAX WORKSHEET

1. 2024 Estimated Income. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1.

2. 2024 Estimated Distributions Deductions. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2.

3. 2024 Estimated Taxable Income. Subtract Line 2 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3.

4. 2024 Estimated Tax. Multiply Line 3 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.

5. Estimated Nonresident Tax Withheld.

See the instructions. (For a NONRESIDENT estate or trust ONLY.) . . . . . . . . . . . . .5.

6. Estimated Resident Credit for Income Tax Paid to Other States. . . . . . . . . . . . . . . .6.

7. Estimated 2024 PA Schedule OC Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7.

8. Estimated Other PA Tax Withheld. See the instructions. . . . . . . . . . . . . . . . . . . . . . .8.

9. Total Estimated Credits. Add Lines 5 through 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9.

10. TOTAL 2024 ESTATE OR TRUST ESTIMATED TAX. Subtract Line 9 from Line 4. . . . . . . . . . . . . . . . . .10.

11. Enter 90% of Line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11.

12. Safe Harbor Method Income. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . .12.

13. Safe Harbor Method Estimated Tax Liability. See the instructions. . . . . . . . . . . . . .13.

14. TOTAL 2024 REQUIRED ANNUAL ESTIMATED TAX.

Enter the smaller of Line 11 or 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14.

NOTE: If Line 14 is less than $292, the estate or trust generally does not have to make estimated tax payments.

CAUTION: If Line 14 is less than $292, the estate or trust may still be subject to estimated underpayment penalties if the estate or trust’s

actual tax liability for 2024 after payments and credits is more than $292. If the estate or trust has unexpected income or income grows

to an amount in excess of $9,500 with no payments or credits being scheduled for the tax year, the estate or trust should immediately file

an amended declaration and make estimated tax payments accordingly.

NOTE. The department will apply the credit from the 2023 PA-41 form as of the due date of the 2023 PA-41 form. If the 2023 credit is greater

than the first 2024 installment payment, it is not necessary to file the first estimated form. The department does not require a 2024 estimated

form until you must make a PA PIT estimated installment payment on behalf of the estate or trust.

SECTION II 2024 AMENDED PA ESTIMATED TAX SCHEDULE (USE IF ESTIMATED TAX CHANGES DURING THE YEAR)

1. Amended estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1.

2. Amount of 2023 overpayment applied to 2024 estimated tax and payments to date. . . . . . . . . . . . . . . . . . .2.

3. Estimated tax payments to date. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3.

4. Total (add Lines 2 and 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.

5. Unpaid balance (subtract Line 4 from Line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5.

SECTION III 2024 RECORD OF ESTIMATED TAX PAYMENTS

Payment number (A) Date (B) Amount (C) 2023 overpayment (D) Total amount paid and

credit applied credited [add (B) and (C)]

1

2

3

4

Total