Enlarge image

2024

Instructions for Estimating PA Personal Income Tax

REV-413 (I) IN 10-23 For Individuals Only

Individuals Worksheet for PA Estimated Tax, and the PA-40

WHAT’S NEW

ES (I), Declaration of Estimated Tax. Instructions for both

Beginning tax year 2024, the income threshold for when forms are included within this document. The forms may be

estimated payments are required to be made has increased obtained from the department's website or by contacting the

from $8,000 to $9,500. This threshold will continue to department’s Forms Ordering Service at 1-800-362-2050.

increase each year per legislation that was passed in 2022. The forms may also be obtained by sending written

requests to:

GENERAL INFORMATION

PA DEPARTMENT OF REVENUE

PURPOSE TAX FORMS SERVICE UNIT

The REV-413 (I) is used by individual taxpayers for 1854 BROOKWOOD ST

determining if they are required to make estimated tax HARRISBURG PA 17104-2244

payments, the amount of their estimated tax liability, the

amount of their estimated tax payments, and when the CAUTION: Do not mail estimated tax payments to this

estimated tax payments are due. The REV-413 (I) also address. See the “Payment and Mailing Instructions”

provides the instructions for the REV-414 (I), Individuals included in the Instructions for Completing the PA-40 ES (I),

Worksheet for PA Estimated Tax, and the PA-40 ES (I), Declaration of Estimated Personal Income Tax, for mailing

Declaration of Estimated Personal Income Tax. an estimated tax payment to the department.

Estimated tax is the method used to pay tax on income not WHO MUST MAKE ESTIMATED TAX PAYMENTS

subject to employer withholding that includes, but is not The estimated tax rules apply to:

limited to, the following types of income:

• Resident and part-year resident individuals; and

• Wages for domestic services;

• Nonresident individuals (or residents of other countries)

• Tips received from customers; that expect to have taxable income from sources within

• Wages paid to residents who are seamen engaged in Pennsylvania.

interstate or intercoastal trade when PA income tax is

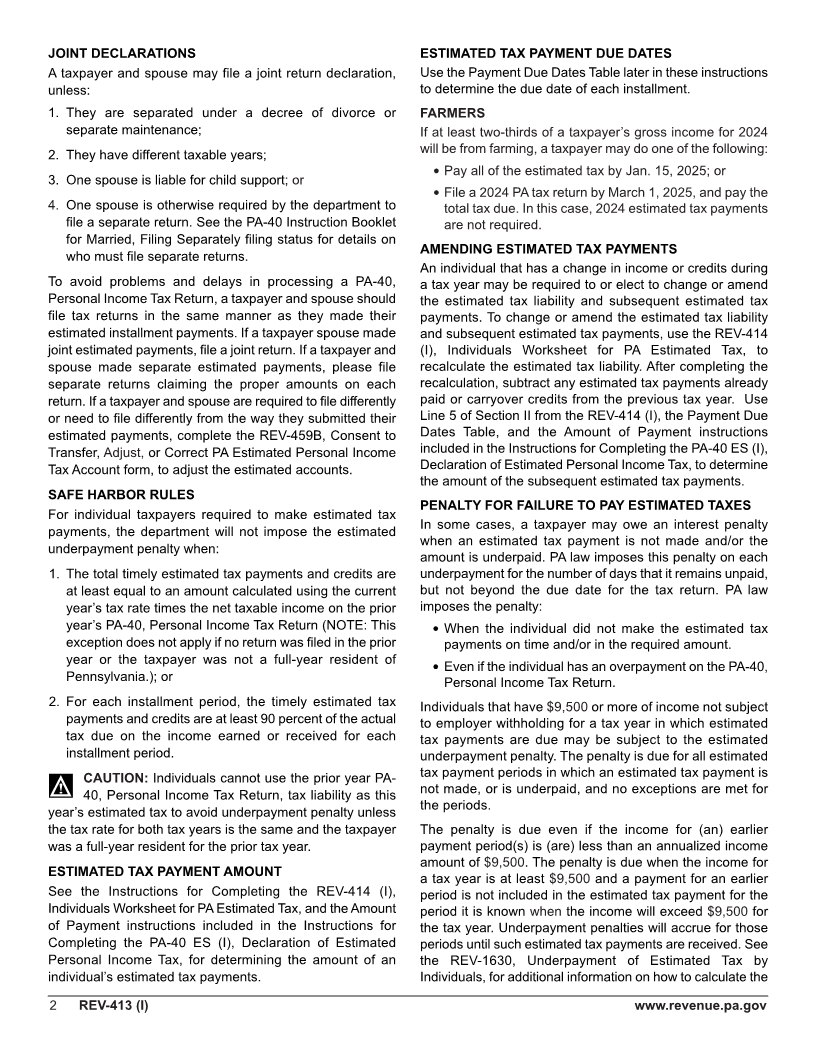

not withheld by the employer; Except for farmers as explained later in these instructions,

an individual must make PA estimated tax payments if:

• Wages paid to PA residents who work in the reciprocal

states of Indiana, Maryland, New Jersey, Ohio, Virginia, 1. The individual can reasonably expect to owe at least

or West Virginia when PA income tax is not withheld by $292 ($9,500 of income not subject to employer

the employer; withholding) in tax after subtracting withholding and

• Earnings from self-employment or profits made in a credits; and

trade, profession, business, or farming by residents or 2. The individual can reasonably expect withholdings and

nonresidents regardless of whether the nonresident is

credits to be less than the smaller of:

a resident of a reciprocal state or not;

• 90 percent of the tax to be shown on the 2024

• Gains from the sale, exchange, or disposition of

personal income tax return; or

property;

• Interest and dividends; • 100 percent of the product of multiplying the net PA

taxable income shown on the 2023 PA-40 return by

• Rents and royalties; 3.07 percent (0.0307). This calculation can only be

• Gambling and lottery winnings (except PA Lottery used by a taxpayer who a filed full-year PA-40 return

noncash winnings); and in 2023.

• Income derived from estates and trusts. To determine the estimated tax liability, see the Instructions

FORMS REQUIRED TO MAKE for Completing the REV-414 (I), Individuals Worksheet for

ESTIMATED TAX PAYMENTS PA Estimated Tax. Use the PA-40 ES (I), Declaration of

Individual taxpayers required to make estimated tax Estimated Personal Income Tax, to declare and pay the

payments should obtain and complete the REV-414 (I), estimated tax for individual taxpayers.

www.revenue.pa.gov REV-413 (I) 1