- 2 -

Enlarge image

|

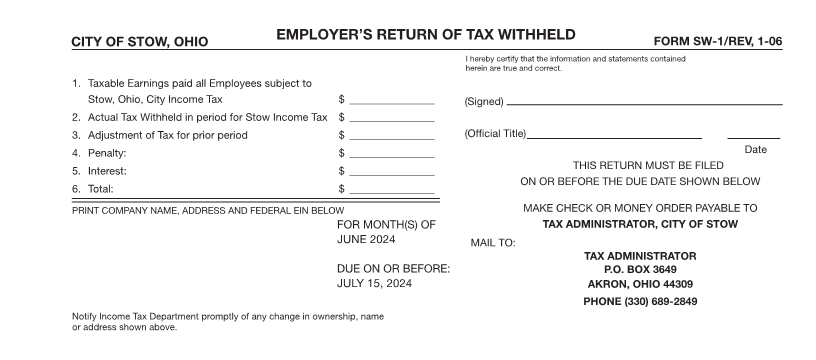

INSTRUCTIONS FOR PREPARING AND FILING FORM SW-1

WHO MUST FILE: (0.833% per month or fraction thereof). The interest rate is based on the

Every business entity which conducts business within the corporate Federal rate and may change each year. In addition, employers required to

limits of the City of Stow, regardless of where that entity is located, withhold taxes from employees, may impose a penalty not exceeding

is required to withhold tax from all compensated employees at the time 50% of the amount not timely paid and a late file penalty of $25.

or times such compensation is paid, or in the case of any type of Failure to File Return and Pay Tax

deferred compensation, when such compensation is earned. Any individual, firm or corporation who fails, neglects or refuses to

Definition of “Taxable Earnings” file a return, who refuses to pay the tax, penalties and interest imposed,

The term “Taxable Earnings” has the same meaning as “Qualifying who refuses to permit the Tax Administrator or any duly authorized

Wages” as defined in the ORC 718.03(A). For most employees this is the agent or employee to examine his books, records and papers, who

“Medicare Wage” amount. If the employee is not subject to knowingly makes an incomplete, false or fraudulent return, or who

Medicare withholding, the provisions in ORC 718.03(A) apply. attempts to do anything to avoid payment of the whole or any part of the

Definition of “Employer” tax shall be guilty of a first degree misdemeanor and shall be fined not

The term “Employer” means an individual, co-partnership, association, more than $1,000 or imprisoned for not more than 6 months, or both, for

corporation (including a corporation of the first or non-profit class), each offense. The failure of any taxpayer to receive a return shall not

governmental administration agency, arm, authority, board, body, excuse such taxpayer from filing a return or paying the tax due.

branch, bureau, department, division, section unit, or any other entity, Any check in payment of tax, penalty and/or interest which is

who or that employs one or more persons on a salary, wage, returned to the City marked Insufficient Funds, Account Closed or Stop

commission, or other compensation basis, whether or not such employer Payment, shall be subject to a $10.00 charge for the purpose of

is engaged in business as define in the Ordinance and in the Regulations. defraying additional processing expenses incurred by the city.

Interest and Penalties:

All taxes required to be withheld by employers and remaining unpaid

after they become due shall bear interest at the rate of 10% per annum The employer is responsible for payment of under-withholding.

|