Enlarge image

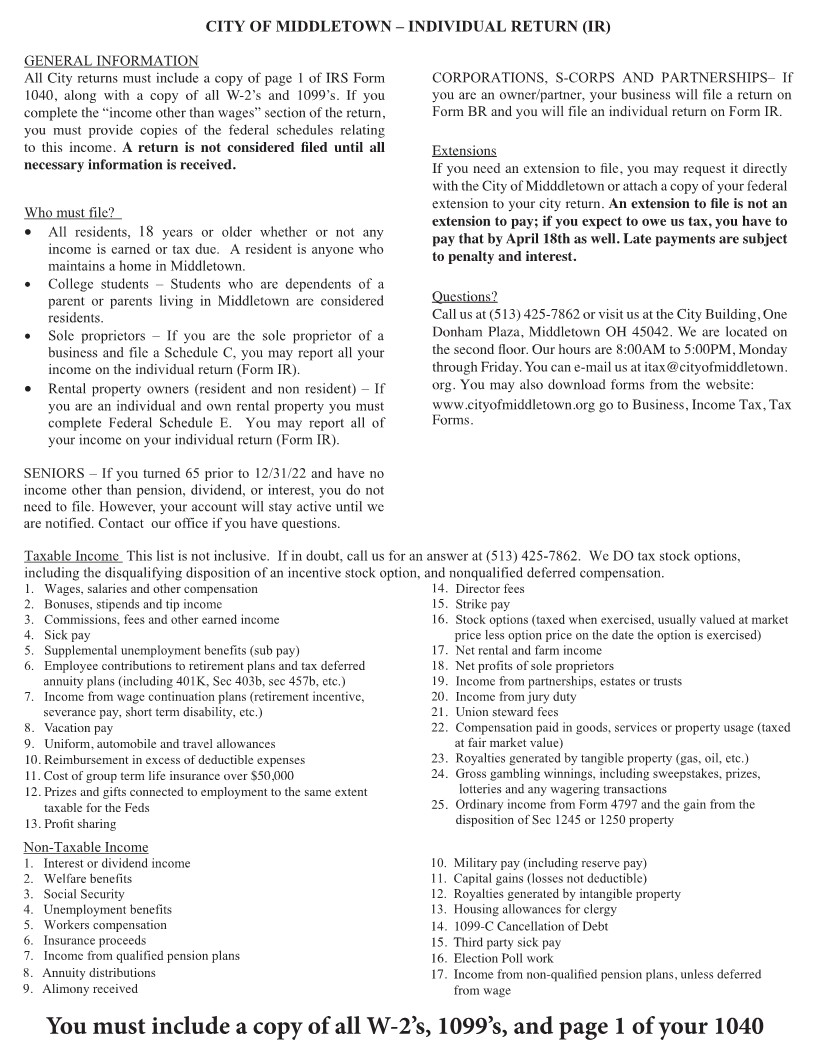

All City returns must include a copy of page 1 of IRS Form

1040, along with a copy of all W-2’s and 1099’s. If you

complete the “income other than wages” section of the return,

you must provide copies of the federal schedules relating 15

to this income. A return is not considered filed until all Extensions

necessary information is received. If you need an extension to file,15you may request it directly

with the City of Midddletown or15attach a copy of15your federal

extension to your city return. An15extension to file is not an

15

extension to pay; if you expect to owe us tax, you have to

18 pay that by April 18th as well. Late payments15are subject

to penalty and interest. 15

Questions?

Call us at (513) 425-7862 or visit us at the City Building, One

Donham Plaza, Middletown OH 45042. We are located on

business, under Middletown Income Tax, then to download the second floor. Our hours are 8:00AM to 5:00PM, Monday

forms.through Friday. You can e-mail us at itax@cityofmiddletown.

business, under Middletown Income Tax, then to download

org. You may also download forms from the website:

forms.business, under Middletown Income Tax, then to download

SENIORS – If you turned 65 prior to 12/31/15 and have no www.cityofmiddletown.org go to Business, Income Tax, Tax

forms.

income other than pension, dividend, or interest, you do not business,Forms.under Middletown Income Tax, then to download

need to file. However, your account will stay active until we SENIORS – If you turned 65 prior to 12/31/15 and have no

are notified. Contact our office if you have questions.income other than pension, dividend, or interest, you do not SENIORS – If you turned 65 prior to 12/31/15 and have no

needSENIORSincometo file.other–However,Ifthanyoupension,turnedyour65dividend,accountprior to willor12stayinterest,/31/active22 andyouuntilhavedo notweno

areincomeneednotified.to file.otherHowever,Contact than pension,ouryourofficedividend,accountif youwillorhaveinterest,stayquestions.activeyouuntildo notwe

needare notified.to file. However,Contact ouryourofficeaccountif youwillhavestayquestions.active until we

are notified. Contact our office if you have questions.

14.

15.

16.

17.

18.

19.

20.

21.

8. Vacation pay 22.

9. Uniform, automobile and travel allowances

10. Reimbursement in excess of deductible expenses 23.

11. Cost of group term life insurance over $50,000 24.

12. Prizes and gifts connected to employment to the same extent

taxable for the Feds 25.

13. Profit sharing

14. 1099-C Cancellation of Debt

15. Third party sick pay

16. Election Poll work

8. Annuity distributions 17. Income from non-qualified pension plans, unless deferred

9. Alimony received from wage

You must include a copy of all W-2’s, 1099’s, and page 1 of your 1040