Enlarge image

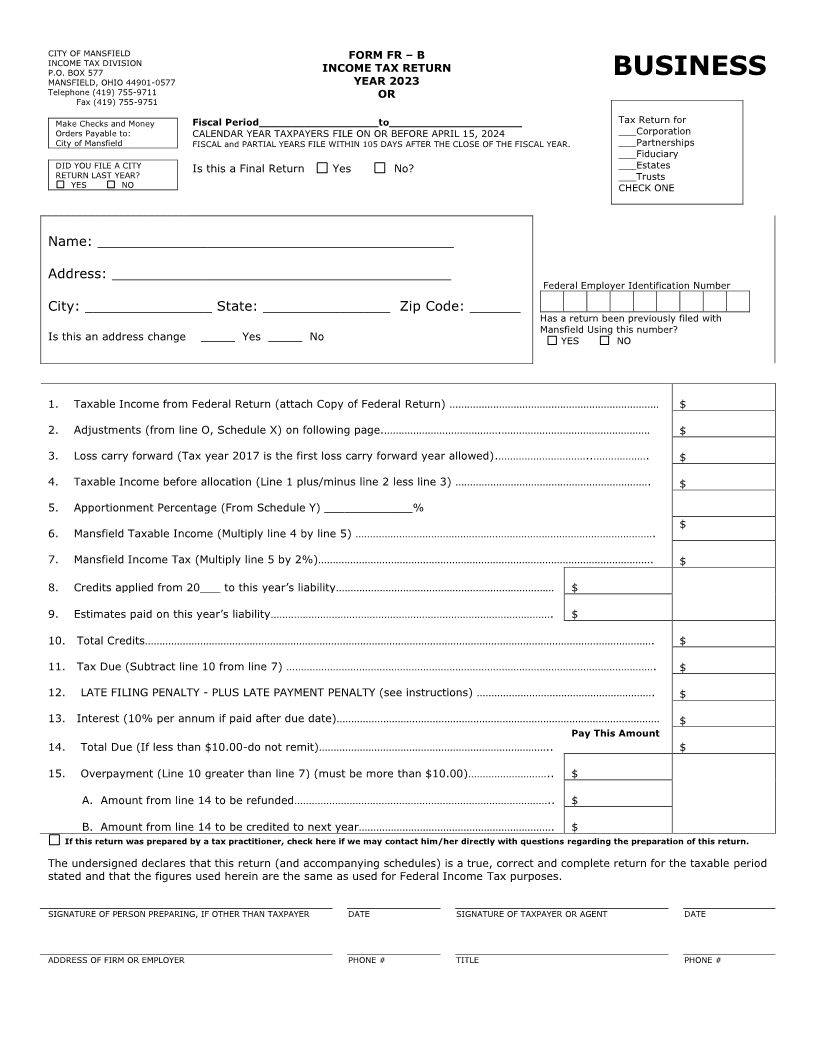

CITY OF MANSFIELD FORM FR –B

P.O. BOX 577

INCOME TAX DIVISION INCOME TAX RETURN BUSINESS

MANSFIELD, OHIO 44901-0577 YEAR 2023

Telephone (419) 755-9711 OR

Fax (419) 755-9751

Make Checks and Money Fiscal Period__________________to____________________ Tax Return for

Orders Payable to: CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15, 2024 ___Corporation

City of Mansfield FISCAL and PARTIAL YEARS FILE WITHIN 105 DAYS AFTER THE CLOSE OF THE FISCAL YEAR. ___Partnerships

___Fiduciary

DID YOU FILE A CITY Is this a Final Return Yes No? ___Estates

RETURN LAST YEAR? ___Trusts

YES NO CHECK ONE

Name: __________________________________________

Address: ________________________________________

Federal Employer Identification Number

City: _______________ State: _______________ Zip Code: ______

Has a return been previously filed with

Mansfield Using this number?

Is this an address change _____ Yes _____ No YES NO

1. Taxable Income from Federal Return (attach Copy of Federal Return) ……………………………………………………………… $

2. Adjustments (from line O, Schedule X) on following page.………………………………….…………………………………………… $

3. Loss carry forward (Tax year 2017 is the first loss carry forward year allowed).…………………………..………………. $

4. Taxable Income before allocation (Line 1 plus/minus line 2 less line 3) …………………………………………………………. $

5. Apportionment Percentage (From Schedule Y) _____________%

$

6. Mansfield Taxable Income (Multiply line 4 by line 5) ………………………………………………………………………………………….

7. Mansfield Income Tax (Multiply line 5 by 2%)……………………………………………………………………………………………………. $

8. Credits applied from 20___ to this year’s liability………………………………………………………………… $

9. Estimates paid on this year’s liability……………………………………………………………………………………. $

10. Total Credits…………………………………………………………………………………………………………………………………………………………. $

11. Tax Due (Subtract line 10 from line 7) ………………………………………………………………………………………………………………. $

12. LATE FILING PENALTY - PLUS LATE PAYMENT PENALTY (see instructions) ……………………………………………………. $

13. Interest (10% per annum if paid after due date)………………………………………………………………………………………………… $

Pay This Amount

14. Total Due (If less than $10.00-do not remit)…………………………………………………………………….. $

15. Overpayment (Line 10 greater than line 7) (must be more than $10.00)……………………….. $

A. Amount from line 14 to be refunded…………………………………………………………………………….. $

B. Amount from line 14 to be credited to next year…………………………………………………………. $

If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period

stated and that the figures used herein are the same as used for Federal Income Tax purposes.

SIGNATURE OF PERSON PREPARING, IF OTHER THAN TAXPAYER DATE SIGNATURE OF TAXPAYER OR AGENT DATE

ADDRESS OF FIRM OR EMPLOYER PHONE # TITLE PHONE #