Enlarge image

City of Fairfield

Individual Tax Return

Income Tax Division Phone: 513-867-5327

2023 701 Wessel Dr Fax: 513-867-5333

Fairfield, OH 45014

Tax Return is due by

April 15, 2024 www.fairfield-city.org

E-file available at:

https://web2.civicacmi.com/FairfieldTax

Account Number: ______________________ SSN: __________________________ PLEASE ATTACH:

Phone: _______________________________ Spouse SSN: __________________________ • FEDERAL 1040 REQUIRED

Name (s): ________________________________________________________ • W-2(S)

Address: ________________________________________________________ • OTHER APPLICABLE

SCHEDULES AND

City/State/Zip ________________________________________________________ DOCUMENTATION

If part-year resident ,indicate dates of Fairfield residency: From_____________To______________

Single

Married Filing Joint Return (even if only one had income) Did you file Joint or Separate last year? Joint Separate

Married Filing Separate Return. Enter Spouse's social security number and full name here:________________________________

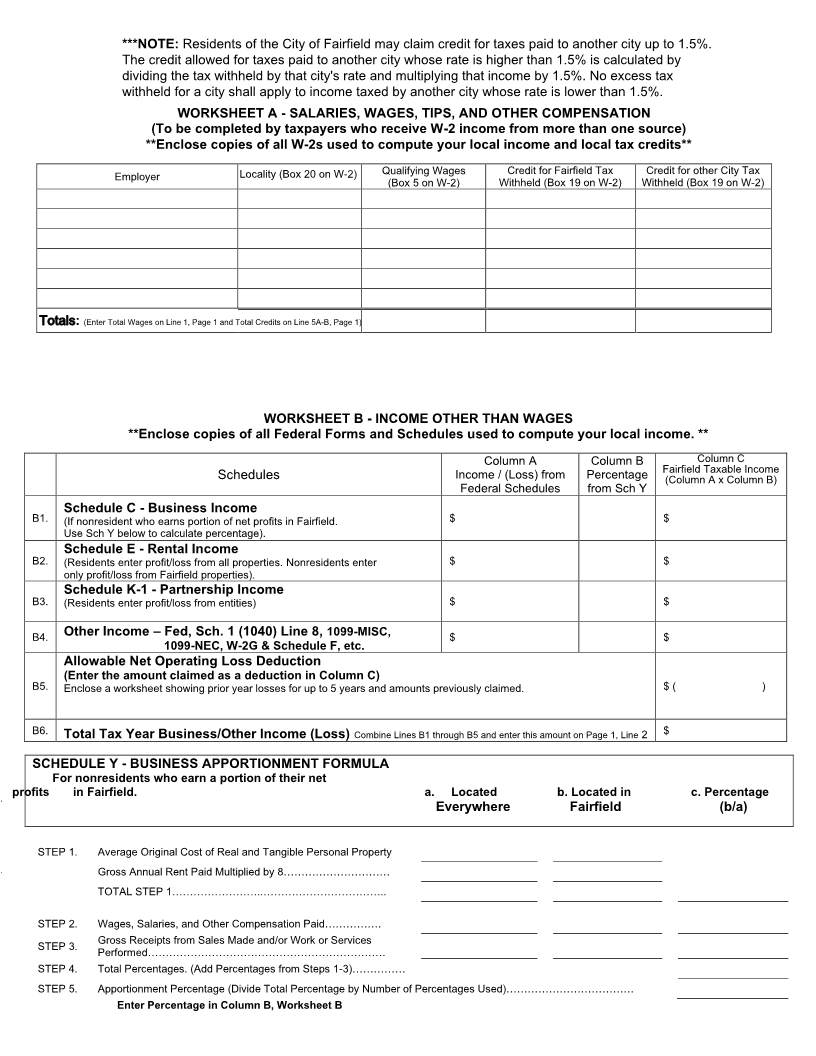

1. TOTAL W-2 INCOME (Box 5 of W-2) 1.

2. INCOME OTHER THAN WAGES(Attach federal schedules, forms, supporting documentation) 2.

3. TOTAL INCOME (Add box 1 and box 2) 3.

4. TAX LIABILITY Multiply box 3 by 1.50% 4.

5. CREDITS A. Fairfield tax withheld 5A.

B. Credit for other city tax withheld (limited to 1.5%) 5B.

C.202 3Estimated tax payments 5C.

D. Prior year credit carried forward 5D.

Total of credits. Add 5A through 5D and enter here. 5E.

E.

6. If box 4 is greater than box 5E, enter your BALANCE DUE (if greater than $10.00) 6.

7. If box 5E is greater than box 4, enter your OVERPAYMENT(if greater than $10.00) 7.

A. REFUND over $10.00)( $___________________ or B.CREDIT TO 2024 (over $10.00) $___________________

8. BALANCE DUE FOR 2023 Add box 6 and box 8 (if $200.00 or greater, complete estimate section below) 8.

2024 DECLARATION OF ESTIMATED TAX DUE - Complete this section if 2023 tax due is $200.00 or greater

9.

9. Total estimated for tax year 2024 (gross taxable income multiplied by 1.50%)

10. Less credits (including tax anticipated to be withheld from employers) 10.

11. Net tax owed for tax year 2024 estimated tax 11.

12. Amount paid with this declaration for 2024 FIRST QUARTER ESTIMATED TAX 12.

13. TOTAL DUE. ADD BOXES 8AND 12 FOR TOTAL BALANCE DUE.

13.

I certify that I have examined this return including accompanying Federal 1040 page one, W-2's, schedules and statements, and to the best of my knowledge and belief, it

is true,accurate, and correct. YES NO (Note: Preparer mustsign on the line appropriate line below)

Check enclosed, made payable to City of Fairfield Income Tax Division

Paying via credit card: Enter number, expiration date, CVV code,

Your signature Date and amount authorized fully and accurately.

Spouse signature (if filing joint return) Date

Card Number: ____________________________________________

Signature of preparer (if not prepared by taxpayer) CVV Code: ______________ Exp: ___________________________

May the Tax Division discuss this return with this preparer? YES NO Amount Authorized: $______________________________________

Phone Number: __________________________________________

Cardholder Signature: _____________________________________