Enlarge image

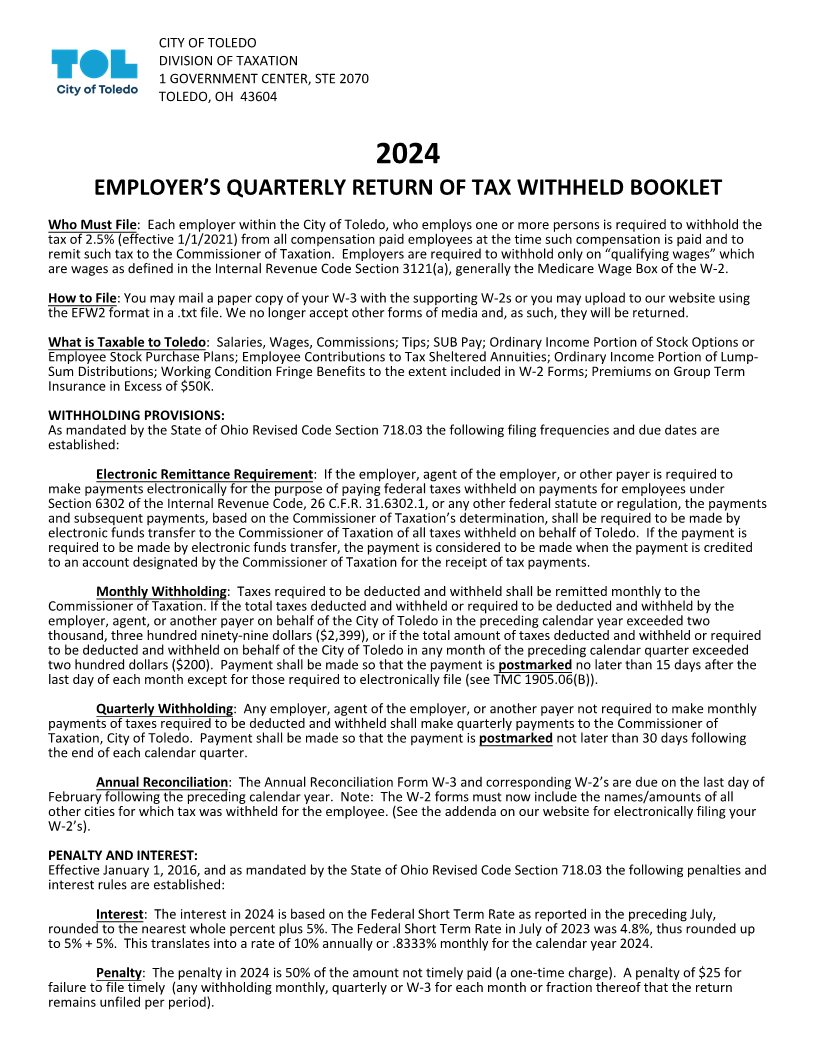

FORM 2024 CITY OF TOLEDO MAIL TO:

Q-1 PAYMENT ENCLOSED: NO PAYMENT ENCLOSED:

EMPLOYER'S QUARTERLY DEPOSIT OF TAX WITHHELD CITY OF TOLEDO CITY OF TOLEDO

PO BOX 632014 PO BOX 929

RETURN THIS FORM WITH REMITTANCE CINCINNATI, OH 45263- 2014 TOLEDO, OH 43697-0929

SIGNATURE ______________________________________ PHONE # _______________________

TITLE____________________________________________ DATE __________________________ AMOUNT OF

TAX $

MAKE CHECK OR MONEY ORDER PAYABLE TO:

FID # _______________________ "COMMISSIONER OF TAXATION"

ACCOUNT # ______________________

FOR TAX PERIOD ENDING March 31, 2024

Q-1 DUE ON OR BEFORE April 30, 2024

NAME & Pay online at the Ohio Business Gateway

VALIDATION

ADDRESS

cut here

MAIL TO:

FORM 2024 CITY OF TOLEDO PAYMENT ENCLOSED: NO PAYMENT ENCLOSED:

Q-2 CITY OF TOLEDO CITY OF TOLEDO

EMPLOYER'S QUARTERLY DEPOSIT OF TAX WITHHELD PO BOX 632014 PO BOX 929

CINCINNATI, OH 45263- 2014 TOLEDO, OH 43697-0929

RETURN THIS FORM WITH REMITTANCE

SIGNATURE ______________________________________ PHONE # _______________________

TITLE____________________________________________ DATE __________________________ AMOUNT OF

TAX $

MAKE CHECK OR MONEY ORDER PAYABLE TO:

FID # _______________________ "COMMISSIONER OF TAXATION"

ACCOUNT # ______________________

FOR TAX PERIOD ENDING June 30, 2024

Q-2 DUE ON OR BEFORE July 31, 2024

NAME & Pay online at the Ohio Business Gateway

VALIDATION

ADDRESS

cut here

MAIL TO:

FORM PAYMENT ENCLOSED: NO PAYMENT ENCLOSED:

Q-3 2024 CITY OF TOLEDO CITY OF TOLEDO CITY OF TOLEDO

EMPLOYER'S QUARTERLY DEPOSIT OF TAX WITHHELD PO BOX 632014 PO BOX 929

CINCINNATI, OH 45263- 2014 TOLEDO, OH 43697-0929

RETURN THIS FORM WITH REMITTANCE

SIGNATURE ______________________________________ PHONE # _______________________

TITLE____________________________________________ DATE __________________________ AMOUNT OF

TAX $

MAKE CHECK OR MONEY ORDER PAYABLE TO:

FID # _______________________ "COMMISSIONER OF TAXATION"

ACCOUNT # ______________________

FOR TAX PERIOD ENDING September 30, 2024

Q-3 DUE ON OR BEFORE October 31, 2024

NAME & Pay online at the Ohio Business Gateway

VALIDATION

ADDRESS