Enlarge image

APPLICATION FOR REFUND

Tax year_______

Your social security number Spouse's social security number Mail To:

CITY OF WOOSTER

First name and initial Last name INCOME TAX DEPT

PO BOX 1088

If joint return, spouse's first name and initial Last name WOOSTER OH 44691

www.woosteroh.com

Address

QUESTIONS?

City, State & Zip Code (330) 263-5226

No refund will be issued without the proper documentation indicated by reason for claim

Reason for Claim

Under 18 years of age. Date of Birth: __/__/__. Attach W-2 and copy of your birth certificate or a copy of your driver's license;

1 complete lower section of this page. If you were under 18 for part of the year your employer must complete the Employer's Certification on

page 2 certifying your wages earned prior to turning 18.

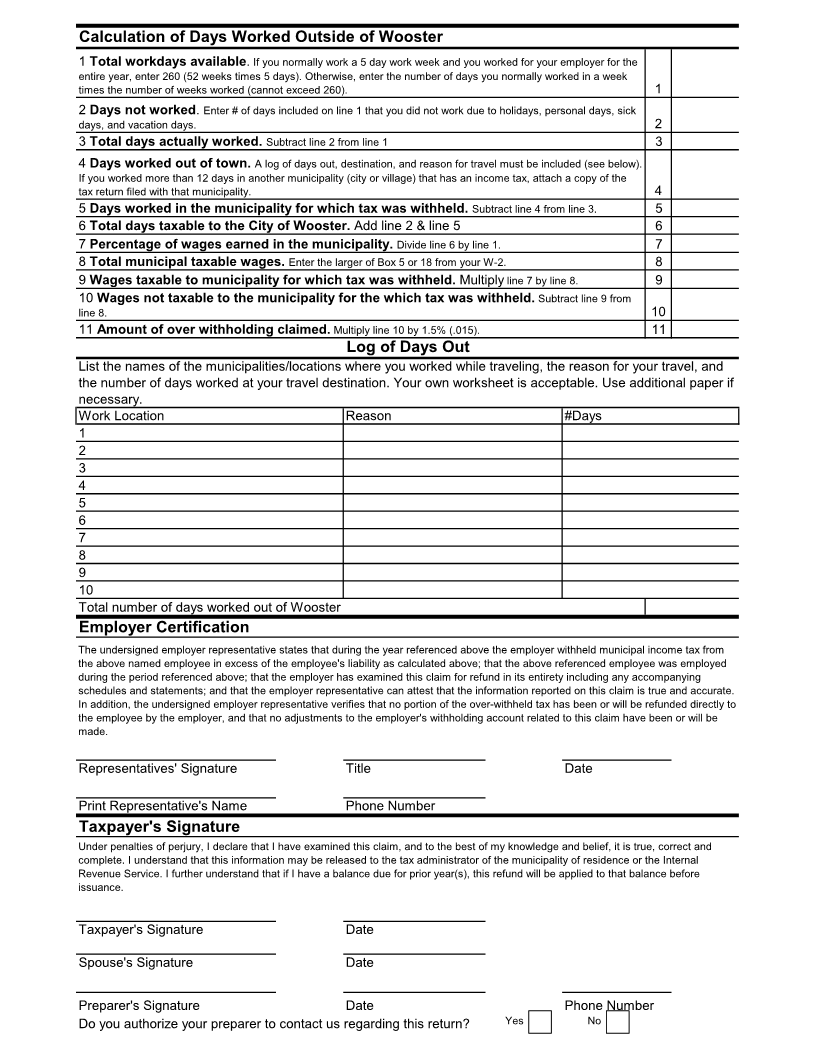

2 Days worked outside of Wooster for which tax was withheld. Attach W-2, complete calculation of days worked outside

Wooster, log of days worked outside Wooster on page 2, and employer certification must be completed, DO NOT complete claim below.

3 Other (explain). Attach W-2 and other documentation supporting your claim. Your employer must sign Employer Certification on page 2

Claim

1 Wages. Box 5, or 18 from your W-2. 1

2 Income Not Taxable. Under 18 Wages, Other etc. 2 ( )

3 Adjusted Taxable Income. Subtract line 2 from line 1. 3

4 Wooster Income Tax 1.5%. (.015) of line 3. 4

5 Wooster Tax Withheld. Enter amount in box 19 of your W-2 5

6 Estimated Tax Payments or Overpayments from Prior Years. 6

7 Total Credits. Add lines 5 and 6. 7

8 Amount of Refund Requested. Subtract line 4 from line 7. 8

Taxpayer's Signature

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct,

and complete. I understand that this information may be released to the tax administrator of the municipality of residence or other

municipalities in which work was performed or the Internal Revenue Service. I further understand that if I have a balance due for prior

year(s), this refund will be applied to that balance before issuance.

To avoid delays or a denial of your refund:

Complete required fields as indicated by

Taxpayer's Signature Date "Reason for Claim"

Attach all required documents indicated

Spouse's Signature Date under your "Reason for Claim"

All incomplete applications will be returned

Preparer's Signature Phone Number Date

Do you authorize your preparer to contact us regarding this return? Yes No