Enlarge image

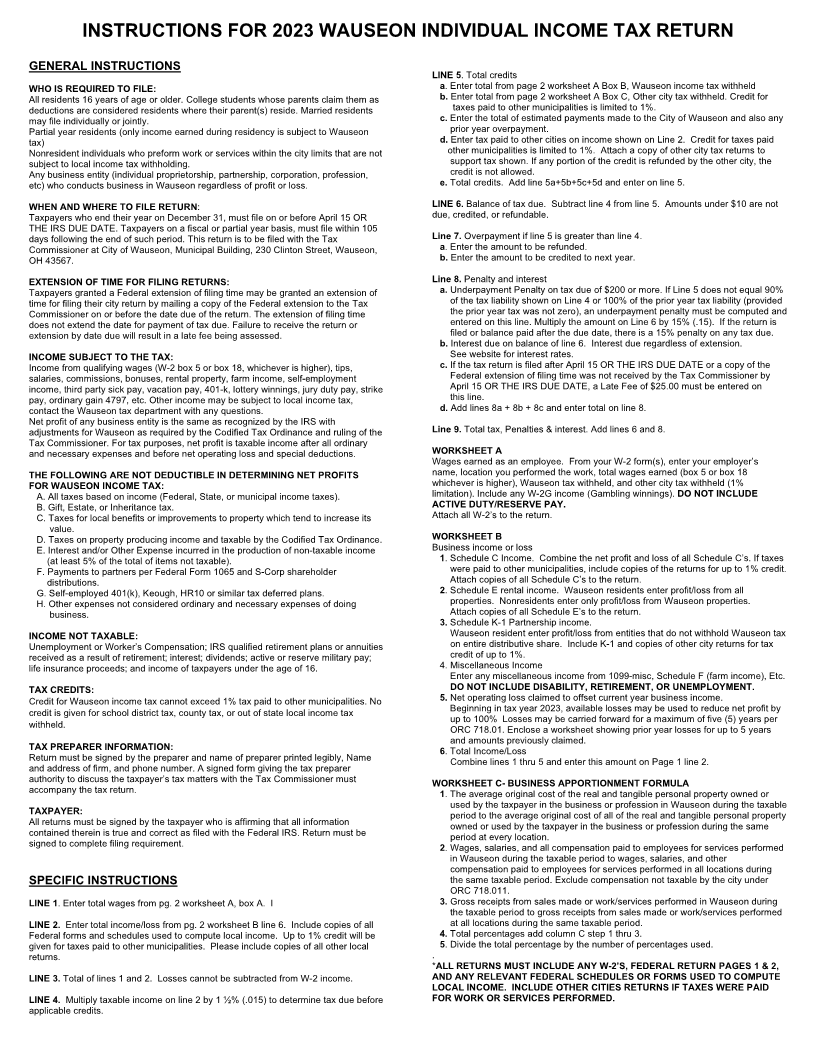

INSTRUCTIONS FOR 2023 WAUSEON INDIVIDUAL INCOME TAX RETURN

GENERAL INSTRUCTIONS

LINE 5. Total credits

WHO IS REQUIRED TO FILE: a. Enter total from page 2 worksheet A Box B, Wauseon income tax withheld

All residents 16 years of age or older. College students whose parents claim them as b. Enter total from page 2 worksheet A Box C, Other city tax withheld. Credit for

deductions are considered residents where their parent(s) reside. Married residents taxes paid to other municipalities is limited to 1%.

may file individually or jointly. c.Enter the total of estimated payments made to the City of Wauseon and also any

Partial year residents (only income earned during residency is subject to Wauseon prior year overpayment.

tax) d.Enter tax paid to other cities on income shown on Line 2. Credit for taxes paid

Nonresident individuals who preform work or services within the city limits that are not other municipalities is limited to 1%. Attach a copy of other city tax returns to

subject to local income tax withholding. support tax shown. If any portion of the credit is refunded by the other city, the

Any business entity (individual proprietorship, partnership, corporation, profession, credit is not allowed.

etc) who conducts business in Wauseon regardless of profit or loss. e. Total credits. Add line 5a+5b+5c+5d and enter on line 5.

WHEN AND WHERE TO FILE RETURN: LINE 6. Balance of tax due. Subtract line 4 from line 5. Amounts under $10 are not

Taxpayers who end their year on December 31, must file on or before April 15 OR due, credited, or refundable.

THE IRS DUE DATE. Taxpayers on a fiscal or partial year basis, must file within 105

days following the end of such period. This return is to be filed with the Tax Line 7. Overpayment if line 5 is greater than line 4.

Commissioner at City of Wauseon, Municipal Building, 230 Clinton Street, Wauseon, a. Enter the amount to be refunded.

OH 43567. b. Enter the amount to be credited to next year.

EXTENSION OF TIME FOR FILING RETURNS: Line 8. Penalty and interest

Taxpayers granted a Federal extension of filing time may be granted an extension of a.Underpayment Penalty on tax due of $200 or more. If Line 5 does not equal 90%

time for filing their city return by mailing a copy of the Federal extension to the Tax of the tax liability shown on Line 4 or 100% of the prior year tax liability (provided

Commissioner on or before the date due of the return. The extension of filing time the prior year tax was not zero), an underpayment penalty must be computed and

does not extend the date for payment of tax due. Failure to receive the return or entered on this line. Multiply the amount on Line 6 by 15% (.15). If the return is

extension by date due will result in a late fee being assessed. filed or balance paid after the due date, there is a 15% penalty on any tax due.

b. Interest due on balance of line 6. Interest due regardless of extension.

INCOME SUBJECT TO THE TAX: See website for interest rates.

Income from qualifying wages (W-2 box 5 or box 18, whichever is higher), tips, c. If the tax return is filed after April 15 OR THE IRS DUE DATE or a copy of the

salaries, commissions, bonuses, rental property, farm income, self-employment Federal extension of filing time was not received by the Tax Commissioner by

income, third party sick pay, vacation pay, 401-k, lottery winnings, jury duty pay, strike April 15 OR THE IRS DUE DATE, a Late Fee of $25.00 must be entered on

pay, ordinary gain 4797, etc. Other income may be subject to local income tax, this line.

contact the Wauseon tax department with any questions. d. Add lines 8a + 8b + 8c and enter total on line 8.

Net profit of any business entity is the same as recognized by the IRS with

adjustments for Wauseon as required by the Codified Tax Ordinance and ruling of the Line 9. Total tax, Penalties & interest. Add lines 6 and 8.

Tax Commissioner. For tax purposes, net profit is taxable income after all ordinary

and necessary expenses and before net operating loss and special deductions. WORKSHEET A

Wages earned as an employee. From your W-2 form(s), enter your employer’s

THE FOLLOWING ARE NOT DEDUCTIBLE IN DETERMINING NET PROFITS name, location you performed the work, total wages earned (box 5 or box 18

FOR WAUSEON INCOME TAX: whichever is higher), Wauseon tax withheld, and other city tax withheld (1%

A. All taxes based on income (Federal, State, or municipal income taxes). limitation). Include any W-2G income (Gambling winnings). DO NOT INCLUDE

B. Gift, Estate, or Inheritance tax. ACTIVE DUTY/RESERVE PAY.

C. Taxes for local benefits or improvements to property which tend to increase its Attach all W-2’s to the return.

value.

D. Taxes on property producing income and taxable by the Codified Tax Ordinance. WORKSHEET B

E. Interest and/or Other Expense incurred in the production of non-taxable income Business income or loss

(at least 5% of the total of items not taxable). 1. Schedule C Income. Combine the net profit and loss of all Schedule C’s. If taxes

F. Payments to partners per Federal Form 1065 and S-Corp shareholder were paid to other municipalities, include copies of the returns for up to 1% credit.

distributions. Attach copies of all Schedule C’s to the return.

G. Self-employed 401(k), Keough, HR10 or similar tax deferred plans. 2. Schedule E rental income. Wauseon residents enter profit/loss from all

H. Other expenses not considered ordinary and necessary expenses of doing properties. Nonresidents enter only profit/loss from Wauseon properties.

business. Attach copies of all Schedule E’s to the return.

3. Schedule K-1 Partnership income.

INCOME NOT TAXABLE: Wauseon resident enter profit/loss from entities that do not withhold Wauseon tax

Unemployment or Worker’s Compensation; IRS qualified retirement plans or annuities on entire distributive share. Include K-1 and copies of other city returns for tax

received as a result of retirement; interest; dividends; active or reserve military pay; credit of up to 1%.

life insurance proceeds; and income of taxpayers under the age of 16. 4. Miscellaneous Income

Enter any miscellaneous income from 1099-misc, Schedule F (farm income), Etc.

TAX CREDITS: DO NOT INCLUDE DISABILITY, RETIREMENT, OR UNEMPLOYMENT.

Credit for Wauseon income tax cannot exceed 1% tax paid to other municipalities. No 5. Net operating loss claimed to offset current year business income.

credit is given for school district tax, county tax, or out of state local income tax Beginning in tax year 2023, available losses may be used to reduce net profit by

withheld. up to 100% Losses may be carried forward for a maximum of five (5) years per

ORC 718.01. Enclose a worksheet showing prior year losses for up to 5 years

and amounts previously claimed.

TAX PREPARER INFORMATION: 6. Total Income/Loss

Return must be signed by the preparer and name of preparer printed legibly, Name Combine lines 1 thru 5 and enter this amount on Page 1 line 2.

and address of firm, and phone number. A signed form giving the tax preparer

authority to discuss the taxpayer’s tax matters with the Tax Commissioner must WORKSHEET C- BUSINESS APPORTIONMENT FORMULA

accompany the tax return. 1. The average original cost of the real and tangible personal property owned or

used by the taxpayer in the business or profession in Wauseon during the taxable

TAXPAYER: period to the average original cost of all of the real and tangible personal property

All returns must be signed by the taxpayer who is affirming that all information owned or used by the taxpayer in the business or profession during the same

contained therein is true and correct as filed with the Federal IRS. Return must be period at every location.

signed to complete filing requirement. 2. Wages, salaries, and all compensation paid to employees for services performed

in Wauseon during the taxable period to wages, salaries, and other

compensation paid to employees for services performed in all locations during

SPECIFIC INSTRUCTIONS the same taxable period. Exclude compensation not taxable by the city under

ORC 718.011.

LINE 1. Enter total wages from pg. 2 worksheet A, box A. I 3. Gross receipts from sales made or work/services performed in Wauseon during

the taxable period to gross receipts from sales made or work/services performed

LINE 2. Enter total income/loss from pg. 2 worksheet B line 6. Include copies of all at all locations during the same taxable period.

Federal forms and schedules used to compute local income. Up to 1% credit will be 4.Total percentages add column C step 1 thru 3.

given for taxes paid to other municipalities. Please include copies of all other local 5. Divide the total percentage by the number of percentages used.

returns. .

*ALL RETURNS MUST INCLUDE ANY W-2’S, FEDERAL RETURN PAGES 1 & 2,

LINE 3. Total of lines 1 and 2. Losses cannot be subtracted from W-2 income. AND ANY RELEVANT FEDERAL SCHEDULES OR FORMS USED TO COMPUTE

LOCAL INCOME. INCLUDE OTHER CITIES RETURNS IF TAXES WERE PAID

LINE 4. Multiply taxable income on line 2 by 1 ½% (.015) to determine tax due before FOR WORK OR SERVICES PERFORMED.

applicable credits.