Enlarge image

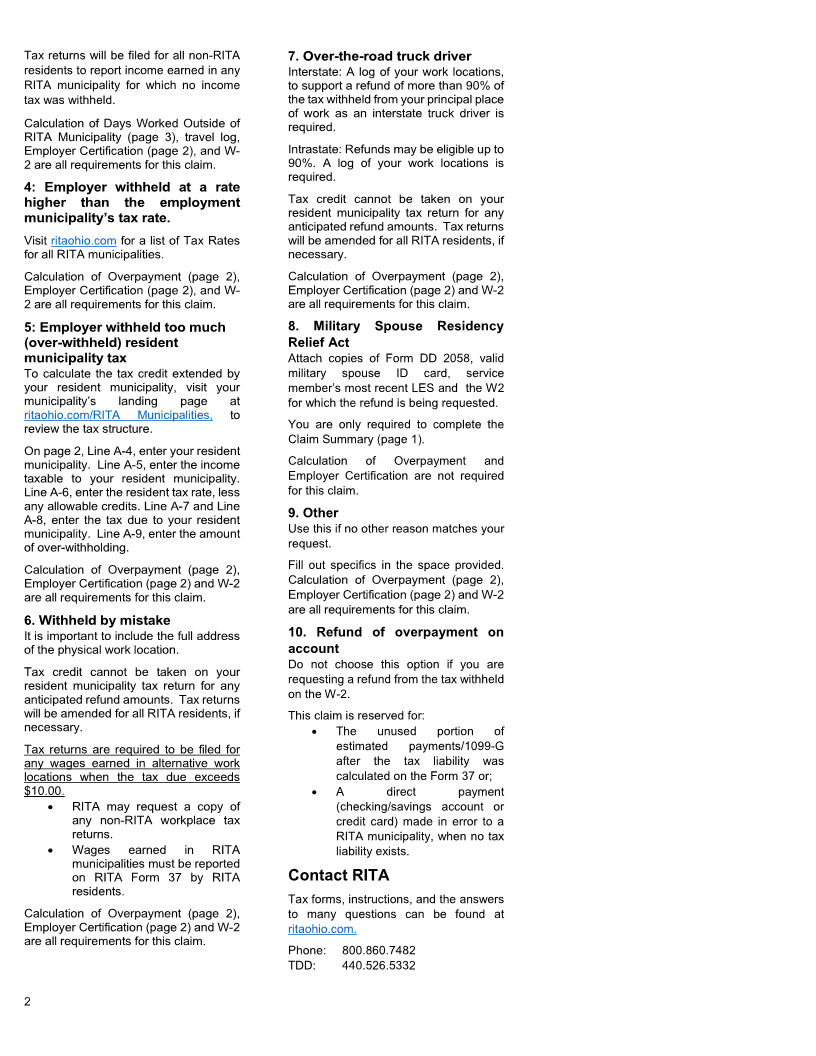

Tax Year 2023 General Also filing Form 37? If you are a resident and only exempt for a portion of the year, it is important that If filing a Form 37, attach the Form 10A you include a Form 37 tax return for any Guidelines for Form 10A to the completed return and mail them income earned after your birthday, or an Form 10A cannot be emailed or together to: exemption form if no additional income electronically filed. Complete forms with Regional Income Tax Agency was earned. the requested documentation should be (RITA) mailed to the address on the Form 10A. P.O. Box 95422 2: Days Worked from Home. Days Do not fax your Form 10A. Cleveland, Ohio worked outside of municipality for Separate 10As are required for each 44101-0033 which the employer withheld tax, refund claim, examples include: Please note, your refund review will be and instead you worked from o multiple municipalities for the same suspended until the return is received home (remote). employer and processed. This includes taxpayers Use this reason if you worked outside of o same municipality with different on a filing extension. your normal workplace municipality for employers o Multiple tax years requested RITA Residents: any time in 2023 (from home, other Tax returns will be amended to disallow remote work location). o Joint accounts in which both any tax credit taken as a result of the taxpayers have a request for a Tax credit cannot be taken on your Form 10A calculations. refund from a W-2 resident municipality tax return for any Missing or incomplete documentation Tax returns will be amended to report anticipated refund amounts. Tax returns will impede the review of your refund work performed in any RITA municipality will be amended for all RITA residents, if request. Be sure to submit legible and in which the tax was not withheld. necessary. complete documentation based on your Non-RITA Residents: Tax returns are required to be filed for ‘reason for claim’, along with your W-2. Tax credit cannot be taken on your any wages earned in alternative work The statute of limitations for requesting a resident municipality tax return for any locations when the tax due exceeds refund from withholding on a W-2 is anticipated refund amount from RITA. $10.00. three years from the filing deadline .Any Tax returns will be filed to report work • RITA may request a copy of refund requests made after the statute performed in any RITA municipality in any non-RITA workplace tax returns. o For example: Tax year 2023 filing expires will be denied. which the tax was not withheld. • Wages earned in RITA deadline is 04/15/2024, therefore a Claim Reasons municipalities must be reported request for refund must be received by on RITA Form 37 by RITA 1: Age Exemption residents. 04/15/2027. While many municipalities exempt Refund amounts of $10.00 or less are income earned under the age of 18, visit Calculation of Days Worked Outside of ineligible for refund or credit. ritaohio.com for specific rules for both RITA Municipality (page 3), travel log, Your account must be current in its tax your workplace and RITA resident Employer Certification (page 2) and W-2 filings, without any outstanding municipality (if applicable). are all requirements for this claim. balances. You can expect your Residents, if your workplace municipality approved refund amount, in whole or in has an age exemption but your resident 3: Other Days Worked Outside of part, to be applied to any past due municipality does not, a tax return is municipality balances. Log into MyAccount at required. Any unused portion of the Use this reason if you worked outside of ritaohio.com to review the status of your workplace tax may be available for the municipality for which the employer account. refund/credit. withheld tax (other than days worked at home/remotely). RITA can only process requests made Proof of birthdate (birth certificate, for RITA municipalities. Go to driver’s license, etc.) is required for the Tax credit cannot be taken on your ritaohio.com and click on the RITA Age Exemption claim reason. resident municipality tax return for any Municipalities link for a full list of RITA anticipated refund amounts. Tax returns members. If you qualify for an underage exemption will be amended for all RITA residents, if for the entire tax year, check box No. 1 necessary. Name, Address, Social and complete the Claim Summary on Security Number and page 1. Enter your wages on line 3, and Tax returns are required to be filed for the tax withheld on line 4. Calculation of any wages earned in alternative work Contact Phone Number. Overpayment and Employer locations when the tax due exceeds Print your name, address, social security Certification is not required. $10.00. number and contact phone number • RITA may request a copy of If you qualify for an underage exemption within the boxes provided. for only a portion of the tax year , you any non-RITA workplace tax returns. must provide a paystub closest to your birthday or the Calculation of • Wages earned in RITA Overpayment (page 2) and Employer municipalities must be reported Certification (page 2) to validate the on RITA Form 37 by RITA residents. amount of wages exempt from taxation. 1