Enlarge image

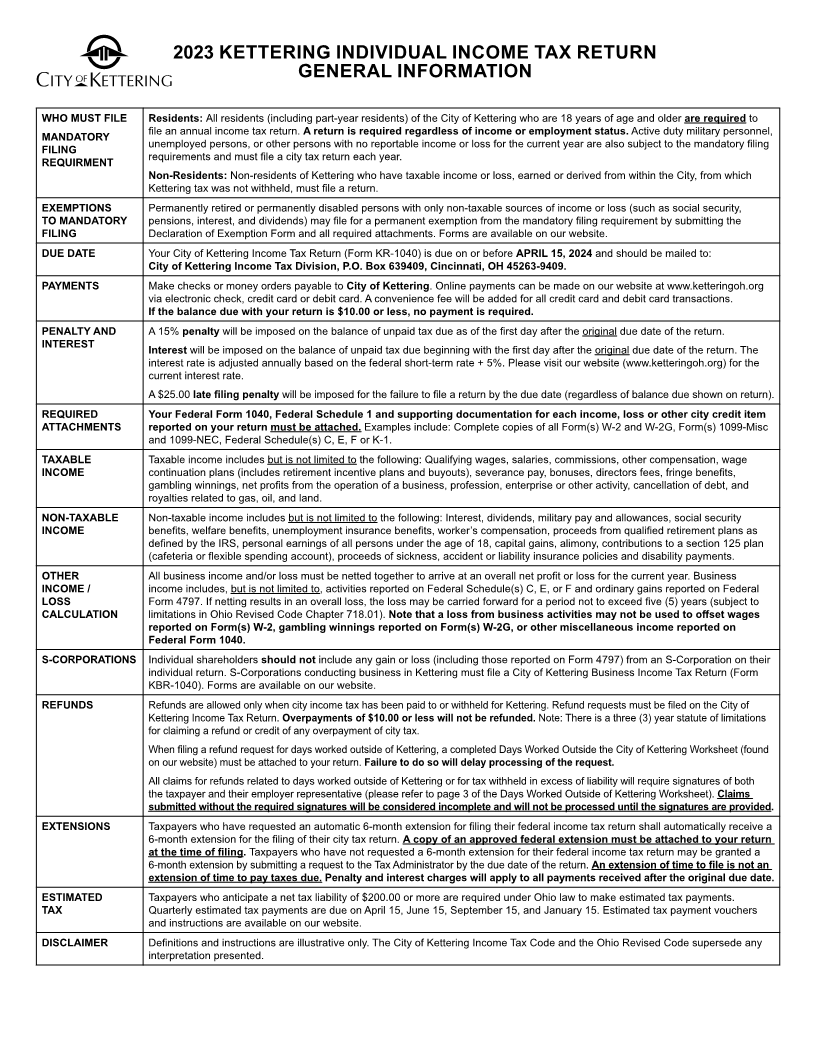

CITY OF KETTERING INCOME TAX DIVISION P.O. Box 639409 • Cincinnati, OH 45263-9409 2023 Phone: (937) 296-2502 • Fax: (937) 296-3242 CITY OF KETTERING www.ketteringoh.org • ketteringtax@ketteringoh.org INDIVIDUAL TAX RETURN DUE ON OR BEFORE APRIL 15, 2024 Account Number: ________________________________________________ Taxpayer Social Security Number CLAIM FOR Taxpayer: ______________________________________________________ REFUND Spouse (if filing joint): _____________________________________________ Spouse Social Security Number (An amount must be placed on Line 13 for this return to be considered a valid refund request.) Address: _______________________________________________________ City / State / Zip Code: ____________________________________________ City of Residence ______________________________________ Physical Work Address __________________________________ Phone Number: _________________________________________________ Resident Date moved in ________________________ Email Address: __________________________________________________ Non-Resident Date moved out _______________________ If partial year resident, indicate previous address: Complete copies of all Forms W-2, Federal Schedule 1, _______________________________________________________ Federal Form 1040 and all other applicable Federal Schedules and/or documentation must be attached. _______________________________________________________ Part A – Tax Calculation 1. Total Qualifying Wages (generally Box 5 of Form W-2; see instructions) – Attach W-2 Forms For multiple W-2’s, complete Worksheet A on page 2 1. 2. Other Income from Worksheet B, Page 2, Line 12 (Do not enter amounts less than zero) 2. 3. Kettering Taxable Income (Line 1 plus Line 2) – Losses from page 2, line 8 cannot offset wages 3. 4. Kettering Income Tax – 2.25% (Multiply Line 3 by .0225) 4. 5a. Kettering Tax Withheld (per W-2’s) 5a. 5b. Other Municipal Taxes Paid (Credit limited to 2.25%) – Residents only 5b. 5c. Estimates Paid 5c. 5d. Prior Year Credit 5d. 6. Total Payments and Credits (Total of Lines 5a through 5d) 6. 7. Balance Due/(Overpayment) (Line 4 minus Line 6) 7. 8. Penalty Due (15% of all tax not timely paid) 8. 9. Interest Due (Imposed on all tax not timely paid) 9. 10. Late Filing Penalty ($25.00 regardless of balance due on Line 7) 10. 11. Total Due (Total of Lines 7, 8, 9 and 10) – If $10.00 or less, enter $0.00 11. 12. Overpayment from Line 11 12. 13. Amount to be Refunded – If $10.00 or less, enter $0.00 13. 14. Credit to Next Year 14. Part B – Declaration of Estimated Tax for 2024 – Must be completed by taxpayers who anticipate a net tax liability of at least $200.00 15. Total Estimated Income Subject to Tax $ ______________ . Multiply by tax rate – 2.25% 15. 16. Kettering Tax to be Withheld or Credit for Tax Paid to Other Cities 16. 17. 2024 Estimated Tax Due (Line 15 minus Line 16) 17. 18. Declaration Due (Multiply Line 17 by 22.5%) 18. 19. Less: Overpayment from Prior Year (from Line 14 above) 19. 20. Net Estimated Tax Due with this Return – subsequent estimated payments are due by 6/15, 9/15, 1/15 20. 21. TOTAL AMOUNT DUE – Add Lines 11 and 20. Make checks payable to City of Kettering. Credit card, debit card and electronic check payments can be made at www.ketteringoh.org. 21. If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return. Yes No The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated. _________________________________________________________________ ________________________________________________________________ Signature of Taxpayer Date Signature of Spouse Date _________________________________________________________________ ________________________________________________________________ Taxpayer Occupation Spouse Occupation _________________________________________________________________ ________________________________________________________________ Preparer Name Preparer Email Address FORM KR-1040