Enlarge image

2023

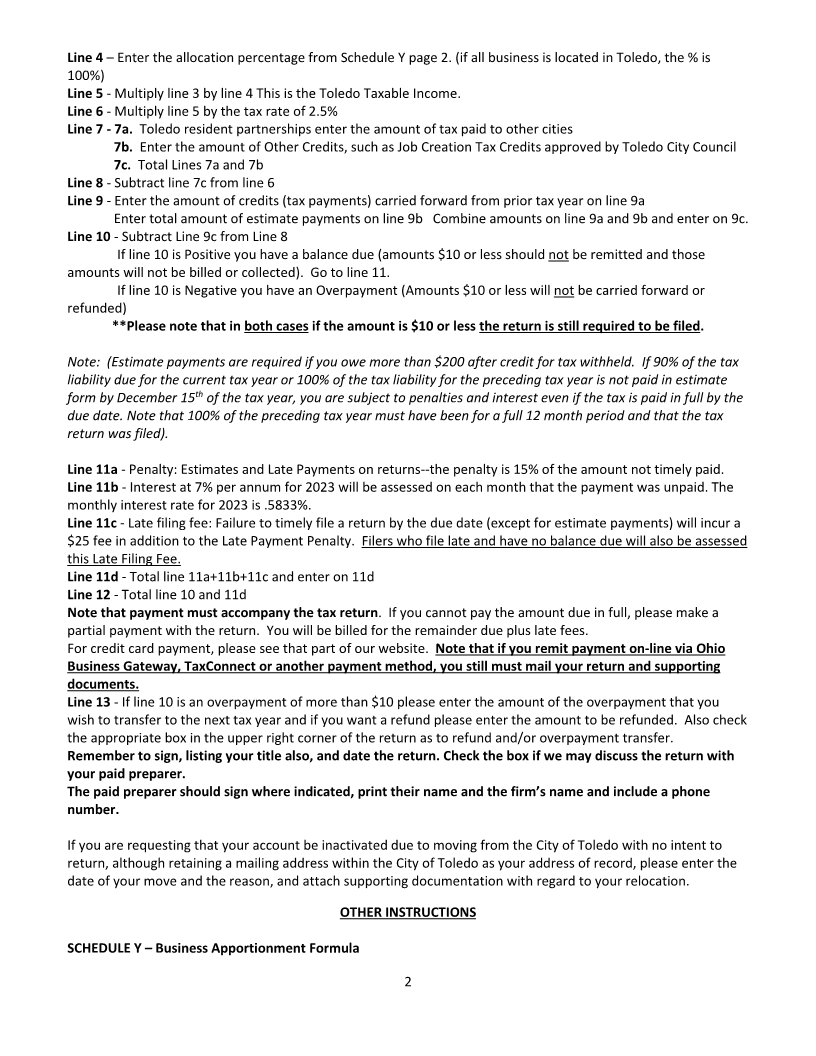

TOLEDO BUSINESS RETURN PLEASE CHECK IF :

For filers of Federal Forms 1120, 1120S, 1065, 1041 REFUND

Return due on or before April 15, 2024 or CREDIT TO 2024

within 3 months 15 days after the close of the fiscal year or period AMENDED

Attach a copy of your Federal return including all supporting schedules BALANCE DUE

and issued 1099-Misc/1099-NEC. PAID ONLINE

FOR FISCAL YEAR

TOLEDO ACCOUNT#_________________________ FED ID#_________________________ BEGINNING____________ENDING___________

(Short period return Yes No)

NAME____________________________________________________________________

FILING STATUS

TRADE NAME ______________________________________________________________ Corporation Fiduciary (Trust & Estates)

Partnership/Association

ADDRESS _________________________________________________________________ (Do not use this form for Schedule C filers)

CITY ________________________________ STATE _____________ ZIP _______________ Did you file a Toledo return last year? Yes No

Is this a consolidated return? Yes No

LOCAL BUSINESS ADDRESS IF DIFFERENT FROM ABOVE Should your account be closed? Yes No

Reason _______________________________

ADDRESS _________________________________________________________________ Do you have employee(s) in Toledo? Yes No

PARTCITYA________________________________TAX CALCULATION – DO NOT COMPLETESTATETAX_____________CALCULATIONZIPUNTIL_______________SCHEDULE X HAS BEEN COMPLETED:

1. Total from Schedule X Line 3 Adjusted Federal Taxable Income ……………..……………………………………………………………………………………….. 1. $ ________________

2. Loss Carried Forward from Schedule NOL Page 2………….. ………. ……………………………………………………………………………………………………… 2. $ ________________

3. Federal Taxable Income before Allocation (Subtract Line 2 from Line 1) .……………………….……………………………………………………………….. 3. $ ________________0.00

4. Allocation percentage from Schedule Y Page 2 Step 5 ……………………………………………………….…………………………………………………………… 4. ________________%0.0000%

5. Toledo Municipal Taxable Income (Multiply Line 3 by line 4) ……….………………………………………………………………………………………………….. 5. $________________0

6. Tax on Line 5 (Multiply Line 5 by 2.5% (.025)) .……………….…………………………………………………………………………………………………………… 6. $________________0

7. 7a. Toledo resident partnership tax paid to other cities $ __________________ (Attach city returns)

7b. Other Credits (see instructions) $ ____________________ Total Line 7a + 7b = 7c. $________________0

8. Subtract Line 7c from Line 6 …………………………………………………………………………………………………………………………….………………………………. 8. $________________0.00

9. Total amount of credits from prior year 9a $________________ total estimate payments 9b $_________________

Total credits Line 9a + 9b = 9c. $_________________ 0.00

IF YOU OWE MORE THAN $200, QUARTERLY ESTIMATE PAYMENTS ARE REQUIRED AND YOU MAY BE SUBJECT TO PENALTIES AND INTEREST DUE TO LACK OF ESTIMATED PAYMENTS.

FURTHER YOU MAY NEED TO MAKE ESTIMATE PAYMENTS FOR 2024 IF YOU EXPECT TO OWE THE SAME OR A GREATER AMOUNT NEXT YEAR.

10. Subtract Line 9c from Line 8 – Balance Due …………………………………………………………………………………………………………..….……………………………..... 10. $___________________0.00

If Line 10 is Positive, you have a balance of tax due; go to Line 11. (Do not remit amounts $10 or less as no billing or collection will occur)

If Line 10 is Negative, you have an overpayment; go to Line 13. (Amounts $10 or less will not be refunded or credited)

Returns need to be filed in both cases even when $10 or less.

11. See instructions to calculate

11a. Penalty $_______________ 11b. Interest $_________________ 11c. Late filing fee $_________________ 11d. total 11a+11b+11c $___________________0.00

12. Total Line 10 and Line 11d – Balance of tax due ………………………………………………………………………………………………………………………………………. 12. $ 0.00

PAYMENT MUST ACCOMPANY RETURN. MAKE PAYMENT PAYABLE TO THE “COMMISSIONER OF TAXATION”

(or see instructions to pay online) (If paying online, return still needs to be mailed) $ $

13. If Line 10 is an overpayment, indicate the amount to be credited to the 2024 ESTIMATE or REFUNDED

(CHECK THE APPROPRIATE BOX AT THE TOP OF THE PAGE)

REFUND: PAYMENT ENCLOSED: NO PAYMENT ENCLOSED:

MAIL TO CITY OF TOLEDO INCOME TAX CITY OF TOLEDO INCOME TAX CITY OF TOLEDO INCOME TAX

PO BOX 902 PO BOX 993 PO BOX 929

TOLEDO, OH 43697-0902 TOLEDO, OH 43697-0993 Toledo, OH 43697-0929

IMPORTANT: This return is NOT considered filed until signed.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated, and that the figures used are

Signature the same as used for federal income tax purposes and understands that this information may be released to the tax administration of the city of residence and the I.R.S.

_________________________________________________________ _________________________________________________________

TAXPAYER MUST SIGN (Signature of Taxpayer) DATE TAX PREPARER’S SIGNATURE DATE

_________________________________________________________ _________________________________________________________

PRINT NAME PRINT NAME PTIN

_________________________________________________________ _________________________________________________________

TITLE PHONE NUMBER FIRM NAME PHONE NUMBER

Check box if City may discuss your return with tax preparer.