Enlarge image

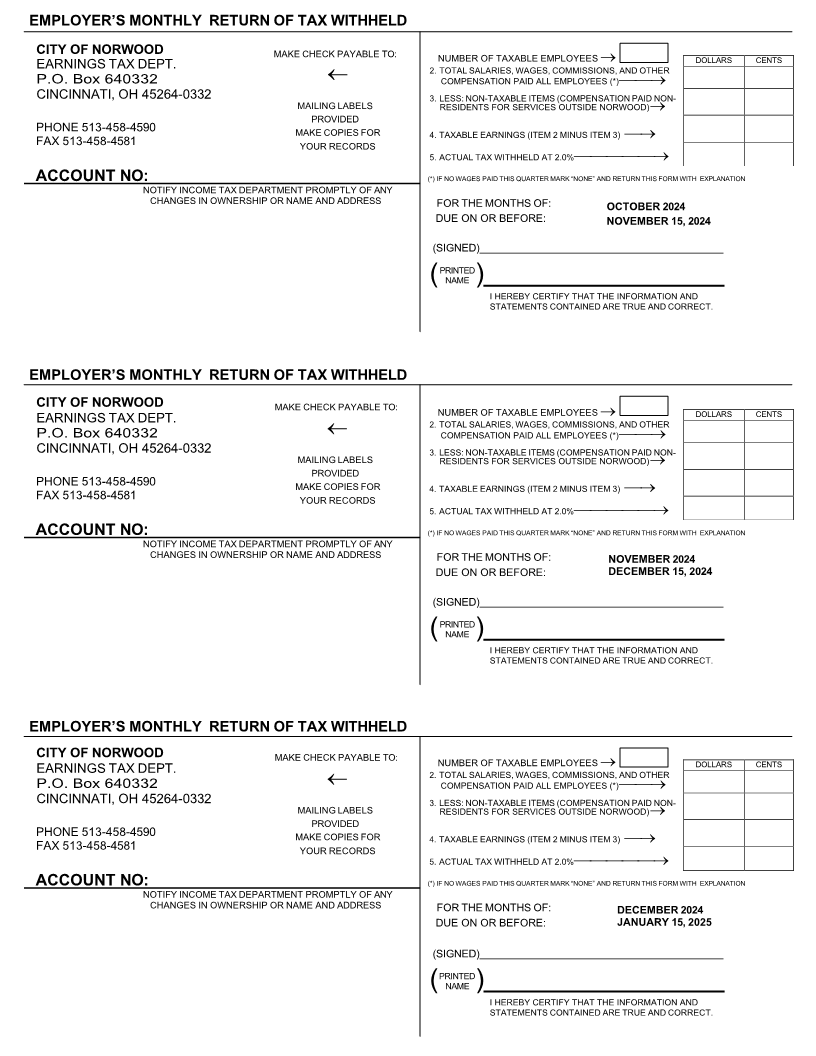

FORM N5-202 3 EMPLOYER’S WITHHOLDING RETURNS

NORWOOD RECONCILIATION OF TAX WITHHELD FOR 202 3

NORWOOD TAX OFFICE 5. WITHHOLDING TAX LIABILITY OF 2% OF LINE 4.........

4645 MONTGOMERY ROAD 6. TOTAL INCOME TAX WITHHELD FROM WAGES AND PAID TO

CITY OF NORWOOD DURING 2023

NORWOOD, OH 45212 QUARTER ENDING MARCH 31 $........

PHONE 513 458- 4590 QUARTER ENDING JUNE 30 $........

1. TOTAL NUMBER OF TAXABLE EMPLOYEES... QUARTER ENDING SEPTEMBER 30 $.......

2. TOTAL PAYROLL FOR THE YEAR. ...................... $ QUARTER ENDING DECEMBER 31 $.........

3. LESS PAYROLL NOT SUBJECT TO TAX ............ $

4. PAYROLL SUBJECT TO TAX ................................ $

TOTAL FOR YEAR $.......

ACCOUNT NO:

7. OVERPAYMENT $.........OR TAX DUE $.......

(SUBTRACT TOTAL OF LINE 6 FROM LINE 5)

THIS FORM MUST BE FILED ON OR BEFORE

FEBRUARY 28, 202 4ATTACH COPIES OF

W-2 FORMS AND INCLUDE 1099 MISC

FORMS

TAX[USEOFFICEONLY ]

DO NOT SEND THE RECONCILIATION TO: NORWOOD P.O. BOX 640332

THIS LOCK BOX IS ONLY FOR QUARTERLY OR MONTHLY PAYMENTS

REMIT THIS RECONCILIATION FORM & W-2 FORMS TO:

NORWOOD TAX OFFICE

4645 MONTGOMERY ROAD

NORWOOD, OH 45212

RECONCILIATION INSTRUCTIONS

Original of this reconciliation form must be filed with the Tax Commissioner of Norwood, OH on or before

February 28, 202 4 together with copies of W-2 Forms or a list of employees withheld from as requested

under line No. 7. List must include employee's name, address, Social Security Number, taxable earnings,

and amount of Norwood earnings tax withheld. Make a copy of this form for your records.