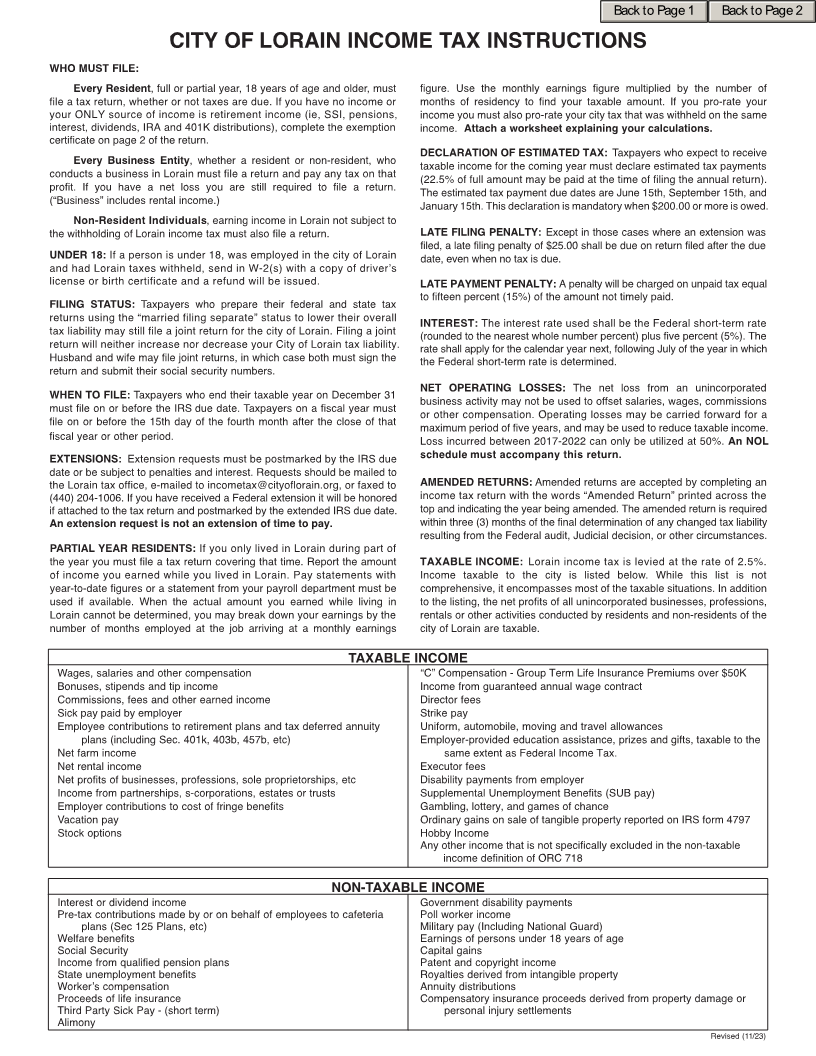

Enlarge image

Change tax year if necessary Instructions Reset Form Print Form

INDIVIDUAL AND BUSINESS TAX RETURN

INCOME TAX DEPARTMENT

(440) 204-1002 Payments

CITY OF LORAIN 2022 FAX (440) 204-1006 from

605 WEST 4TH ST, LORAIN, OH 44052-1605 4th Quarter

THIS RETURN IS DUE BY THE IRS DUE DATE. OR www.cityoflorain.org

FISCAL PERIOD______TO______ If under 18 - Attach proof of age

FISCAL YEAR FILERS MUST FILE ON OR BEFORE THE 15TH DAY OF

THE FOURTH MONTH AFTER THE CLOSE OF THAT FISCAL YEAR. FOR INCOME TAX DEPARTMENT USE ONLY

PAID W/RETURN: CK NO.

PLEASE MAKE SURE NAME AND ADDRESS IS CURRENT INFORMATION

DUE CR TO 2023 REFUND

Enter

__________________________________________________ DECLARING EXEMPTION

Name

__________________________________________________ Exemption Certificate on Pg. 2 Must Be Completed

and

Address __________________________________________________ IF YOU MOVED DURING THE TAX YEAR, COMPLETE THIS BLOCK

Here __________________________________________________ Date moved into Lorain

Previous Address

Date moved out of Lorain

SSN or FID JOINT SSN Present Address

Do you rent or own your home? □ Rent □ Own

W-2 WORKSHEET SEE INSTRUCTIONS BEFORE COMPLETING ROUND TO NEAREST WHOLE DOLLAR

COLUMN 1 COLUMN 2 COLUMN 3 COLUMN 4 COLUMN 5

Date wages were CITY WHERE EMPLOYED GROSS WAGES–HIGHEST WAGES EARNED WHILE LORAIN OTHER CITY MAX CREDIT 2.0 %

Earned (Month/Day)

W-2 From To WAGE ON W-2 LORAINSEE INSTRUCTIONSRESIDENT TAX WITHHELD TAX WITHHELD OF TAXED WAGES

COPIES

MUST

BE

ATTACHED

TOTALS

ATTACH A COPY OF 1040, ALL APPLICABLE W-2S, FEDERAL SCHEDULES, EXPLANATIONS ETC…

INCOME 1. Total W-2 wages from column 2, W-2G and 1099 income........................................................................1 $

2. Partial year wages earned while not a resident of Lorain ........................................................................2 $

3. TAXABLE WAGES. SUBTRACT LINE 2 FROM LINE 1 ..........................................................................3 $

4. Other income. From schedule C, E and H on Pg. 2, Line 12 ..................................................................4 $

5. TOTAL LORAIN INCOME. ADD LINES 3 AND 4 ....................................................................................5 $

TAX 6. LORAIN INCOME TAX. MULTIPLY LINE 5 BY 2-1/2% (.025)..................................................................6 $

TAX 7. Lorain income tax withheld from column 4 .................................................7 $

8. Prior year credits..........................................................................................8 $

WITHHELD,

9. Estimated payments ....................................................................................9 $

PAYMENTS

10. Credit for taxes withheld to other cities from column 5 ............................10 $

AND 11. Credit for taxes paid to other cities (limit 2.0%). See instructions ...........11 $

CREDITS 12. TOTAL PAYMENTS AND CREDITS. ADD LINES 7 THROUGH 11 ............ 12 $

13. TAX BALANCE. If line 6 is more than 12, enter amount due ................................................................13 $

BALANCE 14. Late Filing Penalty. $25, if applicable ......................................................................................................14 $

DUE, 15. Late Payment Penalty. 15% of line 13 ________ Interest (see City website for rates) ________ .......15 $

REFUND 16. TOTAL DUE. Add lines 13 through 15. Carry to line 26 below (No remittance due if $10.00 or less) ...16 $

OR 17. OVERPAYMENT. If line 12 is more than the total of lines 6, 14 and 15 enter here..17 $

CREDIT 18. AMOUNT FROM LINE 17 TO BE REFUNDED (No refund if $10.00 or less) .....18 $

19. AMOUNT FROM LINE 17 TO BE CREDITED TO NEXT YEAR ..............19 $

DECLARATION OF ESTIMATED TAX FOR 2023 (MANDATORY - When tax due is $200.00 or more)

ESTIMATE 20. Total estimated income subject to tax $ Multiply by tax rate of 2-1/2% (.025) ..............20 $

FOR 21. Subtract any estimated income tax to be withheld or paid to other cities (limit 2.0 % of wages) ...........21 $

22. Balance of city income tax declared. Subtract line 21 from line 20 ........................................................22 $

NEXT

23. Tax due before credits. Enter at least 22.5% of line 22 .........................................................................23 $

YEAR 24. Less credits. Enter line 19 from above....................................................................................................24 $

25. Net estimated tax due. Subtract line 24 from line 23 ..............................................................................25 $

26. Enter total due from line 16 above (No remittance due if $10.00 or less) .............................................26 $

TAX DUE 27. TOTAL DUE. ADD LINES 25 & 26. MAKE CHECKS PAYABLE TO LORAIN INCOME TAX DEPT...........................................27 $

If this return was prepared by a tax practitioner, check here if we may NOT contact him/her directly with questions regarding the preparation of this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for Federal Income Tax purposes.

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER DATE SIGNATURE OF TAXPAYER DATE

NAME AND ADDRESS OF PREPARER (PLEASE PRINT) TELEPHONE NUMBER SIGNATURE OF SPOUSE (IF JOINT RETURN) TELEPHONE NUMBER