Enlarge image

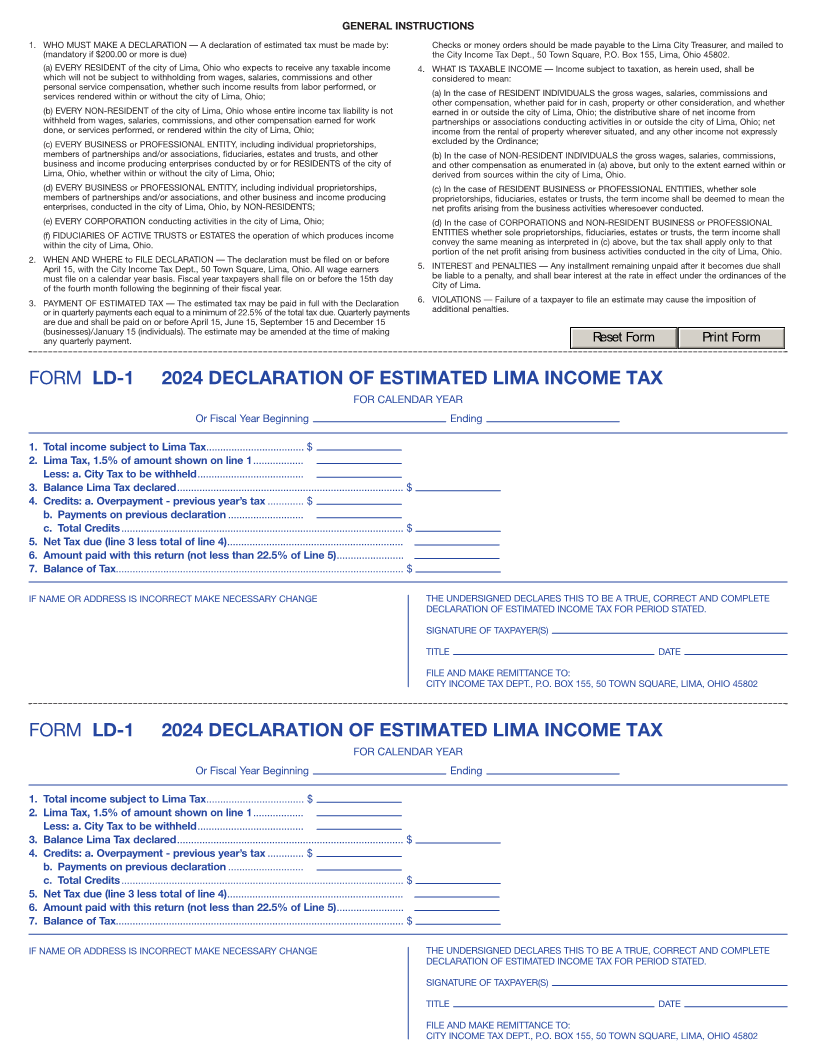

GENERAL INSTRUCTIONS

1. WHO MUST MAKE A DECLARATION — A declaration of estimated tax must be made by: Checks or money orders should be made payable to the Lima City Treasurer, and mailed to

(mandatory if $200.00 or more is due) the City Income Tax Dept., 50 Town Square, P.O. Box 155, Lima, Ohio 45802.

(a) EVERY RESIDENT of the city of Lima, Ohio who expects to receive any taxable income 4. WHAT IS TAXABLE INCOME — Income subject to taxation, as herein used, shall be

which will not be subject to withholding from wages, salaries, commissions and other considered to mean:

personal service compensation, whether such income results from labor performed, or (a) In the case of RESIDENT INDIVIDUALS the gross wages, salaries, commissions and

services rendered within or without the city of Lima, Ohio; other compensation, whether paid for in cash, property or other consideration, and whether

(b) EVERY NON-RESIDENT of the city of Lima, Ohio whose entire income tax liability is not earned in or outside the city of Lima, Ohio; the distributive share of net income from

withheld from wages, salaries, commissions, and other compensation earned for work partnerships or associations conducting activities in or outside the city of Lima, Ohio; net

done, or services performed, or rendered within the city of Lima, Ohio; income from the rental of property wherever situated, and any other income not expressly

(c) EVERY BUSINESS or PROFESSIONAL ENTITY, including individual proprietorships, excluded by the Ordinance;

members of partnerships and/or associations, fiduciaries, estates and trusts, and other (b) In the case of NON-RESIDENT INDIVIDUALS the gross wages, salaries, commissions,

business and income producing enterprises conducted by or for RESIDENTS of the city of and other compensation as enumerated in (a) above, but only to the extent earned within or

Lima, Ohio, whether within or without the city of Lima, Ohio; derived from sources within the city of Lima, Ohio.

(d) EVERY BUSINESS or PROFESSIONAL ENTITY, including individual proprietorships, (c) In the case of RESIDENT BUSINESS or PROFESSIONAL ENTITIES, whether sole

members of partnerships and/or associations, and other business and income producing proprietorships, fiduciaries, estates or trusts, the term income shall be deemed to mean the

enterprises, conducted in the city of Lima, Ohio, by NON-RESIDENTS; net profits arising from the business activities wheresoever conducted.

(e) EVERY CORPORATION conducting activities in the city of Lima, Ohio; (d) In the case of CORPORATIONS and NON-RESIDENT BUSINESS or PROFESSIONAL

(f) FIDUCIARIES OF ACTIVE TRUSTS or ESTATES the operation of which produces income ENTITIES whether sole proprietorships, fiduciaries, estates or trusts, the term income shall

within the city of Lima, Ohio. convey the same meaning as interpreted in (c) above, but the tax shall apply only to that

portion of the net profit arising from business activities conducted in the city of Lima, Ohio.

2. WHEN AND WHERE to FILE DECLARATION — The declaration must be filed on or before 5. INTEREST and PENALTIES — Any installment remaining unpaid after it becomes due shall

April 15, with the City Income Tax Dept., 50 Town Square, Lima, Ohio. All wage earners be liable to a penalty, and shall bear interest at the rate in effect under the ordinances of the

must file on a calendar year basis. Fiscal year taxpayers shall file on or before the 15th day City of Lima.

of the fourth month following the beginning of their fiscal year.

3. PAYMENT OF ESTIMATED TAX — The estimated tax may be paid in full with the Declaration 6. VIOLATIONS — Failure of a taxpayer to file an estimate may cause the imposition of

or in quarterly payments each equal to a minimum of 22.5% of the total tax due. Quarterly payments additional penalties.

are due and shall be paid on or before April 15, June 15, September 15 and December 15

(businesses)/January 15 (individuals). The estimate may be amended at the time of making

any quarterly payment. Reset Form Print Form

FORM LD-1 2024 DECLARATION OF ESTIMATED LIMA INCOME TAX

FOR CALENDAR YEAR

Or Fiscal Year Beginning Ending

1. Total income subject to Lima Tax................................... $

2. Lima Tax, 1.5% of amount shown on line 1..................

Less: a. City Tax to be withheld......................................

3. Balance Lima Tax declared................................................................................. $

4. Credits: a. Overpayment - previous year’s tax ............. $

b. Payments on previous declaration ...........................

c. Total Credits..................................................................................................... $

5. Net Tax due (line 3 less total of line 4)...............................................................

6. Amount paid with this return (not less than 22.5% of Line 5)........................

7. Balance of Tax....................................................................................................... $

IF NAME OR ADDRESS IS INCORRECT MAKE NECESSARY CHANGE THE UNDERSIGNED DECLARES THIS TO BE A TRUE, CORRECT AND COMPLETE

DECLARATION OF ESTIMATED INCOME TAX FOR PERIOD STATED.

SIGNATURE OF TAXPAYER(S)

TITLE DATE

FILE AND MAKE REMITTANCE TO:

CITY INCOME TAX DEPT., P.O. BOX 155, 50 TOWN SQUARE, LIMA, OHIO 45802

FORM LD-1 2024 DECLARATION OF ESTIMATED LIMA INCOME TAX

FOR CALENDAR YEAR

Or Fiscal Year Beginning Ending

1. Total income subject to Lima Tax................................... $

2. Lima Tax, 1.5% of amount shown on line 1..................

Less: a. City Tax to be withheld......................................

3. Balance Lima Tax declared................................................................................. $

4. Credits: a. Overpayment - previous year’s tax ............. $

b. Payments on previous declaration ...........................

c. Total Credits..................................................................................................... $

5. Net Tax due (line 3 less total of line 4)...............................................................

6. Amount paid with this return (not less than 22.5% of Line 5)........................

7. Balance of Tax....................................................................................................... $

IF NAME OR ADDRESS IS INCORRECT MAKE NECESSARY CHANGE THE UNDERSIGNED DECLARES THIS TO BE A TRUE, CORRECT AND COMPLETE

DECLARATION OF ESTIMATED INCOME TAX FOR PERIOD STATED.

SIGNATURE OF TAXPAYER(S)

TITLE DATE

FILE AND MAKE REMITTANCE TO:

Enfocus Software - Customer Support CITY INCOME TAX DEPT., P.O. BOX 155, 50 TOWN SQUARE, LIMA, OHIO 45802