Enlarge image

CITY OF CINCINNATI – 2024 BUSINESS

DECLARATION OF ESTIMATED INCOME TAX

FOR CALENDAR YEAR 2024 OR MONTHS ENDING

A legally filed Declaration must be signed, dated and accompanied by payment. Mail To: Cincinnati Income Tax Division PO Box 637876

Cincinnati, OH 45263-7876by April 15, 2024 or the 15 dayth of the 4 monthth after the tax year begins. Taxpayer Service: (513) 352-3847.

Filing Status (Check one)

Account Number: FID #:

C-Corporation

Email: S-Corporation

LLC

Name Partnership/Association

Address Fiduciary (Trusts and Estates)

PLEASE PROVIDE CURRENT ADDRESS

TAX DECLARATION

1. Total Estimated Income Subject to Tax ______________________

2. Cincinnati Estimated Income Tax Due (Multiply Line 1 by 1.8% (.018) ______________________

3. Quarter One Estimated Tax Due Before Credits (at least 25% of Line 2) ______________________

4. Less Credits (from previous year return) ______________________

5. Net Estimated Tax Due if Line 3 Minus Line 4 is Greater Than Zero * ______________________

* See Payment Schedule below for subsequent payments

The undersigned declares this to be a true, correct and complete Declaration of Estimated Cincinnati Income Tax for the year 2024.

_________________________________ _________ ____________________

SIGNATURE DATE TITLE

INSTRUCTIONS

Line 1. Base estimated income on the amount subject to tax in the preceding year, or on the preceding 3-month period annualized

for the remainder of the year if the preceding tax year was not for a full 12-month period.

Line 2. Multiply Line 1 by 1.8% and enter the estimated tax due for 2024.

Line 3. Divide Line 2 by 4 to determine the amount of estimated tax for the first quarter.

Line 4. If you overpaid last year’s tax and requested transfer of the overpayment toward this year’s estimated tax, enter the amount

on this line.

Line 5. Enter and remit the net estimated tax due if Line 3 minus Line 4 is greater than zero. Make checks payable to "City of

Cincinnati". This is the first of four quarterly estimated tax payments. We will not bill you for the remaining quarterly

installments. The second payment is due on the 15 daythof the 6 monththafter the beginning of the year and is equal to the

total estimated tax on Line 2 divided by 4 less any overpayment still available from prior years. The third payment is due

on the 15 dayth of the 9 monthth after the beginning of the year and the final estimated payment is due on the 15 day ofth the

1 stmonth of the next calendar year.

PAYMENT SCHEDULE FOR CALENDAR YEAR FILERS

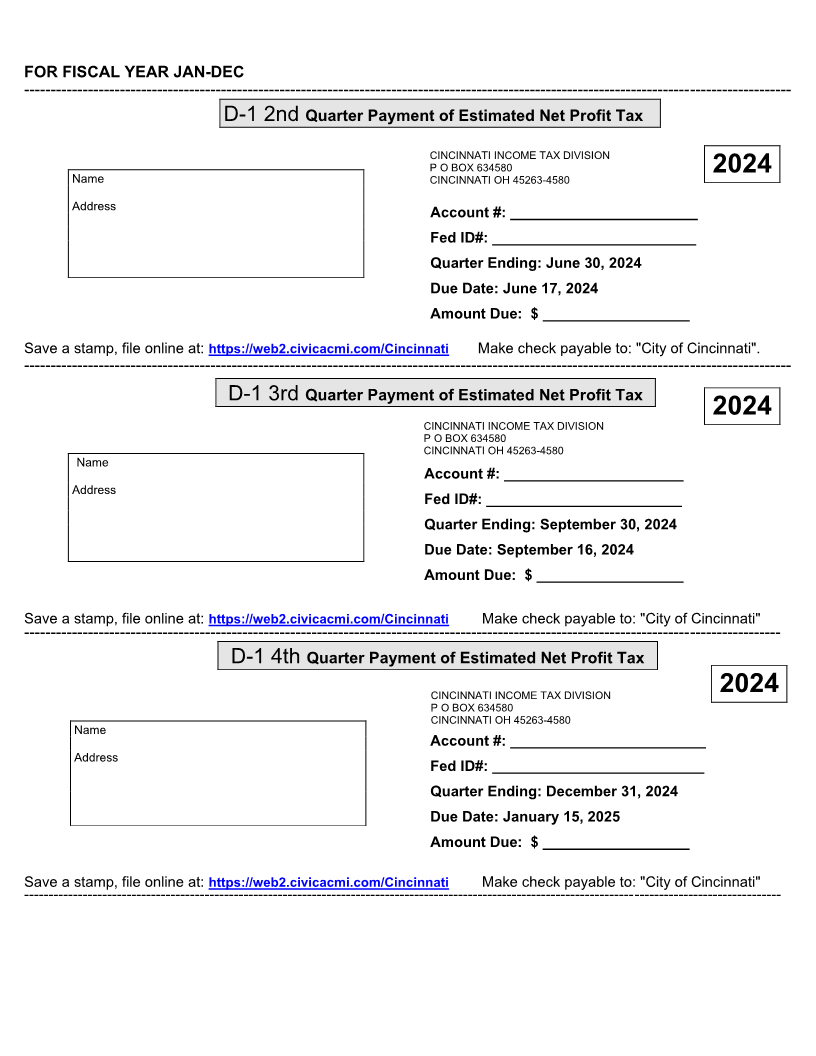

APRIL 15, 2024 JUNE 17, 2024 SEPTEMBER 16, 2024 JANUARY 15, 2025 APRIL 15, 2025

FILE DECLARATION MAKE 2 QUARTERLYND MAKE 3 QUARTERLY RD MAKE 4 QUARTERLY FILETH RETURN . PAY

WITH ¼ PAYMENT. PAYMENT. PAYMENT. PAYMENT. ANY BALANCE DUE.

• Taxpayers with a fiscal year end other than December 31 stmust file their Declaration by the 15 thday of the 4th month of the

fiscal year. Subsequent payments are due on the 15 of thest 6 , 9 andth12 thmonths afterth the beginning of the taxable year.

• Businesses filing for the first time should attach a New Account Application. This form is available on our website at

www.cincinnati-oh.gov/citytax under Income Taxes – New Account Application Form.

• If the total estimate due after applicable credits for 2024 is less than $200.00, then no declaration is required to be filed.