Enlarge image

Business Tax Return City of Cincinnati

2023 Income Tax Division

OR PO Box 637876

FISCAL PERIOD FROM TO Cincinnati OH 45263-7876

Click on the fields below and type in Phone: (513) 352-3847

your information. Then print the form Calendar Year Taxpayersth file onth or before April 15, 2024 E-file available at:

Fiscal Year Due on 15 Day of 4 Month After Year End

and mail it to our office.

https://web2.civicacmi.com/Cincinnati

Did you file a City Return last year? Is this a Consolidated Corporate Return? Should your account be inactivated? YES NO

YES NO YES NO If YES, please explain:

Account Number: FID #: Filing Status (Check one)

C-Corporation

Name: Email: S-Corporation

LLC

Partnership/Association

Address: Fiduciary (Trusts and Estates)

City/State/Zip: Amended Return

Refund (Amount must be entered on

PLEASE PROVIDE CURRENT ADDRESS Line 13 to be a valid refund request)

Part A TAX CALCULATION

1. Adjusted Federal Taxable Income (Enclose Copy of Federal Return) From Form ________ Line ________ $

_________________……….

2. Adjustments (From Line L, Schedule X)…………………………………………………………………………………… $

3. AFTI after Schedule X (Line 1 plus/minus Line 2)…………………………………………………………..….………… $

4.a NOL deduction (50% limitation ended 12/31/22)…………………………………………………………………………. XXXXXXXXXXXXXXXXX

4.b. Apportionment percentage (From Step 5, Schedule Y) _________%………………………………………………….

5. Cincinnati taxable income (Multiply Line 3 by Line 4.b.) ………………………………………………………….………… $

6. Other separately stated items. Cincinnati stock options deducted from adjusted federal taxable income and $

Cincinnati rental income or (loss)………....

7. Amount subject to Cincinnati income tax (Line 5 plus or minus Line 6)……..…………………………………………. $

8. Cincinnati income tax (Multiply Line 7 by 1.8% [.018])…………………………………………………………………… $

9 a. Estimates paid on this year’s liability…………………………………………………………..….. $

9 b. Credits applied to this year’s liability………………………………………………………..…….. $

10. Total payments and credits (Lines 9a + 9b) …………………………………………………………………………….. $

11. Tax due (Subtract Line 10 from Line 8) (Amounts less than $10.00 are not due) …………………………………………….. $

12. Overpayment (Line 10 greater than Line 8)…………………………………………………….... $ Federal Extension filed

If yes, attach copy

13. Amount to be refunded (Amounts less than $10.00 will not be refunded) ………………………….. $ Yes

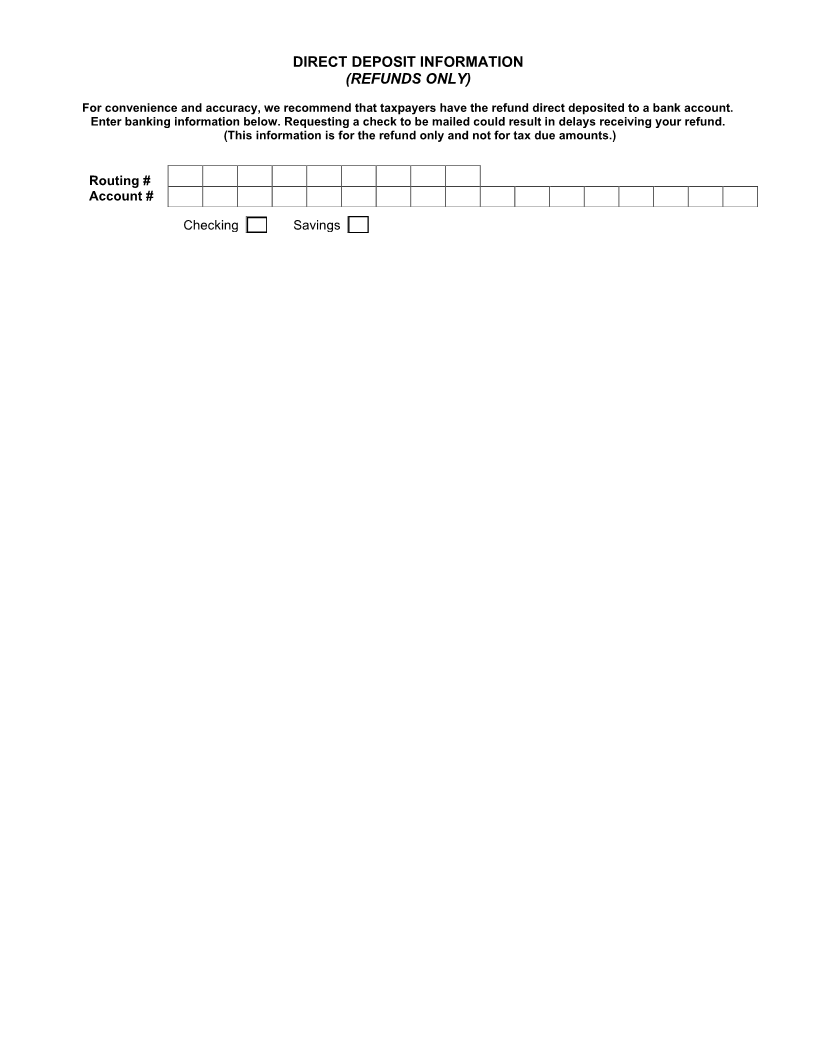

Check box for Direct Deposit request Enter Direct Deposit Information on Page 3

14. Credit to next year………………………………………………………….. $ No

Part B DECLARATION OF ESTIMATED TAX FOR 2024

15. Total Estimated Income Subject to Tax…………………………………………………………… ……………………… . $

16. Cincinnati Estimated Income Tax Due (Multiply Line 15 by 1.8% [.018])……………………… ……………………... . $

17. Quarter One Estimated Tax Due Before Credits (at least 25% of Line 16)…………………………………………….. $

18. Less Credits (from Line 14 above) or Amounts Already Paid on This Y ear’s Liability.………….………… ………... .. $

19. Net Estimated Tax Due if Line 17 Minus Line 18 is Greater Than Zero*……………………………………………….. $

20. TOTAL AMOUNT DUE—Combine Line 11 above with Line 19 $

(Make checks payable to "City of Cincinnati" or pay online at https://web2.civicacmi.com/Cincinnati )

* Subsequent estimated payments are due by the 15 day ofth the 6 , 9 andth12 monthsth afterththe beginning of the taxable year.

Failure to remit timely estimated payments will result in the assessment of interest and penalties.

If the total estimate due after applicable credits for 2024 is less than $200.00, then no declaration is required.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period

stated and that the figures used herein are the same as used for Federal Income Tax purposes and understands that this information may

be released to the Internal Revenue Service.

May the City Tax Division

discuss this return with the

Signature of Person Preparing Return PTIN preparer shown to t he left? Signature of Officer or Agent Date

( ) YES ( ) NO

Name of Person Preparing Return Phone Number Name and Title Phone Number