Enlarge image

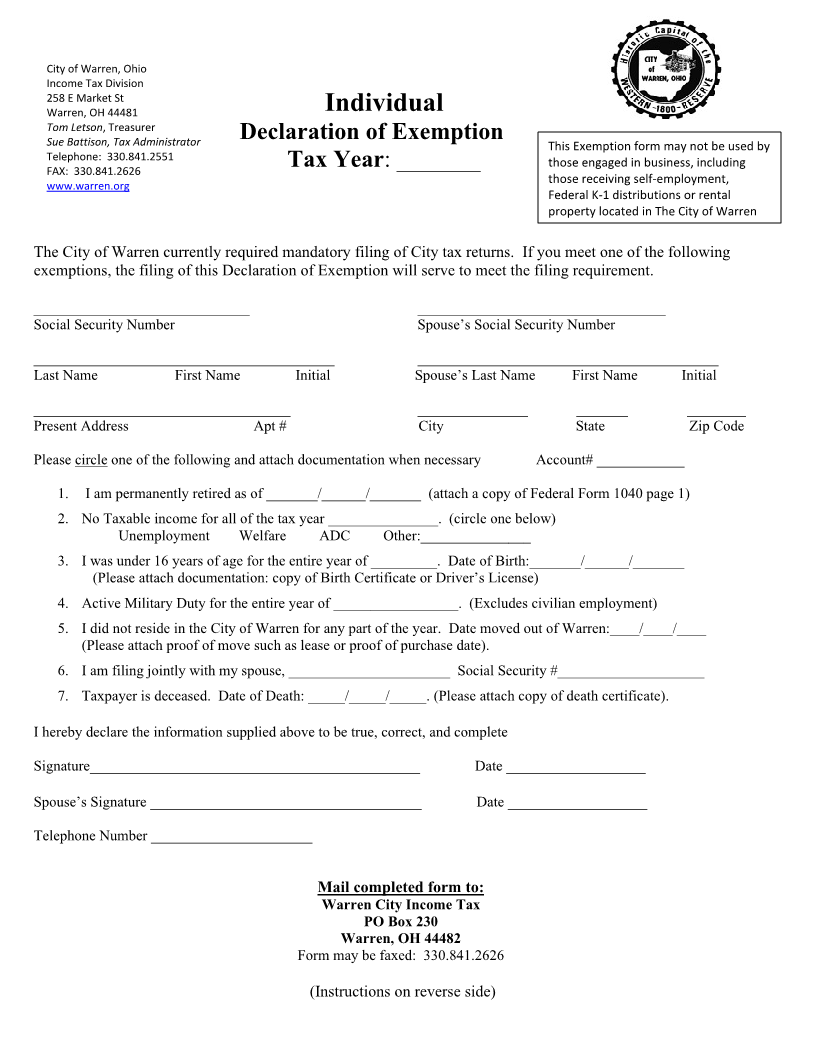

City of Warren, Ohio Income Tax Division 258 E Market St Warren, OH 44481 Individual Tom Letson , Treasurer Sue Battison, Tax Administrator Declaration of Exemption This Exemption form may not be used by Telephone: 330.841.2551 Tax Year: _______ those engaged in business, including FAX: 330.841.2626 www.warren.org those receiving self-employment, Federal K-1 distributions or rental property located in The City of Warren The City of Warren currently required mandatory filing of City tax returns. If you meet one of the following exemptions, the filing of this Declaration of Exemption will serve to meet the filing requirement. ___________________________ _______________________________ Social Security Number Spouse’s Social Security Number _________________________________________ _________________________________________ Last Name First Name Initial Spouse’s Last Name First Name Initial ___________________________________ _______________ _______ ________ Present Address Apt # City State Zip Code Please circle one of the following and attach documentation when necessary Account# ____________ 1. I am permanently retired as of _______/______/_______ (attach a copy of Federal Form 1040 page 1) 2. No Taxable income for all of the tax year _______________. (circle one below) Unemployment Welfare ADC Other:_______________ 3. I was under 16 years of age for the entire year of _________. Date of Birth:_______/______/_______ (Please attach documentation: copy of Birth Certificate or Driver’s License) 4. Active Military Duty for the entire year of _________________. (Excludes civilian employment) 5. I did not reside in the City of Warren for any part of the year. Date moved out of Warren:____/____/____ (Please attach proof of move such as lease or proof of purchase date). 6. I am filing jointly with my spouse, ______________________ Social Security #____________________ 7. Taxpayer is deceased. Date of Death: _____/_____/_____. (Please attach copy of death certificate). I hereby declare the information supplied above to be true, correct, and complete Signature_____________________________________________ Date ___________________ Spouse’s Signature _____________________________________ Date ___________________ Telephone Number ______________________ Mail completed form to: Warren City Income Tax PO Box 230 Warren, OH 44482 Form may be faxed: 330.841.2626 (Instructions on reverse side)