Enlarge image

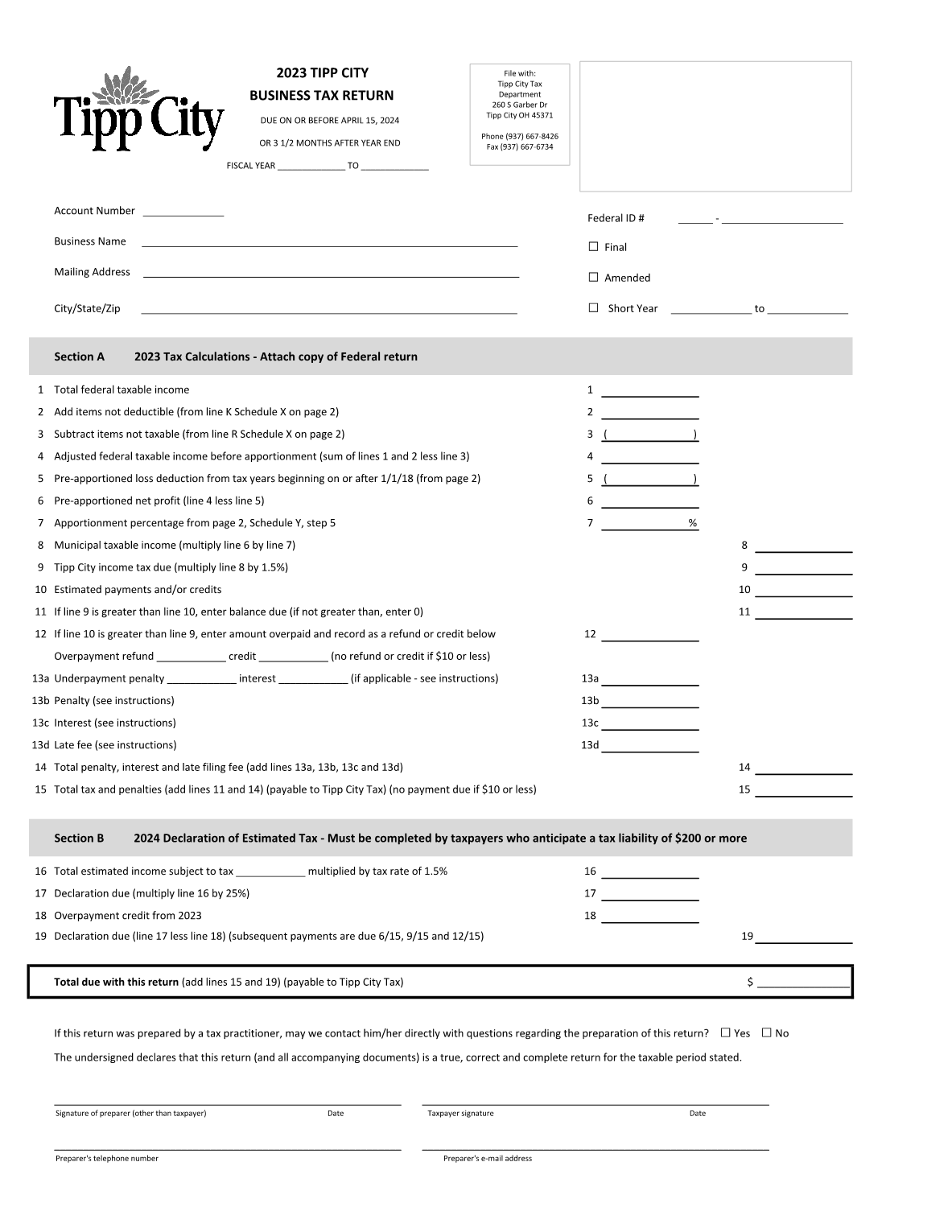

2023 TIPP CITY File with:

Tipp City Tax

BUSINESS TAX RETURN Department

260 S Garber Dr

Tipp City OH 45371

DUE ON OR BEFORE APRIL 15, 2024

Phone (937) 667-8426

OR 3 1/2 MONTHS AFTER YEAR END Fax (937) 667-6734

FISCAL YEAR ______________ TO ______________

Account Number ______________

Federal ID # ______ - _____________________

Business Name _________________________________________________________________

□ Final

Mailing Address _________________________________________________________________

□ Amended

City/State/Zip _________________________________________________________________ □ Short Year ______________ to ______________

Section A 2023 Tax Calculations - Attach copy of Federal return

1 Total federal taxable income 1

2 Add items not deductible (from line K Schedule X on page 2) 2

3 Subtract items not taxable (from line R Schedule X on page 2) 3 ( )

4 Adjusted federal taxable income before apportionment (sum of lines 1 and 2 less line 3) 4

5 Pre-apportioned loss deduction from tax years beginning on or after 1/1/18 (from page 2) 5 ( )

6 Pre-apportioned net profit (line 4 less line 5) 6

7 Apportionment percentage from page 2, Schedule Y, step 5 7 %

8 Municipal taxable income (multiply line 6 by line 7) 8

9 Tipp City income tax due (multiply line 8 by 1.5%) 9

10 Estimated payments and/or credits 10

11 If line 9 is greater than line 10, enter balance due (if not greater than, enter 0) 11

12 If line 10 is greater than line 9, enter amount overpaid and record as a refund or credit below 12

Overpayment refund ____________ credit ____________ (no refund or credit if $10 or less)

13a Underpayment penalty ____________ interest ____________ (if applicable - see instructions) 13a

13b Penalty (see instructions) 13b

13c Interest (see instructions) 13c

13d Late fee (see instructions) 13d

14 Total penalty, interest and late filing fee (add lines 13a, 13b, 13c and 13d) 14

15 Total tax and penalties (add lines 11 and 14) (payable to Tipp City Tax) (no payment due if $10 or less) 15

Section B 2024 Declaration of Estimated Tax - Must be completed by taxpayers who anticipate a tax liability of $200 or more

16 Total estimated income subject to tax ____________ multiplied by tax rate of 1.5% 16

17 Declaration due (multiply line 16 by 25%) 17

18 Overpayment credit from 2023 18

19 Declaration due (line 17 less line 18) (subsequent payments are due 6/15, 9/15 and 12/15) 19

Total due with this return (add lines 15 and 19) (payable to Tipp City Tax) $ ________________

If this return was prepared by a tax practitioner, may we contact him/her directly with questions regarding the preparation of this return? □ Yes □ No

The undersigned declares that this return (and all accompanying documents) is a true, correct and complete return for the taxable period stated.

____________________________________________________________ ____________________________________________________________

Signature of preparer (other than taxpayer) Date Taxpayer signature Date

____________________________________________________________ ____________________________________________________________

Preparer's telephone number Preparer's e-mail address