Enlarge image

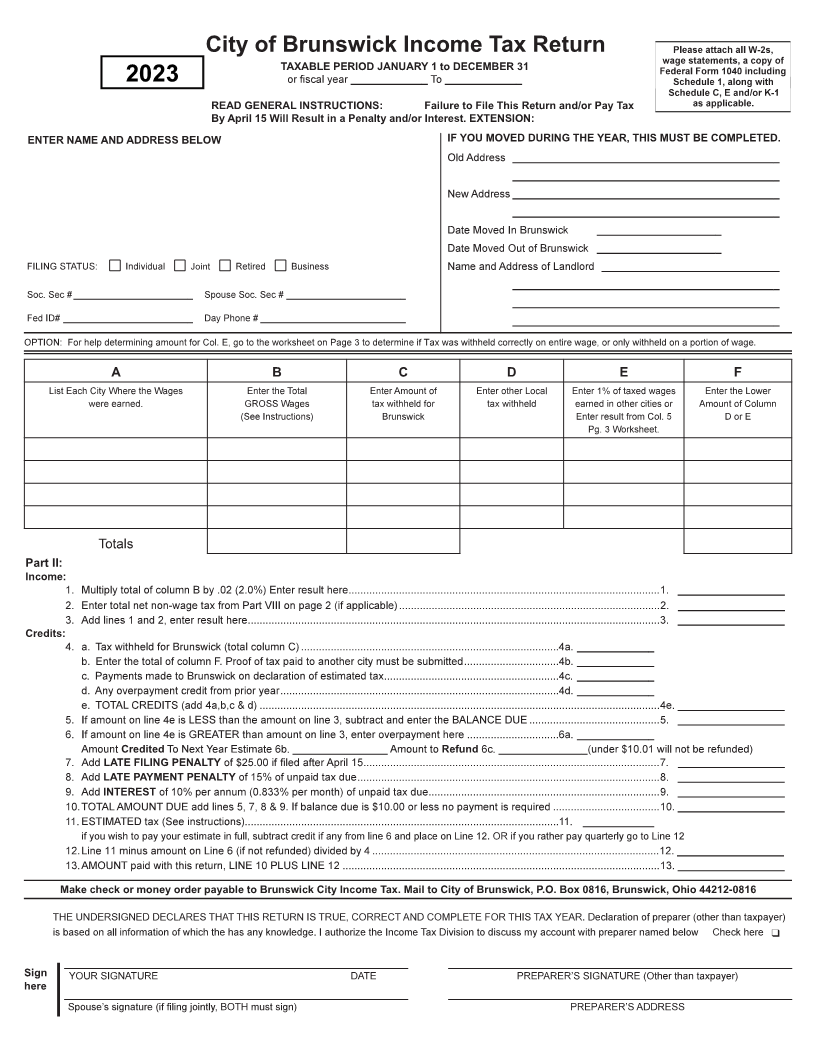

City of Brunswick Income Tax Return

TAXABLE PERIOD JANUARY 1 to DECEMBER 31

READ GENERAL INSTRUCTIONS: Failure to File This Return and/or Pay Tax

By April 15 Will Result in a Penalty and/or Interest. EXTENSION:

ENTER NAME AND ADDRESS BELOW IF YOU MOVED DURING THE YEAR, THIS MUST BE COMPLETED.

Joint

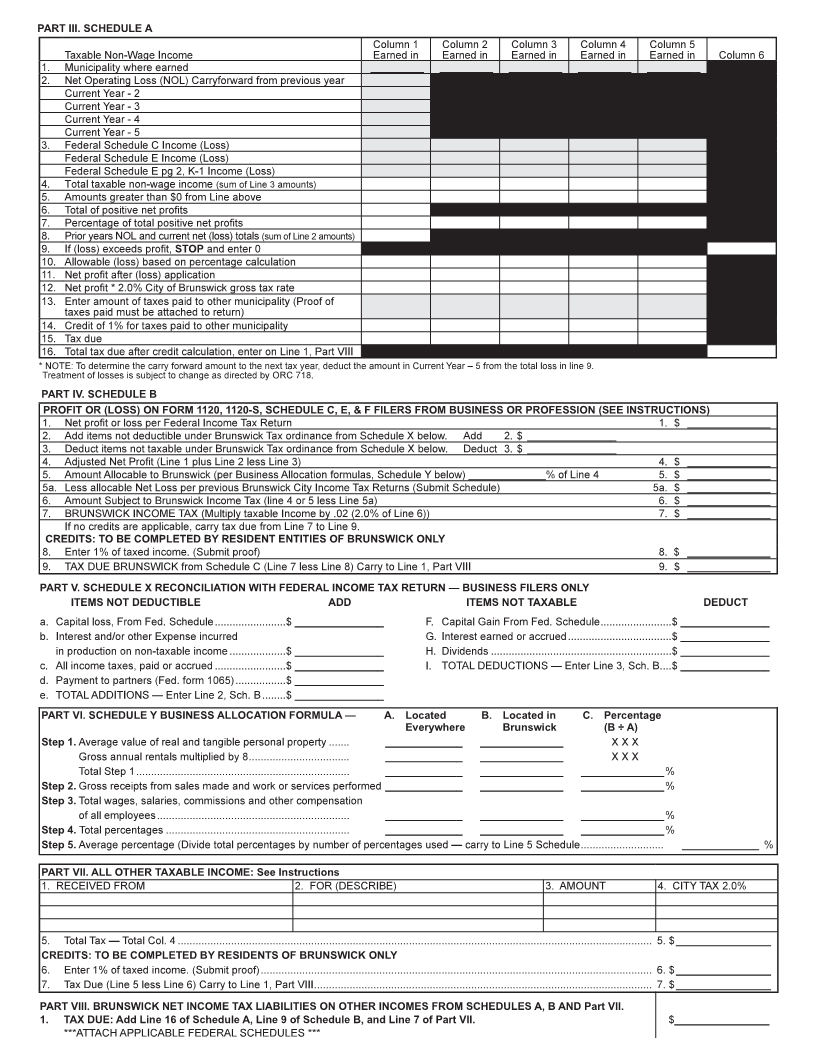

A B C D E F

Part II:

Income:

Credits:

Credited Refund

LATE FILING PENALTY

LATE PAYMENT PENALTY

INTEREST

Make check or money order payable to Brunswick City Income Tax. Mail to City of Brunswick, P.O. Box 0816, Brunswick, Ohio 44212-0816

Sign

here