Enlarge image

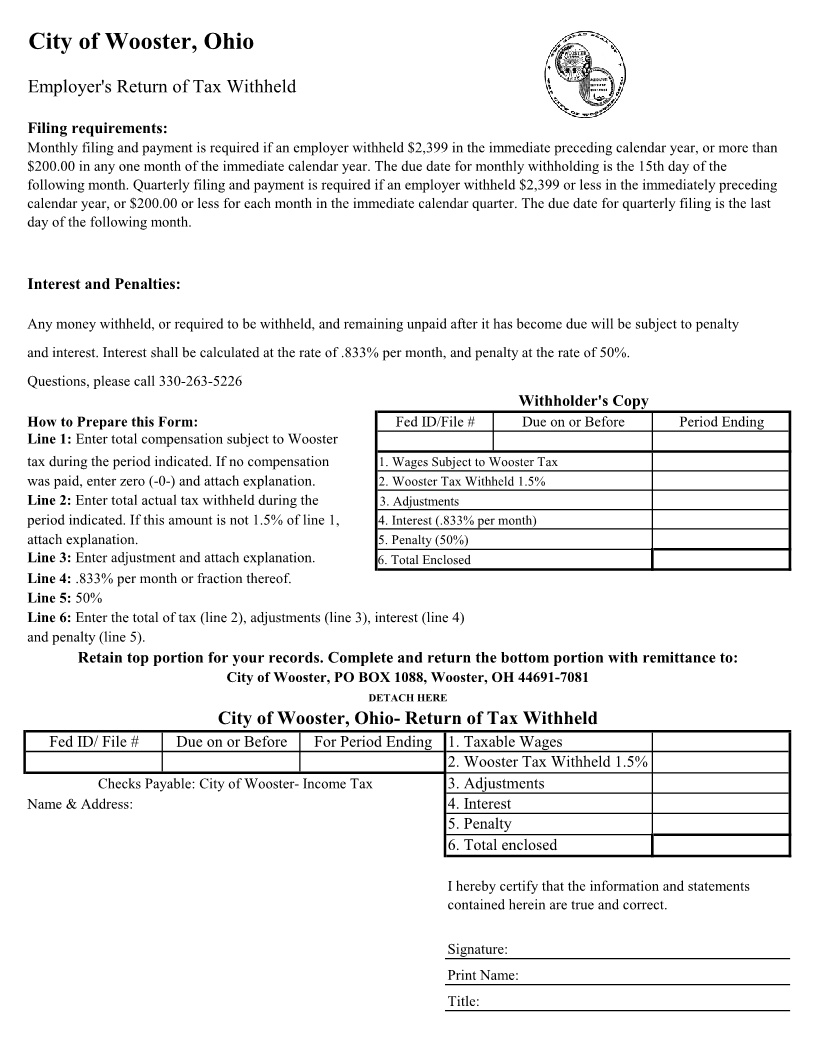

City of Wooster, Ohio Employer's Return of Tax Withheld Filing requirements: Monthly filing and payment is required if an employer withheld $2,399 in the immediate preceding calendar year, or more than $200.00 in any one month of the immediate calendar year. The due date for monthly withholding is the 15th day of the following month. Quarterly filing and payment is required if an employer withheld $2,399 or less in the immediately preceding calendar year, or $200.00 or less for each month in the immediate calendar quarter. The due date for quarterly filing is the last day of the following month. Interest and Penalties: Any money withheld, or required to be withheld, and remaining unpaid after it has become due will be subject to penalty and interest. Interest shall be calculated at the rate of .833% per month, and penalty at the rate of 50%. Questions, please call 330-263-5226 Withholder's Copy How to Prepare this Form: Fed ID/File # Due on or Before Period Ending Line 1: Enter total compensation subject to Wooster tax during the period indicated. If no compensation 1. Wages Subject to Wooster Tax was paid, enter zero (-0-) and attach explanation. 2. Wooster Tax Withheld 1.5% Line 2: Enter total actual tax withheld during the 3. Adjustments period indicated. If this amount is not 1.5% of line 1, 4. Interest (. 833% per month) attach explanation. 5. Penalty (50%) Line 3: Enter adjustment and attach explanation. 6. Total Enclosed Line 4: .833% per month or fraction thereof. Line 5: 50% Line 6:Enter the total of tax (line 2), adjustments (line 3), i nterest (line 4) and penalty (line 5). Retain top portion for your records. Complete and return the bottom portion with remittance to: City of Wooster, PO BOX 1088, Wooster, OH 44691-7081 DETACH HERE City of Wooster, Ohio- Return of Tax Withheld Fed ID/ File # Due on or Before For Period Ending 1. Taxable Wages 2. Wooster Tax Withheld 1.5% Checks Payable: City of Wooster- Income Tax 3. Adjustments Name & Address: 4. Interest 5. Penalty 6. Total enclosed I hereby certify that the information and statements contained herein are true and correct. Signature: Print Name: Title: