Enlarge image

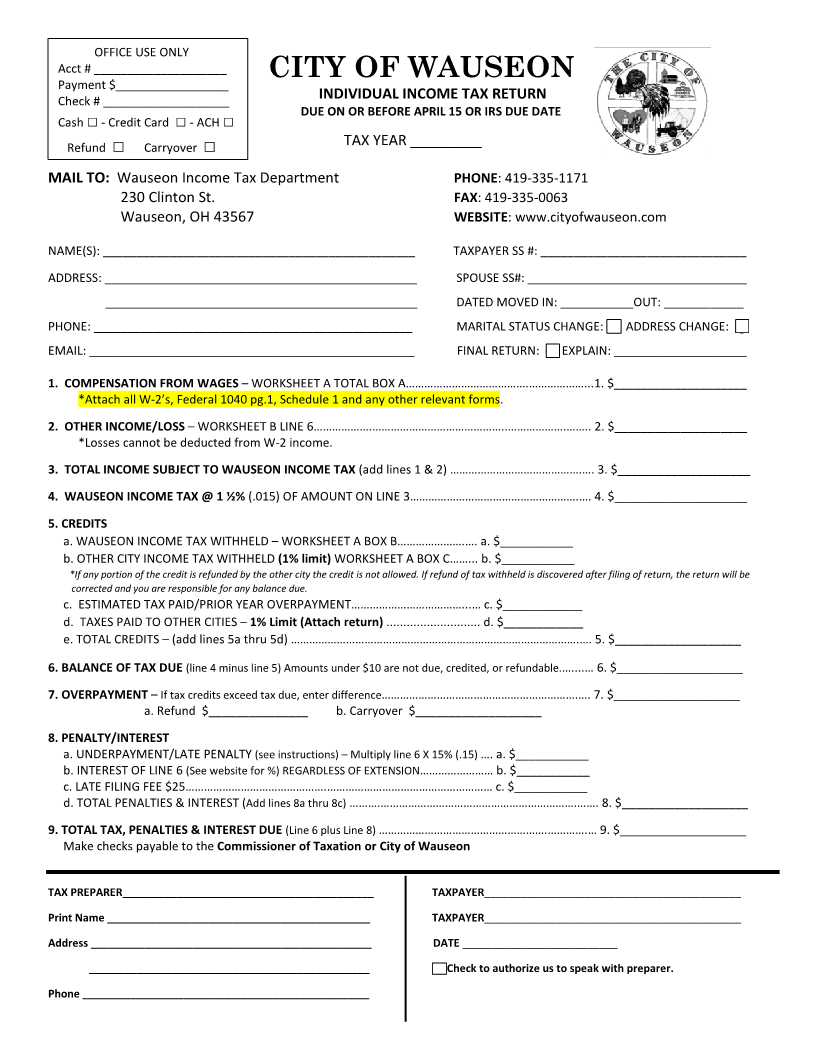

OFFICE USE ONLY

Acct # ____________________

CITY OF WAUSEON

Payment $_________________

Check # ___________________ INDIVIDUAL INCOME TAX RETURN

DUE ON OR BEFORE APRIL 15 OR IRS DUE DATE

Cash □- Credit Card -□ACH □

Refund □ Carryover □ TAX YEAR _________

MAIL TO: Wauseon Income Tax Department PHONE: 419-335-1171

230 Clinton St. FAX: 419-335-0063

Wauseon, OH 43567 WEBSITE: www.cityofwauseon.com

NAME(S): _______________________________________________ TAXPAYER SS #: _______________________________

ADDRESS: _______________________________________________ SPOUSE SS#: _________________________________

_______________________________________________ DATED MOVED IN: ___________OUT: ____________

PHONE: ________________________________________________ MARITAL STATUS CHANGE: ⃝ ADDRESS CHANGE: ⃝

EMAIL: _________________________________________________ FINAL RETURN: ⃝ EXPLAIN: ____________________

1. COMPENSATION FROM WAGES – WORKSHEET A TOTAL BOX A………………………………….………………...1. $____________________

*Attach all W-2’s, Federal 1040 pg.1, Schedule 1 and any other relevant forms.

2. OTHER INCOME/LOSS – WORKSHEET B LINE 6……………….……………………………………..……………….…….. 2. $____________________

*Losses cannot be deducted from W-2 income.

3. TOTAL INCOME SUBJECT TO WAUSEON INCOME TAX (add lines 1 & 2) …………………………………….…. 3. $____________________

4. WAUSEON INCOME TAX @ 1 ½% (.015) OF AMOUNT ON LINE 3……………………………………………….…. 4. $____________________

5. CREDITS

a. WAUSEON INCOME TAX WITHHELD – WORKSHEET A BOX B………………….…. a. $___________

b. OTHER CITY INCOME TAX WITHHELD (1% limit) WORKSHEET A BOX C……... b. $___________

*If any portion of the credit is refunded by the other city the credit is not allowed. If refund of tax withheld is discovered after filing of return, the return will be

corrected and you are responsible for any balance due.

c. ESTIMATED TAX PAID/PRIOR YEAR OVERPAYMENT………………………………...… c. $____________

d. TAXES PAID TO OTHER CITIES – 1% Limit (Attach return) ............................ d. $____________

e. TOTAL CREDITS – (add lines 5a thru 5d) ………………………………………………………………………………….…. 5. $___________________

6. BALANCE OF TAX DUE (line 4 minus line 5) Amounts under $10 are not due, credited, or refundable.…....… 6. $___________________

7. OVERPAYMENT – If tax credits exceed tax due, enter difference……………………………………………………….…. 7. $___________________

a. Refund $_______________ b. Carryover $___________________

8. PENALTY/INTEREST

a. UNDERPAYMENT/LATE PENALTY (see instructions) – Multiply line 6 X 15% (.15) …. a. $___________

b. INTEREST OF LINE 6 (See website for %) REGARDLESS OF EXTENSION…………………… b. $___________

c. LATE FILING FEE $25……………………………………….……………………………………………… c. $___________

d. TOTAL PENALTIES & INTEREST (Add lines 8a thru 8c) ……….……………………………………………………….……. 8. $___________________

9. TOTAL TAX, PENALTIES & INTEREST DUE (Line 6 plus Line 8) ……………………………………………….………….… 9. $___________________

Make checks payable to the Commissioner of Taxation or City of Wauseon

TAX PREPARER__________________________________________ TAXPAYER___________________________________________

Print Name ____________________________________________ TAXPAYER___________________________________________

Address _______________________________________________ DATE __________________________

_______________________________________________ ⃝ Check to authorize us to speak with preparer.

Phone ______________________________________________________