Enlarge image

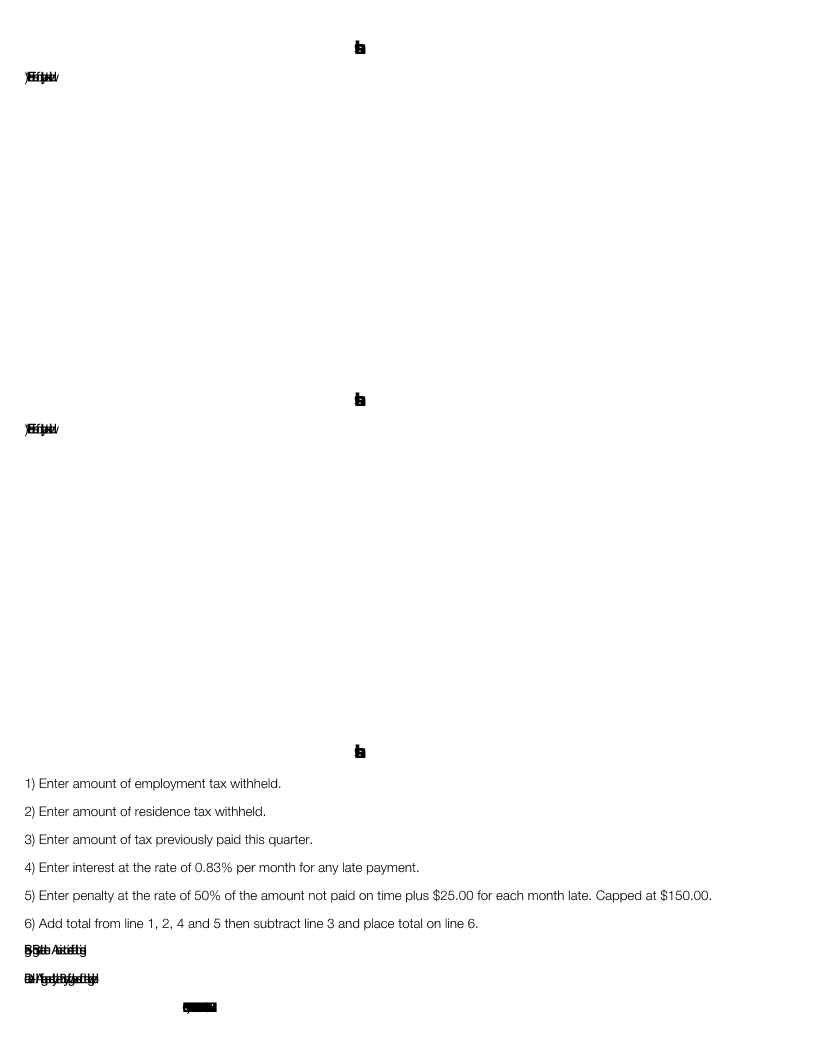

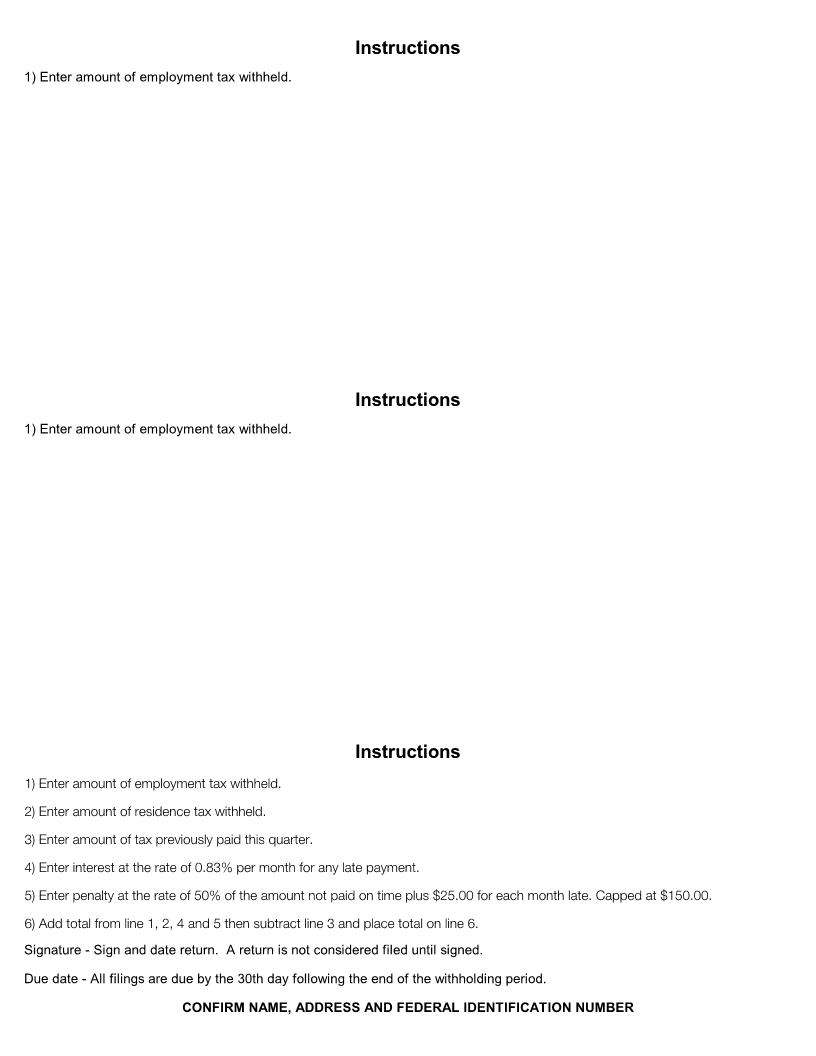

CITY OF PARMA - DIVISION OF TAXATION FORM PW-12

FOR INCOME TAX WITHHELD ON WAGES MONTHLY FOR OFFICE USE ONLY. DO NOT WRITE

IN THIS AREA.

TOTAL TAXES WITHHELD

FOR THE MONTH OF DUE ON OR BEFORE DOLLARS CENTS

JAN 02/1 /2025 4

FEDERAL EMPLOYER I.D. NO. PARMA ACCOUNT NUMBER FOR TAX YEAR

TAX RATE IS 2.5%

TAX CREDIT OF 100% UP TO 2%

MAKE CHECK PAYABLE

AND MAIL THIS FORM TO:

CITY OF PARMA DIV. OF TAX

P.O. BOX 94734

CLEVELAND, OHIO 44101-4734

RETURN WITH PAYMENT

A late penalty of $25 per month or any fraction thereof

regardless of liability. Capped at $150.00 per return.

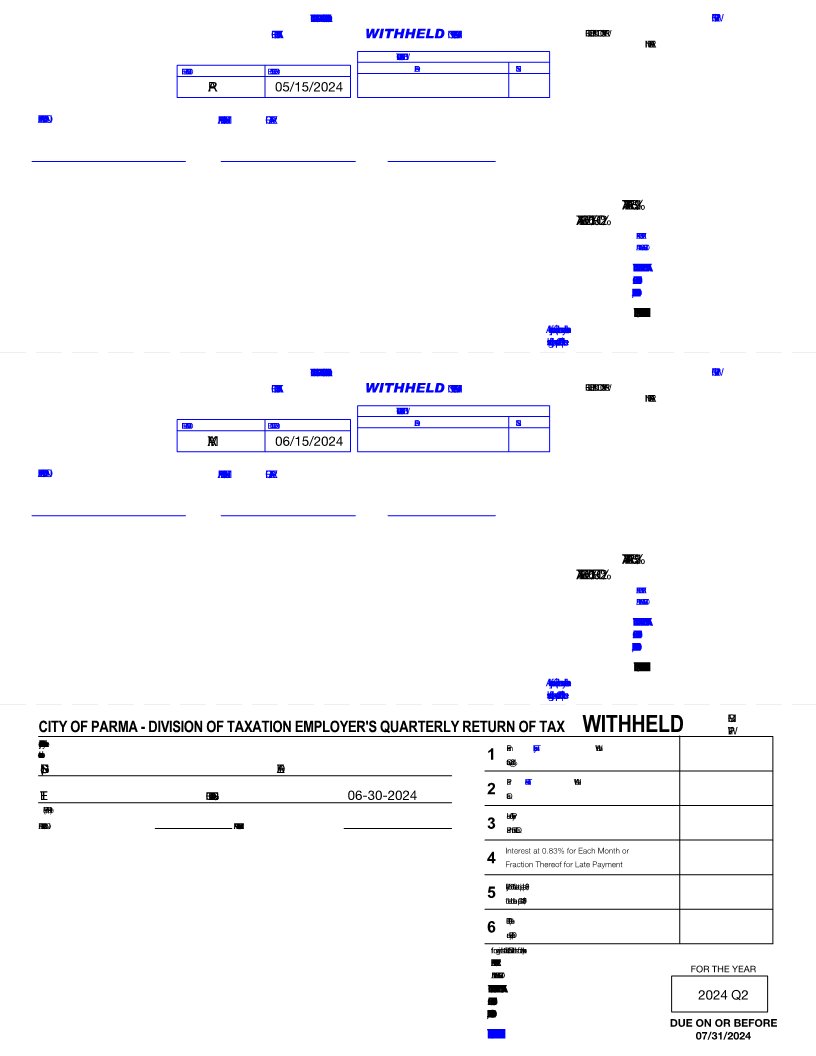

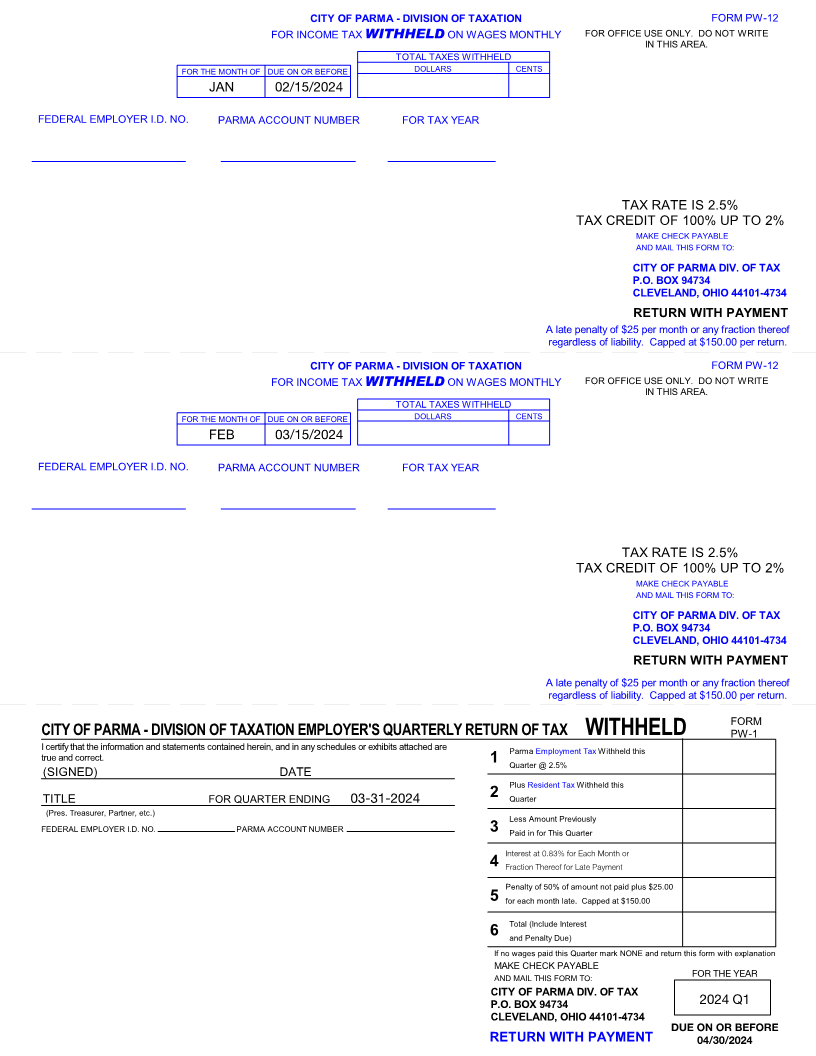

CITY OF PARMA - DIVISION OF TAXATION FORM PW-12

FOR INCOME TAX WITHHELD ON WAGES MONTHLY FOR OFFICE USE ONLY. DO NOT WRITE

IN THIS AREA.

TOTAL TAXES WITHHELD

FOR THE MONTH OF DUE ON OR BEFORE DOLLARS CENTS

FEB 03/15/2024

FEDERAL EMPLOYER I.D. NO. PARMA ACCOUNT NUMBER FOR TAX YEAR

TAX RATE IS 2.5%

TAX CREDIT OF 100% UP TO 2%

MAKE CHECK PAYABLE

AND MAIL THIS FORM TO:

CITY OF PARMA DIV. OF TAX

P.O. BOX 94734

CLEVELAND, OHIO 44101-4734

RETURN WITH PAYMENT

A late penalty of $25 per month or any fraction thereof

regardless of liability. Capped at $150.00 per return.

FORM

CITY OF PARMA - DIVISION OF TAXATION EMPLOYER’S QUARTERLY RETURN OF TAX WITHHELD PW-1

I certify that the information and statements contained herein, and in any schedules or exhibits attached are Parma Employment Tax Withheld this

true and correct. 1 Quarter @ 2.5%

(SIGNED) DATE

Plus Resident Tax Withheld this

TITLE FOR QUARTER ENDING 03-31-2024 2 Quarter

(Pres. Treasurer, Partner, etc.) Less Amount Previously

FEDERAL EMPLOYER I.D. NO. PARMA ACCOUNT NUMBER 3 Paid in for This Quarter

Interest at 0.83% for Each Month or

4 Fraction Thereof for Late Payment

Penalty of 50% of amount not paid plus $25.00

5 for each month late. Capped at $150.00

Total (Include Interest

6 and Penalty Due)

If no wages paid this Quarter mark NONE and return this form with explanation

MAKE CHECK PAYABLE

AND MAIL THIS FORM TO: FOR THE YEAR

CITY OF PARMA DIV. OF TAX

P.O. BOX 94734 2024Q1

CLEVELAND, OHIO 44101-4734

DUE ON OR BEFORE

RETURN WITH PAYMENT 04/30/2024