Enlarge image

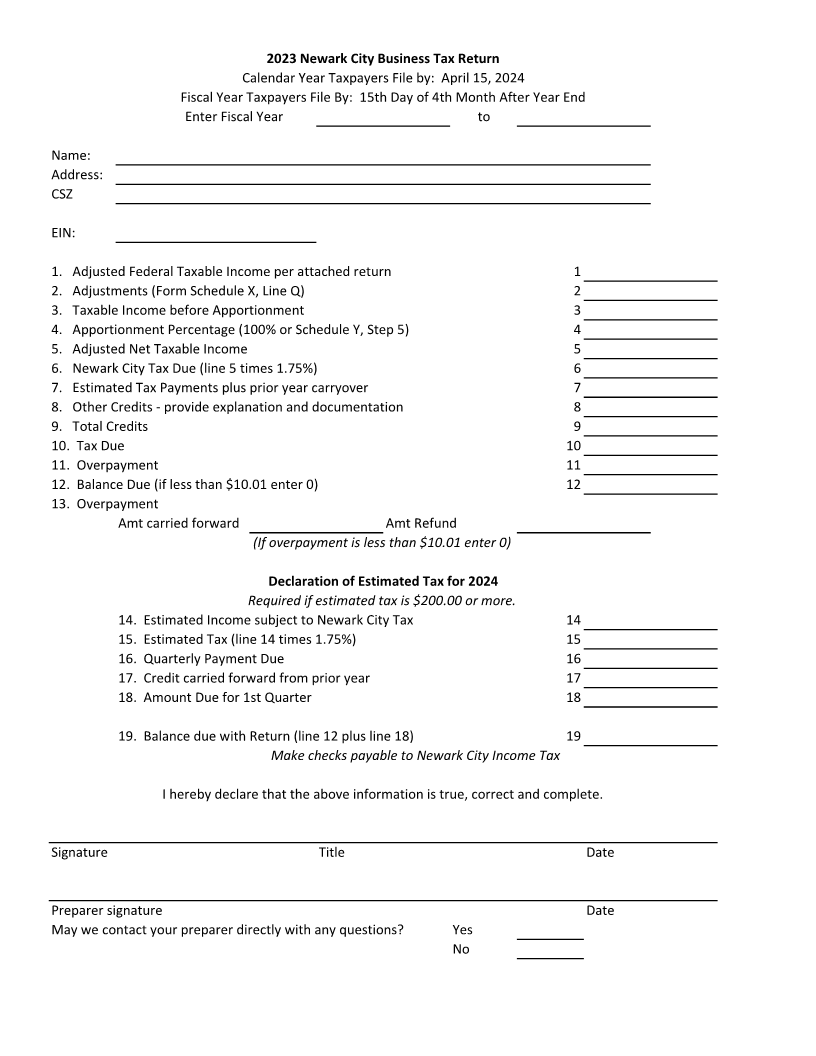

2023 Newark City Business Tax Return

Calendar Year Taxpayers File by: April 15, 2024

Fiscal Year Taxpayers File By: 15th Day of 4th Month After Year End

Enter Fiscal Year to

Name:

Address:

CSZ

EIN:

1. Adjusted Federal Taxable Income per attached return 1

2. Adjustments (Form Schedule X, Line Q) 2

3. Taxable Income before Apportionment 3

4. Apportionment Percentage (100% or Schedule Y, Step 5) 4

5. Adjusted Net Taxable Income 5

6. Newark City Tax Due (line 5 times 1.75%) 6

7. Estimated Tax Payments plus prior year carryover 7

8. Other Credits - provide explanation and documentation 8

9. Total Credits 9

10. Tax Due 10

11. Overpayment 11

12. Balance Due (if less than $10.01 enter 0) 12

13. Overpayment

Amt carried forward Amt Refund

(If overpayment is less than $10.01 enter 0)

Declaration of Estimated Tax for 2024

Required if estimated tax is $200.00 or more.

14. Estimated Income subject to Newark City Tax 14

15. Estimated Tax (line 14 times 1.75%) 15

16. Quarterly Payment Due 16

17. Credit carried forward from prior year 17

18. Amount Due for 1st Quarter 18

19. Balance due with Return (line 12 plus line 18) 19

Make checks payable to Newark City Income Tax

I hereby declare that the above information is true, correct and complete.

Signature Title Date

Preparer signature Date

May we contact your preparer directly with any questions? Yes

No