Enlarge image

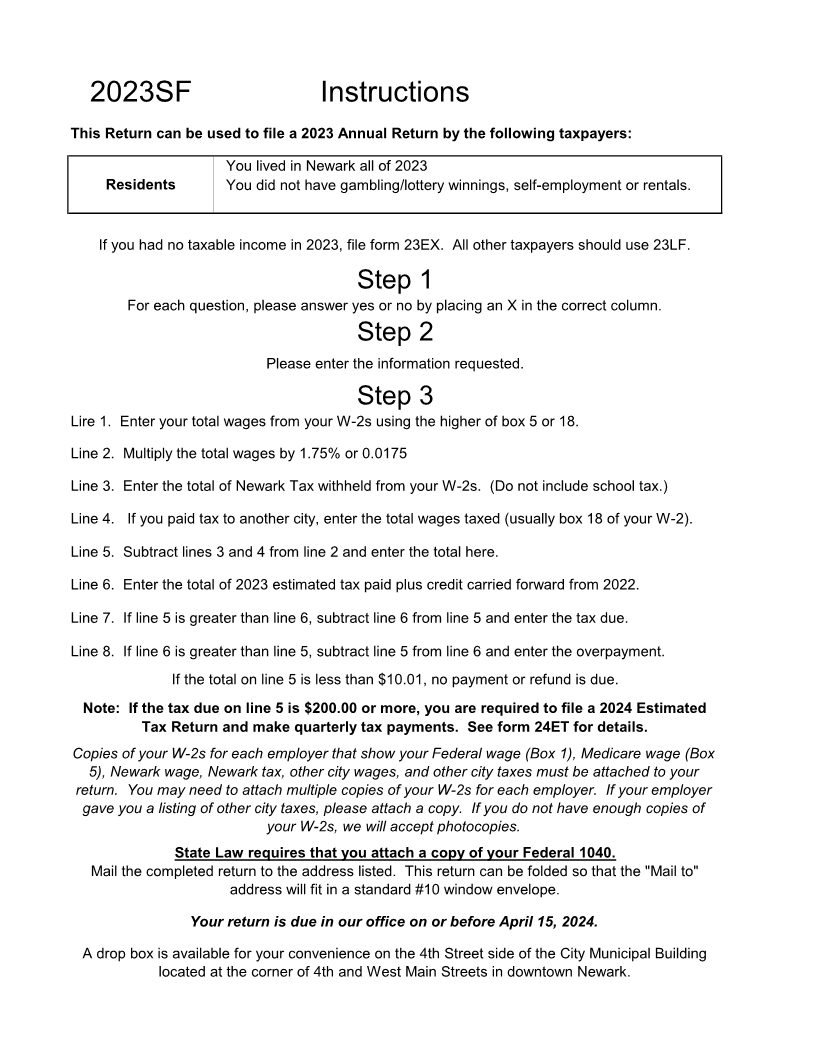

Return with attachments

2023SF due by April 15, 2024

Step 1

Please answer these questions, about this past year, by placing an X in the correct box.

Yes No

Did you have any gambling or lottery winnings?

Did you have self-employment or rental income?

If you answered yes to any of the above questions, you have income that cannot be reported on

this return. Use 2023LF to file your Newark Return.

Step 2 Account

Name

Address

Phone Email

SSN SSN

Filing Status

Single Married filing separately

Married filing joint Head of household

Step 3

When completing your return use the higher of box 5 or 18 wages from your W-2s. You must

attach copies of your W-2s and your Federal 1040 per State Law.

1 Enter Total Wages

Newark Tax Rate x 0.0175

2 Enter Newark Tax Due (multiply wage times tax rate)

3 Newark Tax Withheld

4 Other City Wages x0.01

5 Tax Due Before Credits

6 Estimated Tax Payments & Credit on Account

7 Amount due with Return 8 Overpayment

No payment and or refund of tax under $10.01.

Check here for refund.

I hereby declare that the above information is true under penalty of perjury

Signature Date Signature Date

Tax Preparer Signature Date May we contact: Yes No

Mail to: Questions?

Newark City Tax Office

740-670-7580 phone

PO Box 4577 740-670-7581 fax

Newark, OH 43058-4577 citytax@newarkohio.net