Enlarge image

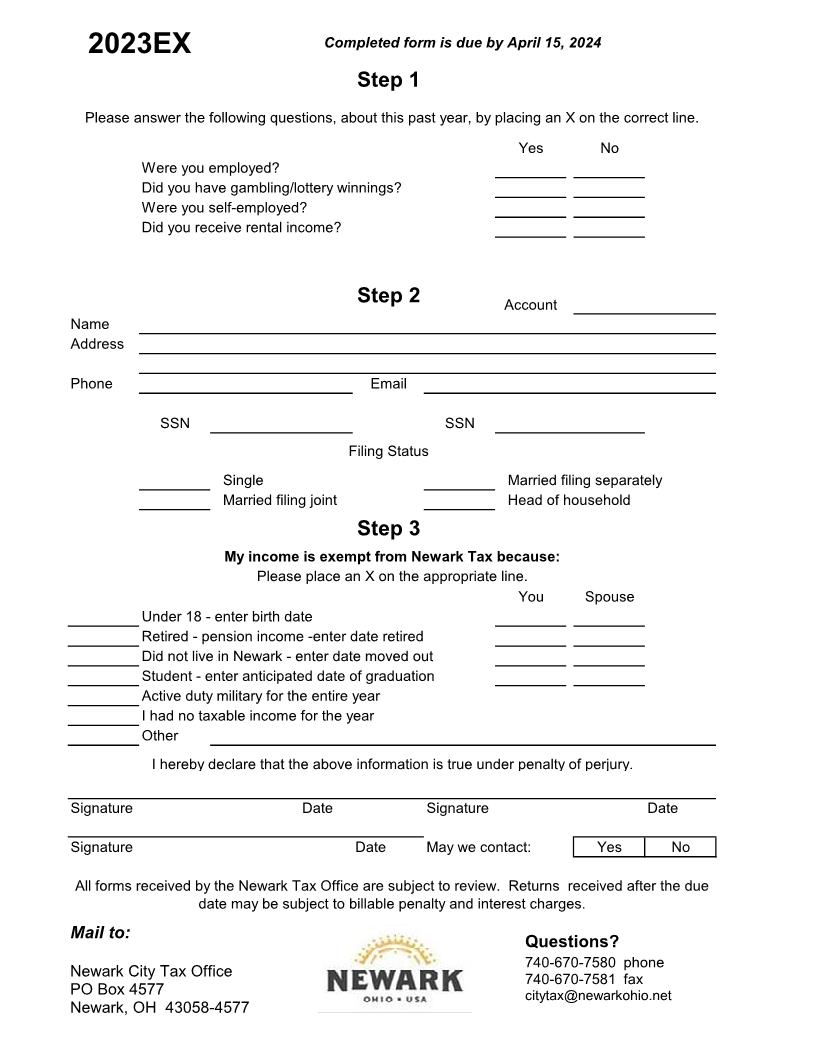

Completed form is due by April 15, 2024

2023EX

Step 1

Please answer the following questions, about this past year, by placing an X on the correct line.

Yes No

Were you employed?

Did you have gambling/lottery winnings?

Were you self-employed?

Did you receive rental income?

Step 2 Account

Name

Address

Phone Email

SSN SSN

Filing Status

Single Married filing separately

Married filing joint Head of household

Step 3

My income is exempt from Newark Tax because:

Please place an X on the appropriate line.

You Spouse

Under 18 - enter birth date

Retired - pension income -enter date retired

Did not live in Newark - enter date moved out

Student - enter anticipated date of graduation

Active duty military for the entire year

I had no taxable income for the year

Other

I hereby declare that the above information is true under penalty of perjury.

Signature Date Signature Date

Signature Date May we contact: Yes No

All forms received by the Newark Tax Office are subject to review. Returns received after the due

date may be subject to billable penalty and interest charges.

Mail to:

Questions?

740-670-7580 phone

Newark City Tax Office

740-670-7581 fax

PO Box 4577 citytax@newarkohio.net

Newark, OH 43058-4577