- 6 -

Enlarge image

|

CITY OF TOLEDO

DIVISION OF TAXATION

1 GOVERNMENT CENTER, STE 2070

TOLEDO, OH 43604

2024

EMPLOYER’S MONTHLY RETURN OF TAX WITHHELD BOOKLET

Who Must File: Each employer within the City of Toledo, who employs one or more persons is required to withhold the

tax of 2.5% (effective 1/1/2021) from all compensation paid employees at the time such compensation is paid and to

remit such tax to the Commissioner of Taxation. Employers are required to withhold only on “qualifying wages” which

are wages as defined in the Internal Revenue Code Section 3121(a), generally the Medicare Wage Box of the W-2.

How to File: You may mail a paper copy of your W-3 with the supporting W-2s or you may upload to our website using

the EFW2 format in a .txt file. We no longer accept other forms of media and, as such, they will be returned.

What is Taxable to Toledo: Salaries, Wages, Commissions; Tips; SUB Pay; Ordinary Income Portion of Stock Options or

Employee Stock Purchase Plans; Employee Contributions to Tax Sheltered Annuities; Ordinary Income Portion of Lump-

Sum Distributions; Working Condition Fringe Benefits to the extent included in W-2 Forms; Premiums on Group Term

Insurance in Excess of $50K.

WITHHOLDING PROVISIONS:

As mandated by the State of Ohio Revised Code Section 718.03 the following filing frequencies and due dates are

established:

Electronic Remittance Requirement: If the employer, agent of the employer, or other payer is required to

make payments electronically for the purpose of paying federal taxes withheld on payments for employees under

Section 6302 of the Internal Revenue Code, 26 C.F.R. 31.6302.1, or any other federal statute or regulation, the payments

and subsequent payments, based on the Commissioner of Taxation’s determination, shall be required to be made by

electronic funds transfer to the Commissioner of Taxation of all taxes withheld on behalf of Toledo. If the payment is

required to be made by electronic funds transfer, the payment is considered to be made when the payment is credited

to an account designated by the Commissioner of Taxation for the receipt of tax payments.

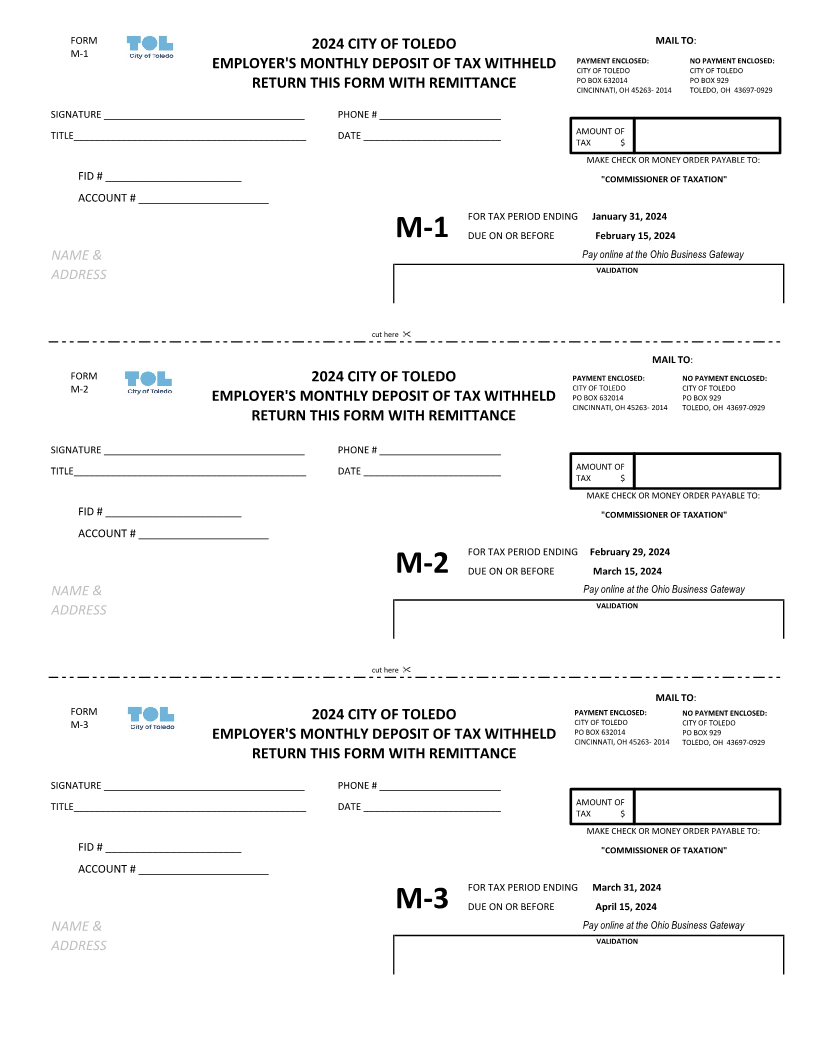

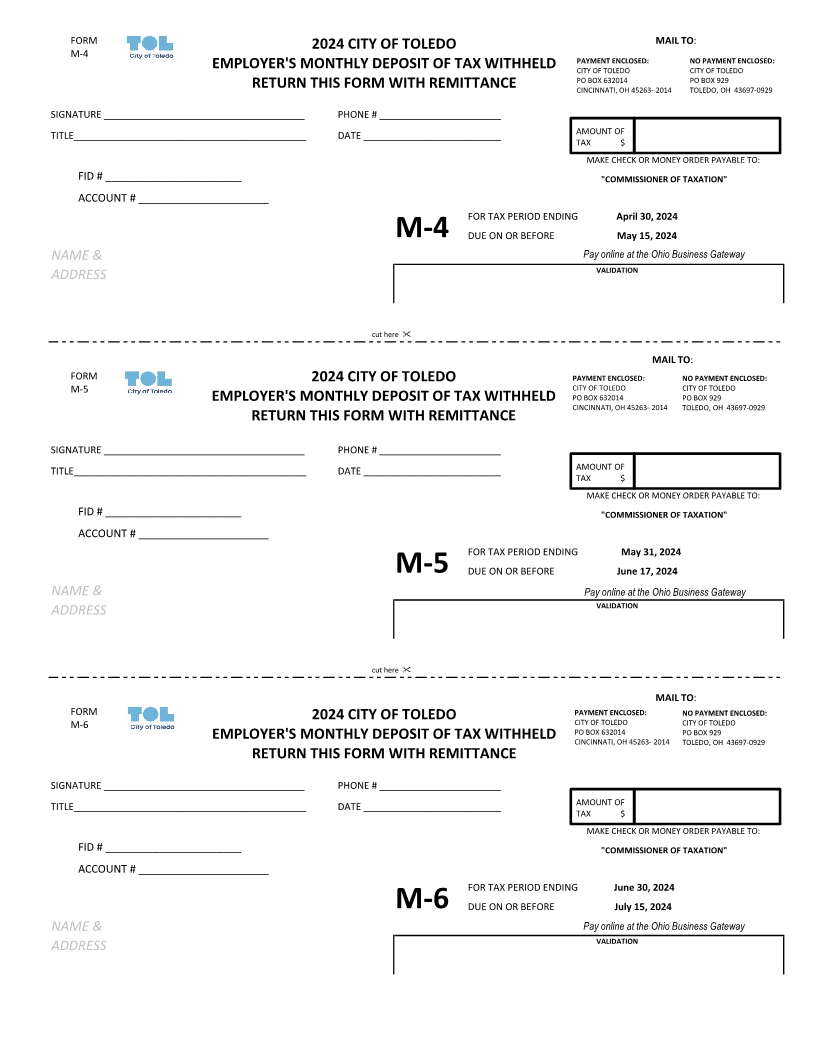

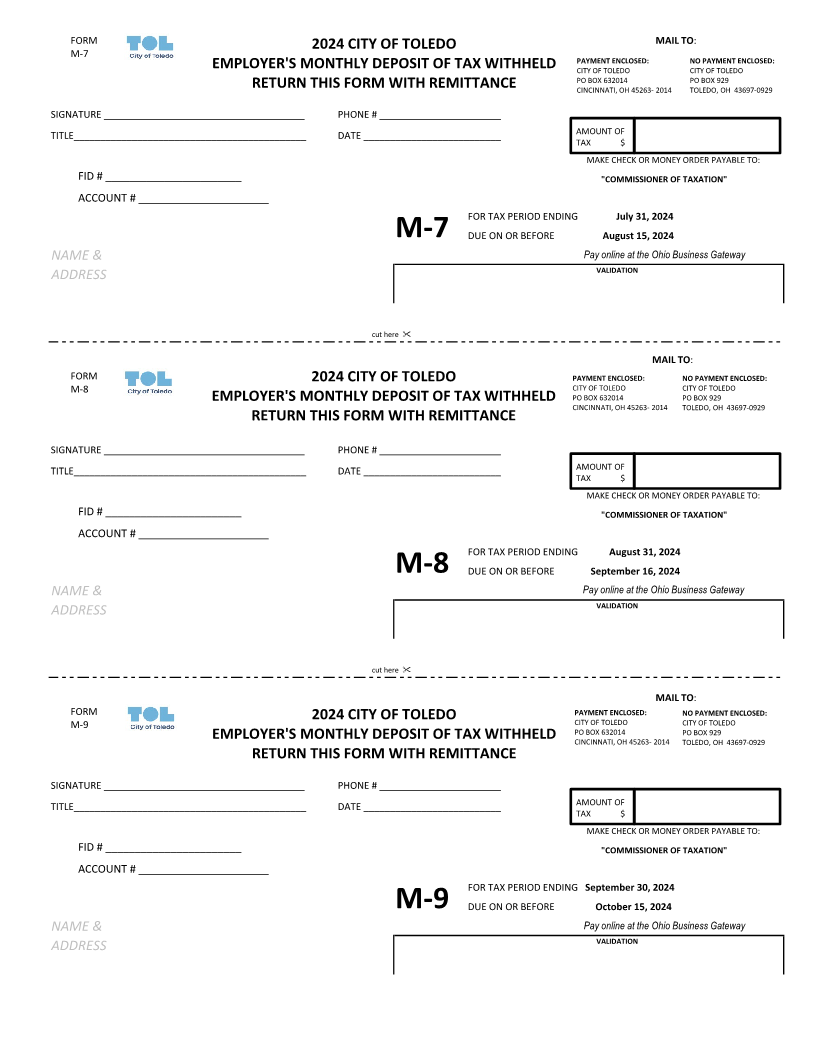

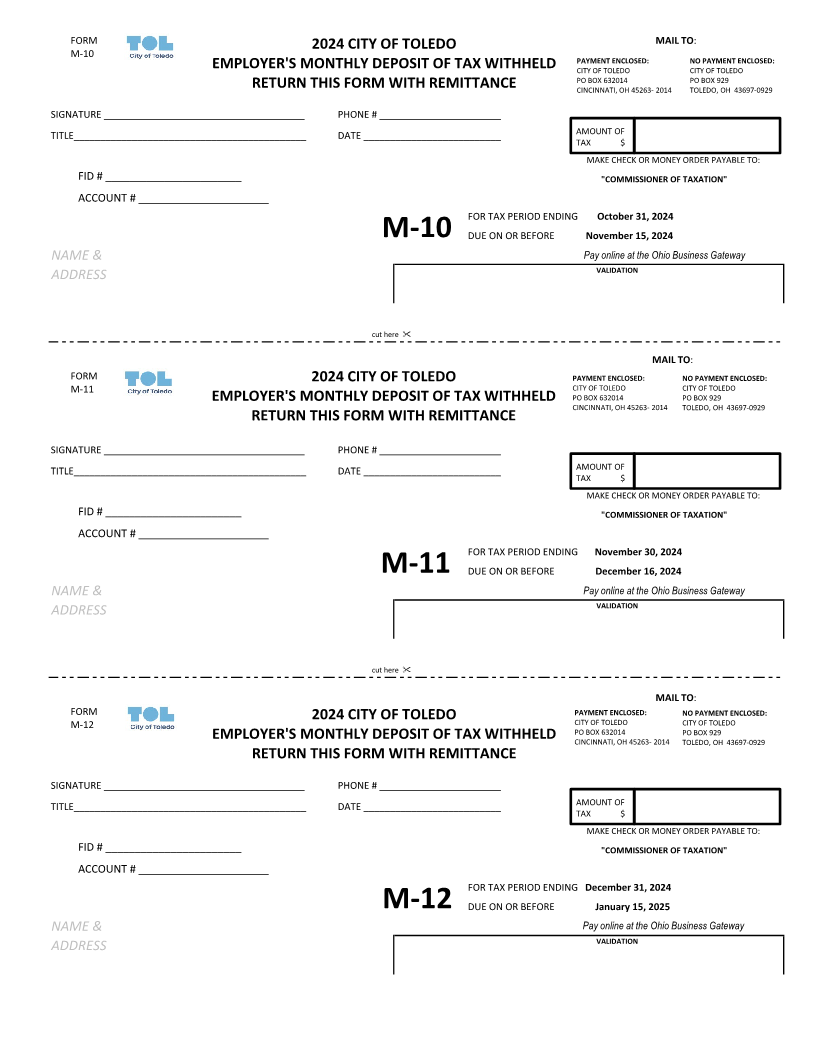

Monthly Withholding: Taxes required to be deducted and withheld shall be remitted monthly to the

Commissioner of Taxation. If the total taxes deducted and withheld or required to be deducted and withheld by the

employer, agent, or another payer on behalf of the City of Toledo in the preceding calendar year exceeded two

thousand, three hundred ninety-nine dollars ($2,399), or if the total amount of taxes deducted and withheld or required

to be deducted and withheld on behalf of the City of Toledo in any month of the preceding calendar quarter exceeded

two hundred dollars ($200). Payment shall be made so that the payment is postmarked no later than 15 days after the

last day of each month except for those required to electronically file (see TMC 1905.06(B)).

Quarterly Withholding: Any employer, agent of the employer, or another payer not required to make monthly

payments of taxes required to be deducted and withheld shall make quarterly payments to the Commissioner of

Taxation, City of Toledo. Payment shall be made so that the payment is postmarked not later than 30 days following

the end of each calendar quarter.

Annual Reconciliation: The Annual Reconciliation Form W-3 and corresponding W-2’s are due on the last day of

February following the preceding calendar year. Note: The W-2 forms must now include the names/amounts of all

other cities for which tax was withheld for the employee. (See the addenda on our website for electronically filing your

W-2’s).

PENALTY AND INTEREST:

Effective January 1, 2016, and as mandated by the State of Ohio Revised Code Section 718.03 the following penalties and

interest rules are established:

Interest: The interest in 2024 is based on the Federal Short Term Rate as reported in the preceding July,

rounded to the nearest whole percent plus 5%. The Federal Short Term Rate in July of 2023 was 4.8%, thus rounded up

to 5% + 5%. This translates into a rate of 10% annually or .8333% monthly for the calendar year 2024.

Penalty: The penalty in 2024 is 50% of the amount not timely paid (a one-time charge). A penalty of $25 for

failure to file timely (any withholding monthly, quarterly or W-3 for each month or fraction thereof that the return

remains unfiled per period).

|