Enlarge image

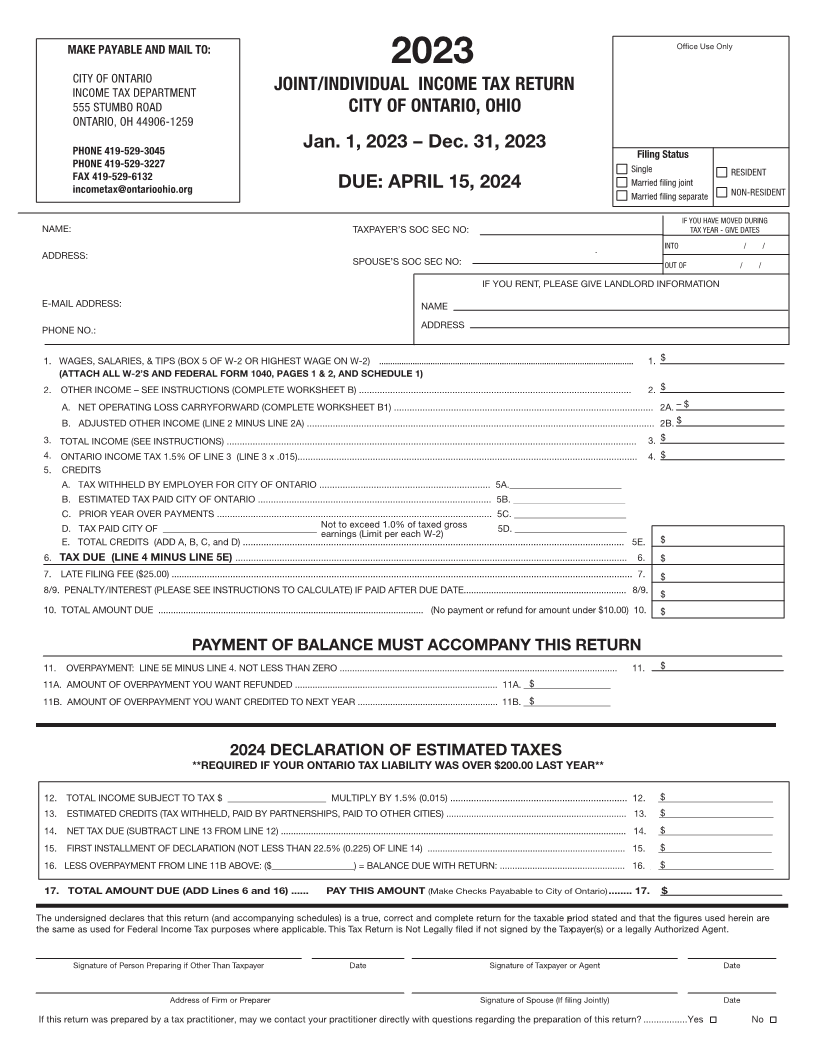

CITY OF ONTARIO

INCOME TAX DIVISION

555 STUMBO ROAD

ONTARIO, OHIO 44906-1259 2023

CITY OF ONTARIO

INCOME TAX FORMS

JOINT / INDIVIDUAL RETURN

PENALTY AND INTEREST WILL BE ASSESSED FOR FAILURE TO COMPLY

• INCOME TAX RATE 1.5%

• INCOME TAX FORGIVENESS / CREDIT EQUALS 1.0%

Reminder: City of Ontario PDF Forms CANNOT be filed electronically.

* *

Dear Taxpayer:

This is your Ontario City Income Tax Package.To assist you in ling your return, we have included

INSTRUCTIONS, THE ANNUAL RETURN and THE DECLARATION OF ESTIMATED TAX.

Every Ontario resident 18 years of age and older must le an Ontario Income Tax Return

by April 15, 2024.

Every non-resident individual earning income in Ontario not subject to the withholding of Ontario

income tax must also le an annual return.

Website www.ontarioohio.org

IMPORTANT

BEFORE preparing your return: READ ALL GENERAL INFORMATION AND INSTRUCTIONS CAREFULLY.

AFTER preparing your return – Be sure the following requirements have been completed:

• FILE YOUR RETURN BY APRIL 15th. If delinquent, Late Filing Penalty and/or Interest Charges will be Assessed.

• ATTACH REQUIRED FORMS (W-2, 1099, Federal Form 1040, pages 1 & 2, Federal Schedules) to verify reported gures.

• INCLUDE PAYMENT OF TAX DUE. NONPAYMENT WILL INCUR PENALTY AND/OR INTEREST CHARGES.

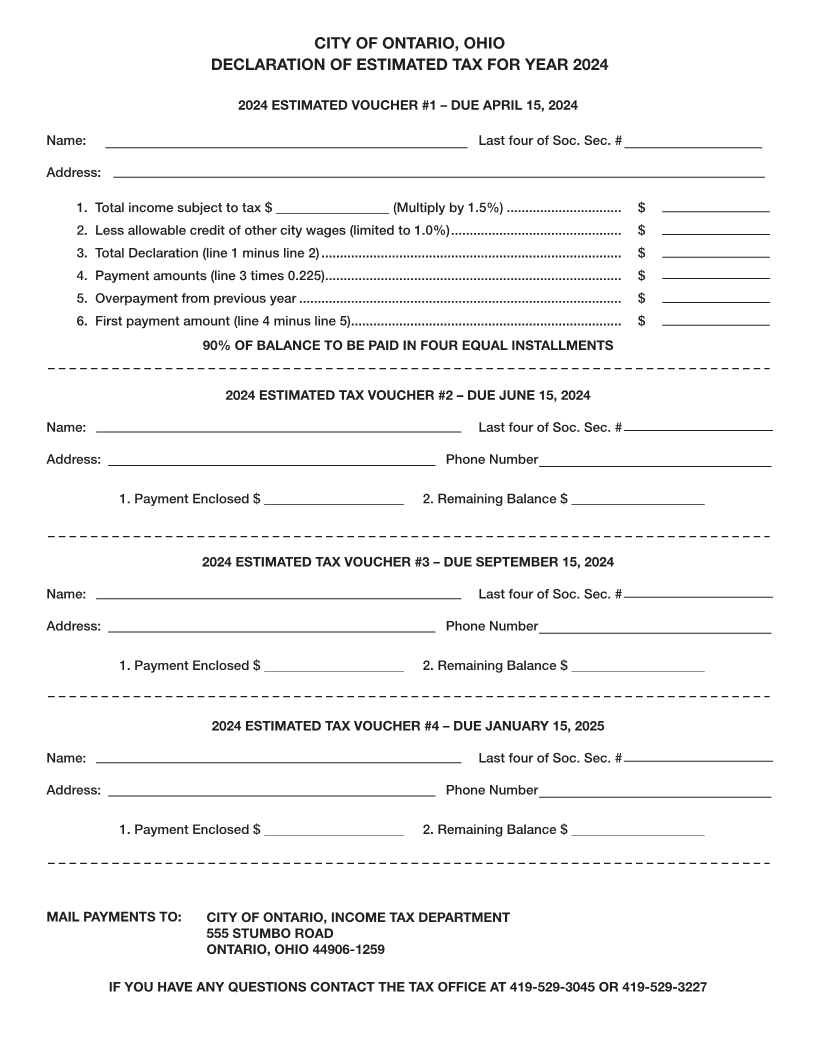

• COMPLETE DECLARATION OF ESTIMATED TAX for the following year and include payment of the rst installment.

• SIGN THE RETURN.

If you have questions, call or visit our of ce at 555 Stumbo Road. Our telephone number is (419) 529-3045 or

(419) 529-3227, our fax number is (419) 529-6132.

Sincerely,

Sallie Neal Kristy Frost

Income Tax Clerk Assistant Income Tax Clerk