Enlarge image

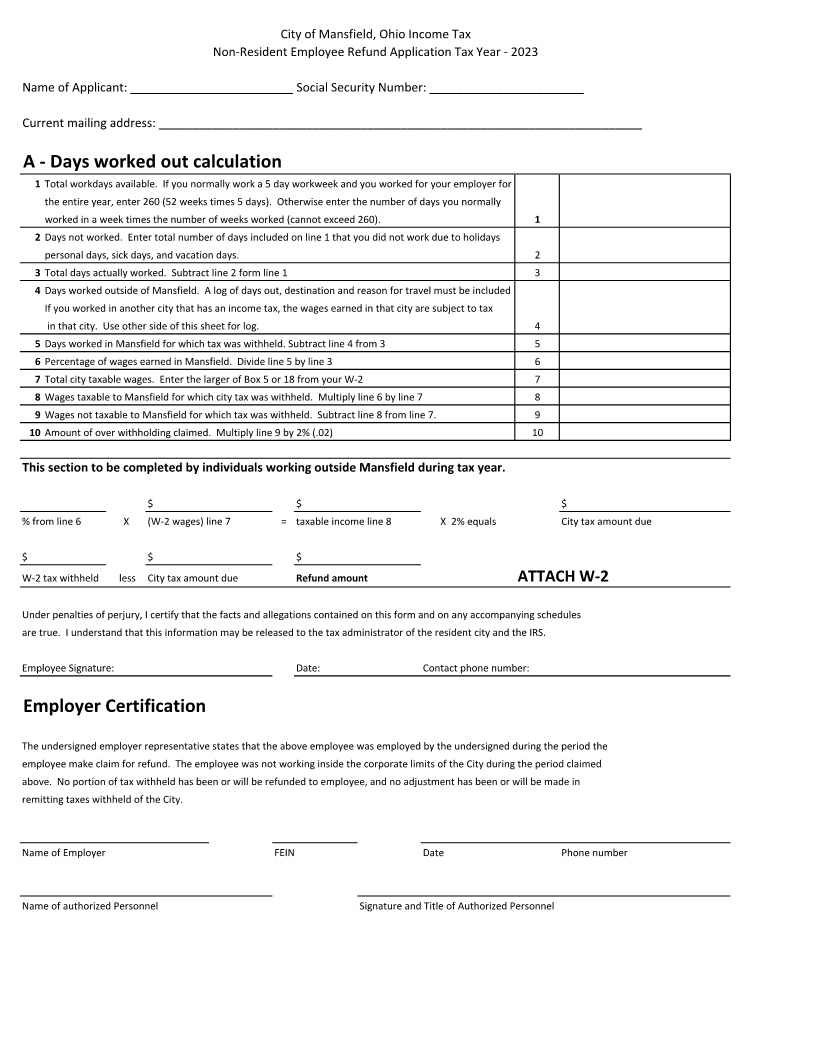

City of Mansfield, Ohio Income Tax

Non-Resident Employee Refund Application Tax Year - 2023

Name of Applicant: ____________________________ Social Security Number: _______________________

Current mailing address: ________________________________________________________________________

A - Days worked out calculation

1 Total workdays available. If you normally work a 5 day workweek and you worked for your employer for

the entire year, enter 260 (52 weeks times 5 days). Otherwise enter the number of days you normally

worked in a week times the number of weeks worked (cannot exceed 260). 1

2 Days not worked. Enter total number of days included on line 1 that you did not work due to holidays

personal days, sick days, and vacation days. 2

3 Total days actually worked. Subtract line 2 form line 1 3

4 Days worked outside of Mansfield. A log of days out, destination and reason for travel must be included

If you worked in another city that has an income tax, the wages earned in that city are subject to tax

in that city. Use other side of this sheet for log. 4

5 Days worked in Mansfield for which tax was withheld. Subtract line 4 from 3 5

6 Percentage of wages earned in Mansfield. Divide line 5 by line 3 6

7 Total city taxable wages. Enter the larger of Box 5 or 18 from your W-2 7

8 Wages taxable to Mansfield for which city tax was withheld. Multiply line 6 by line 7 8

9 Wages not taxable to Mansfield for which tax was withheld. Subtract line 8 from line 7. 9

10 Amount of over withholding claimed. Multiply line 9 by 2% (.02) 10

This section to be completed by individuals working outside Mansfield during tax year.

$ $ $

% from line 6 X (W-2 wages) line 7 = taxable income line 8 X 2% equals City tax amount due

$ $ $

W-2 tax withheld less City tax amount due Refund amount ATTACH W-2

Under penalties of perjury, I certify that the facts and allegations contained on this form and on any accompanying schedules

are true. I understand that this information may be released to the tax administrator of the resident city and the IRS.

Employee Signature: Date: Contact phone number:

Employer Certification

The undersigned employer representative states that the above employee was employed by the undersigned during the period the

employee make claim for refund. The employee was not working inside the corporate limits of the City during the period claimed

above. No portion of tax withheld has been or will be refunded to employee, and no adjustment has been or will be made in

remitting taxes withheld of the City.

Name of Employer FEIN Date Phone number

Name of authorized Personnel Signature and Title of Authorized Personnel