Enlarge image

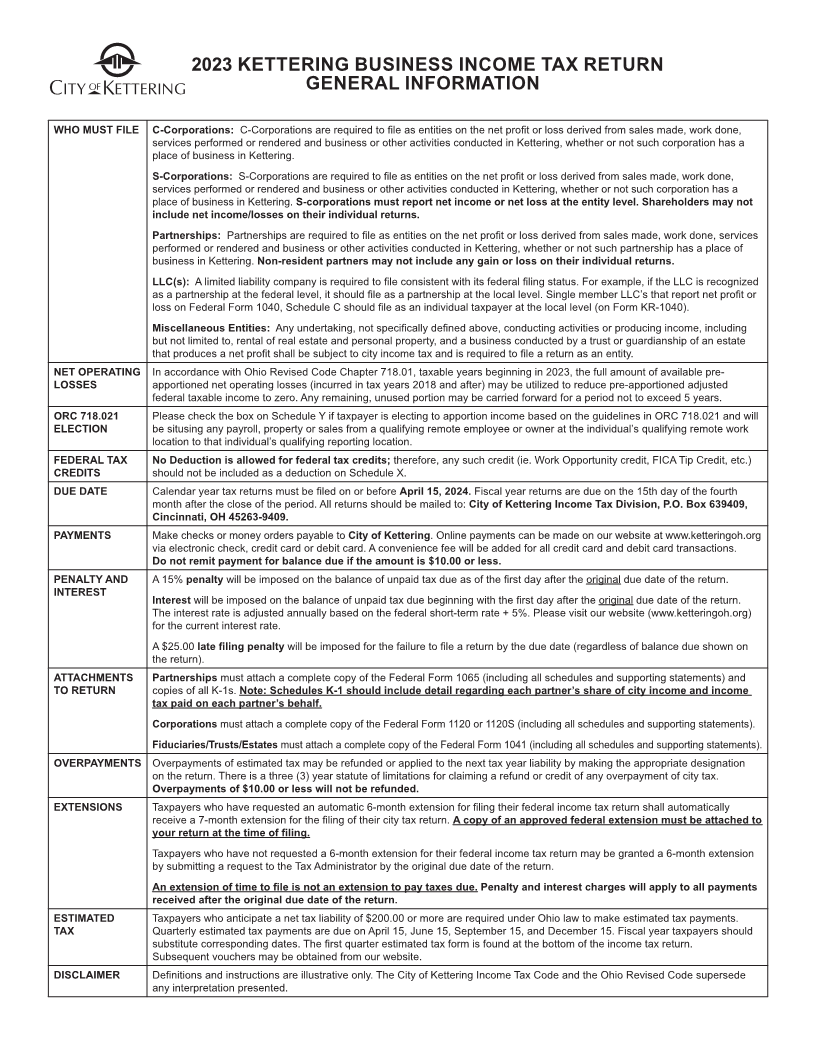

2023 KETTERING BUSINESS INCOME TAX RETURN

GENERAL INFORMATION

WHO MUST FILE C-Corporations: C-Corporations are required to file as entities on the net profit or loss derived from sales made, work done,

services performed or rendered and business or other activities conducted in Kettering, whether or not such corporation has a

place of business in Kettering.

S-Corporations: S-Corporations are required to file as entities on the net profit or loss derived from sales made, work done,

services performed or rendered and business or other activities conducted in Kettering, whether or not such corporation has a

place of business in Kettering. S-corporations must report net income or net loss at the entity level. Shareholders may not

include net income/losses on their individual returns.

Partnerships: Partnerships are required to file as entities on the net profit or loss derived from sales made, work done, services

performed or rendered and business or other activities conducted in Kettering, whether or not such partnership has a place of

business in Kettering. Non-resident partners may not include any gain or loss on their individual returns.

LLC(s): A limited liability company is required to file consistent with its federal filing status. For example, if the LLC is recognized

as a partnership at the federal level, it should file as a partnership at the local level. Single member LLC’s that report net profit or

loss on Federal Form 1040, Schedule C should file as an individual taxpayer at the local level (on Form KR-1040).

Miscellaneous Entities: Any undertaking, not specifically defined above, conducting activities or producing income, including

but not limited to, rental of real estate and personal property, and a business conducted by a trust or guardianship of an estate

that produces a net profit shall be subject to city income tax and is required to file a return as an entity.

NET OPERATING In accordance with Ohio Revised Code Chapter 718.01, taxable years beginning in 2023, the full amount of available pre-

LOSSES apportioned net operating losses (incurred in tax years 2018 and after) may be utilized to reduce pre-apportioned adjusted

federal taxable income to zero. Any remaining, unused portion may be carried forward for a period not to exceed 5 years.

ORC 718.021 Please check the box on Schedule Y if taxpayer is electing to apportion income based on the guidelines in ORC 718.021 and will

ELECTION be situsing any payroll, property or sales from a qualifying remote employee or owner at the individual’s qualifying remote work

location to that individual’s qualifying reporting location.

FEDERAL TAX No Deduction is allowed for federal tax credits; therefore, any such credit (ie. Work Opportunity credit, FICA Tip Credit, etc.)

CREDITS should not be included as a deduction on Schedule X.

DUE DATE Calendar year tax returns must be filed on or before April 15, 2024. Fiscal year returns are due on the 15th day of the fourth

month after the close of the period. All returns should be mailed to: City of Kettering Income Tax Division, P.O. Box 639409,

Cincinnati, OH 45263-9409.

PAYMENTS Make checks or money orders payable to City of Kettering. Online payments can be made on our website at www.ketteringoh.org

via electronic check, credit card or debit card. A convenience fee will be added for all credit card and debit card transactions.

Do not remit payment for balance due if the amount is $10.00 or less.

PENALTY AND A 15% penalty will be imposed on the balance of unpaid tax due as of the first day after the original due date of the return.

INTEREST

Interest will be imposed on the balance of unpaid tax due beginning with the first day after the original due date of the return.

The interest rate is adjusted annually based on the federal short-term rate + 5%. Please visit our website (www.ketteringoh.org)

for the current interest rate.

A $25.00 late filing penalty will be imposed for the failure to file a return by the due date (regardless of balance due shown on

the return).

ATTACHMENTS Partnerships must attach a complete copy of the Federal Form 1065 (including all schedules and supporting statements) and

TO RETURN copies of all K-1s. Note: Schedules K-1 should include detail regarding each partner’s share of city income and income

tax paid on each partner’s behalf.

Corporations must attach a complete copy of the Federal Form 1120 or 1120S (including all schedules and supporting statements).

Fiduciaries/Trusts/Estates must attach a complete copy of the Federal Form 1041 (including all schedules and supporting statements).

OVERPAYMENTS Overpayments of estimated tax may be refunded or applied to the next tax year liability by making the appropriate designation

on the return. There is a three (3) year statute of limitations for claiming a refund or credit of any overpayment of city tax.

Overpayments of $10.00 or less will not be refunded.

EXTENSIONS Taxpayers who have requested an automatic 6-month extension for filing their federal income tax return shall automatically

receive a 7-month extension for the filing of their city tax return. A copy of an approved federal extension must be attached to

your return at the time of filing.

Taxpayers who have not requested a 6-month extension for their federal income tax return may be granted a 6-month extension

by submitting a request to the Tax Administrator by the original due date of the return.

An extension of time to file is not an extension to pay taxes due. Penalty and interest charges will apply to all payments

received after the original due date of the return.

ESTIMATED Taxpayers who anticipate a net tax liability of $200.00 or more are required under Ohio law to make estimated tax payments.

TAX Quarterly estimated tax payments are due on April 15, June 15, September 15, and December 15. Fiscal year taxpayers should

substitute corresponding dates. The first quarter estimated tax form is found at the bottom of the income tax return.

Subsequent vouchers may be obtained from our website.

DISCLAIMER Definitions and instructions are illustrative only. The City of Kettering Income Tax Code and the Ohio Revised Code supersede

any interpretation presented.