Enlarge image

City of Fairfield

Instructions for Income Tax Division Phone: 513-867-5327

701 Wessel Dr Fax: 513-867-5333

Remitting 2024 Fairfield, OH 45014

Withholding Tax www.fairfield-city.org

Mail Withholding Payments to: Mail Annual Reconciliations to:

Fairfield Income Tax Division Fairfield Income Tax Division

P.O. Box 181543 701 Wessel Dr

Fairfield, OH 45018 Fairfield, OH 45014

Am I required to withhold? Every employer located within or doing business within the City of Fairfield who employs one or

more persons is required to withhold the City of Fairfield municipal tax from wages subject to withholding.

What is the City of Fairfield's tax rate? 1.5 %

Should I remit withholdings quarterly, monthly or semi-monthly? Eligibility for onthly m uarterly, q , or semi-monthly

withholding is based on the following "Look Back" provisions. If your business remitted more than $2,399.00 in the previous

year or more than $200.00 any month in the previous quarter, you will be required to remit monthly. If your business remitted less

than $2,399.00 in the previous year or less than $200.00 any month n the previous quarter,ipayments should be remitted

quarterly. If your business remitted more than $11,999.00 in the previous year or more than $1,000.00 any month in the previous

quarter, payments should be remitted semi-monthly.

Am I required to withhold for Fairfield resident employees who are working from home? No, if an employee is working

from home you may choose to withhold Fairfield tax as a courtesy, but you are not legally required to do so.

What are the ways that I can remit withholding payments? Checks can be mailed to the Fairfield P.O. Box listed above.

Electronic filing through the Ohio Business Gateway (OBG) can also be utilized to submit withholding payments. The date used

for determining timeliness of the electronic filing will be the date submitted. Information and instructions on how to register and

remit payments through the OBG may be found at business.ohio.gov.

What are the penalties for late or missing withholding payments? Quarterly withholding payments are due on the last day of

the month following the end of the last day of each quarter. Monthly withholding payments are due on the fifteenth day of the

month following the end of month. Semi-monthly withholding payments are due the third banking day after the fifteenth day of

the month (for the first semi-monthly payment of the month) or the third banking day after the last day of the month (for the

second semi-monthly payment of the month). Your payment must be postmarked on or before the due date to be considered on

time. There is no grace period. Late withholding payments are penalized at the rate of 50% of the amount not timely paid, plus

interest. This is a penalty prescribed by the ORC Chapter 718. Specific language may be found at http://codes.ohio.gov/

orc/718.27. Interest is calculated using the Federal Short Term Rate (rounded to the nearest percent) + 5%.

When is the Annual Reconciliation due? The last day of February each year.

What is required to be submitted with the annual reconciliation? A completed copy of the Fairfield Annual Reconciliation

and all W-2(s) which include the employee's name, address, full social security number, qualifying wage compensation, and City

of Fairfield tax withholding. If more than one city tax was withheld, then the W-2's must show a breakdown of each city for which

tax was withheld, the wages earned in each city, and the amount of city tax withheld for each city.

Where can I find information about submitting W-2s in electronic file format? Instructions and filing information can be

found on the Income Tax Division's page of the City of Fairfield website under "Business Tax Forms".

https://www.fairfield-city.org/254/Business-Tax-Forms

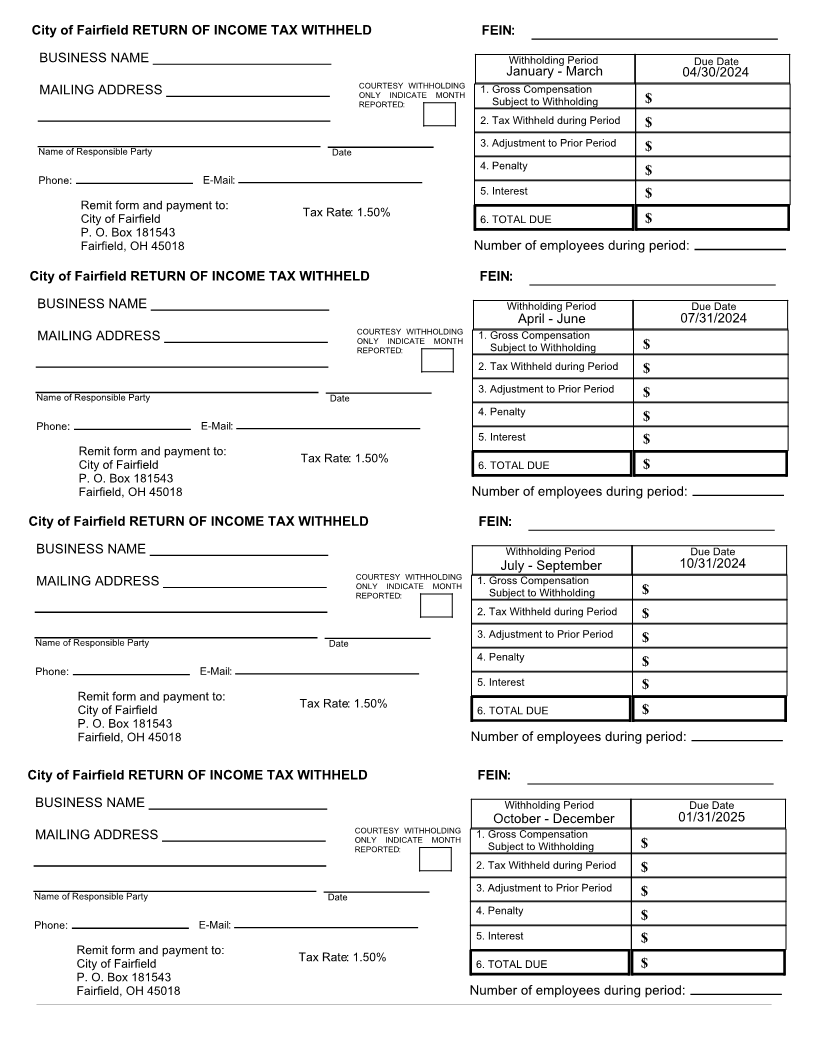

Form Instructions:

1) To ensure that your payment is applied appropriately, please incluide your Federal EIN number, business

name, address, the name of a contact for the business, phone number, and email.

2)Gross compensation subject to withholding: Enter the gross compensation subject to Fairfield withholding for the filing

period. If there are no qualifying wages for this period, enter zero.

3)Enter the total City of Fairfield tax withheld.

4)Enter adjustments (if any) and attach a full written explanation of adjustments .

5)Indicate the number of employees subject to ityCof Fairfield tax during the period.

6) Sign and date where indicated.