Enlarge image

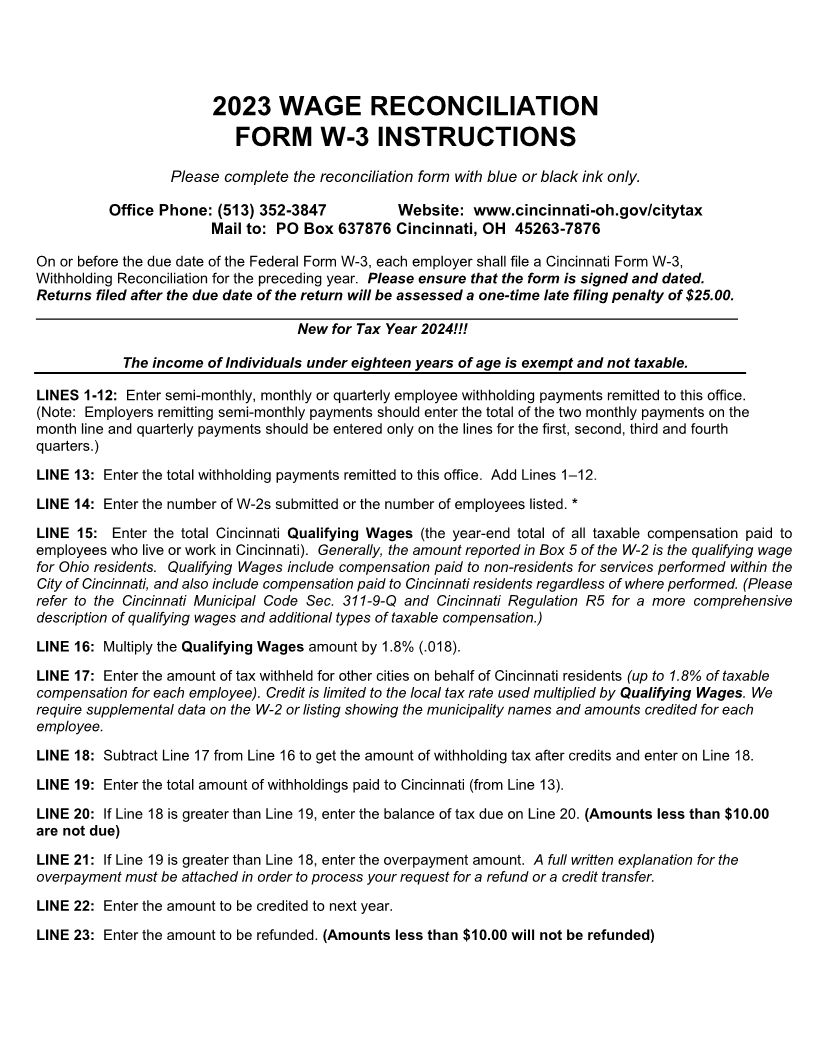

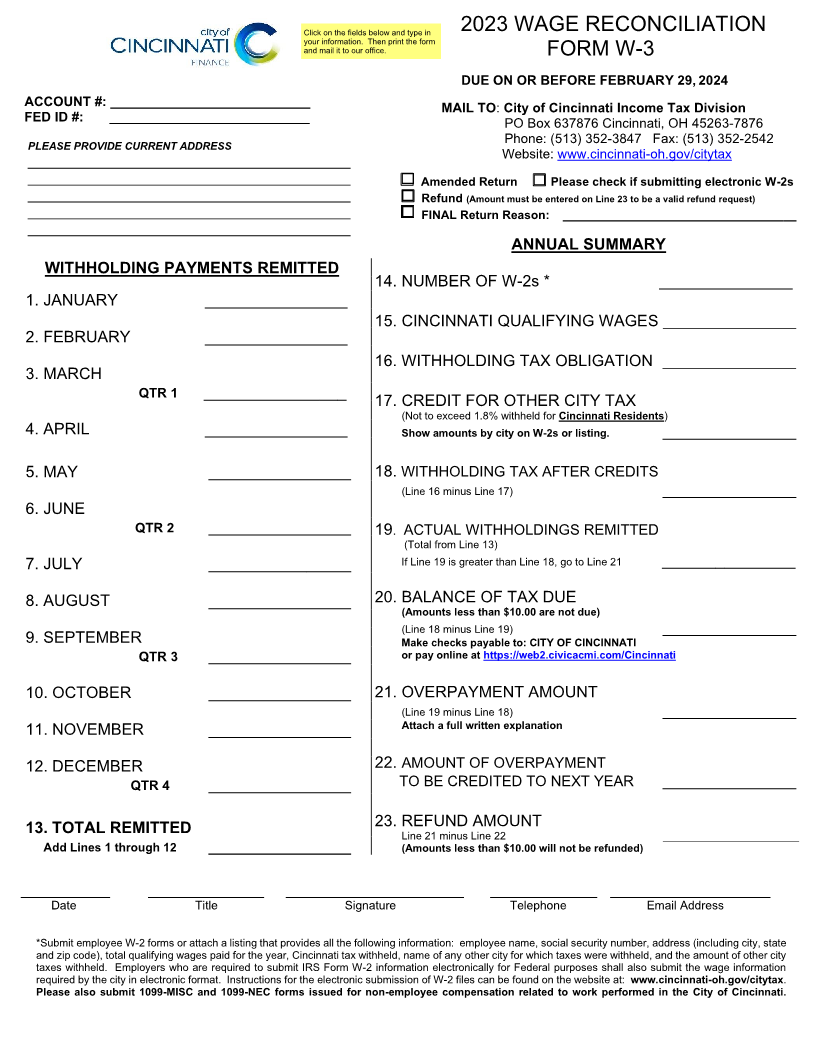

Click on the fields below and type in 2023 WAGE RECONCILIATION

your information. Then print the form

and mail it to our office. FORM W-3

DUE ON OR BEFORE FEBRUARY 29, 2024

ACCOUNT #: ___________________________ MAIL TO City of:Cincinnati Income Tax Division

FED ID #: ___________________________ PO Box 637876 Cincinnati, OH 45263-7876

Phone: (513) 352-3847 Fax: (513) 352-2542

PLEASE PROVIDE CURRENT ADDRESS

Website: www.cincinnati-oh.gov/citytax

____________________________________________

____________________________________________ Amended Return Please check if submitting electronic W-2s

____________________________________________ Refund (Amount must be entered on Line 23 to be a valid refund request)

____________________________________________ FINAL Return Reason: ___________________________________

____________________________________________

ANNUAL SUMMARY

WITHHOLDING PAYMENTS REMITTED

14. NUMBER OF W-2s * _______________

1. JANUARY ________________

15. CINCINNATI QUALIFYING WAGES __________________

2. FEBRUARY ________________

16. WITHHOLDING TAX OBLIGATION __________________

3. MARCH

QTR 1 ________________

17. CREDIT FOR OTHER CITY TAX

(Not to exceed 1.8% withheld for Cincinnati Residents)

4. APRIL ________________ Show amounts by city on W-2s or listing. _______________

5. MAY ________________ 18. WITHHOLDING TAX AFTER CREDITS

(Line 16 minus Line 17) _______________

6. JUNE

QTR 2 ________________ 19. ACTUAL WITHHOLDINGS REMITTED

(Total from Line 13)

7. JULY ________________ If Line 19 is greater than Line 18, go to Line 21 _______________

8. AUGUST ________________ 20. BALANCE OF TAX DUE

(Amounts less than $10.00 are not due)

(Line 18 minus Line 19) _______________

9. SEPTEMBER Make checks payable to: CITY OF CINCINNATI

QTR 3 ________________ or pay online at https://web2.civicacmi.com/Cincinnati

10. OCTOBER ________________ 21. OVERPAYMENT AMOUNT

(Line 19 minus Line 18) _______________

Attach a full written explanation

11. NOVEMBER ________________

12. DECEMBER 22. AMOUNT OF OVERPAYMENT

QTR 4 ________________ TO BE CREDITED TO NEXT YEAR _______________

23. REFUND AMOUNT

13. TOTAL REMITTED Line 21 minus Line 22 _______________________

Add Lines 1 through 12 ________________ (Amounts less than $10.00 will not be refunded)

_______________

__________ _____________ ____________________ ____________ __________________

Date Title Signature Telephone Email Address

*Submit employee W-2 forms or attach a listing that provides all the following information: employee name, social security number, address (including city, state

and zip code), total qualifying wages paid for the year, Cincinnati tax withheld, name of any other city for which taxes were withheld, and the amount of other city

taxes withheld. Employers who are required to submit IRS Form W-2 information electronically for Federal purposes shall also submit the wage information

required by the city in electronic format. Instructions for the electronic submission of W-2 files can be found on the website at: www.cincinnati-oh.gov/citytax.

Please also submit 1099-MISC and 1099-NEC forms issued for non-employee compensation related to work performed in the City of Cincinnati.