Enlarge image

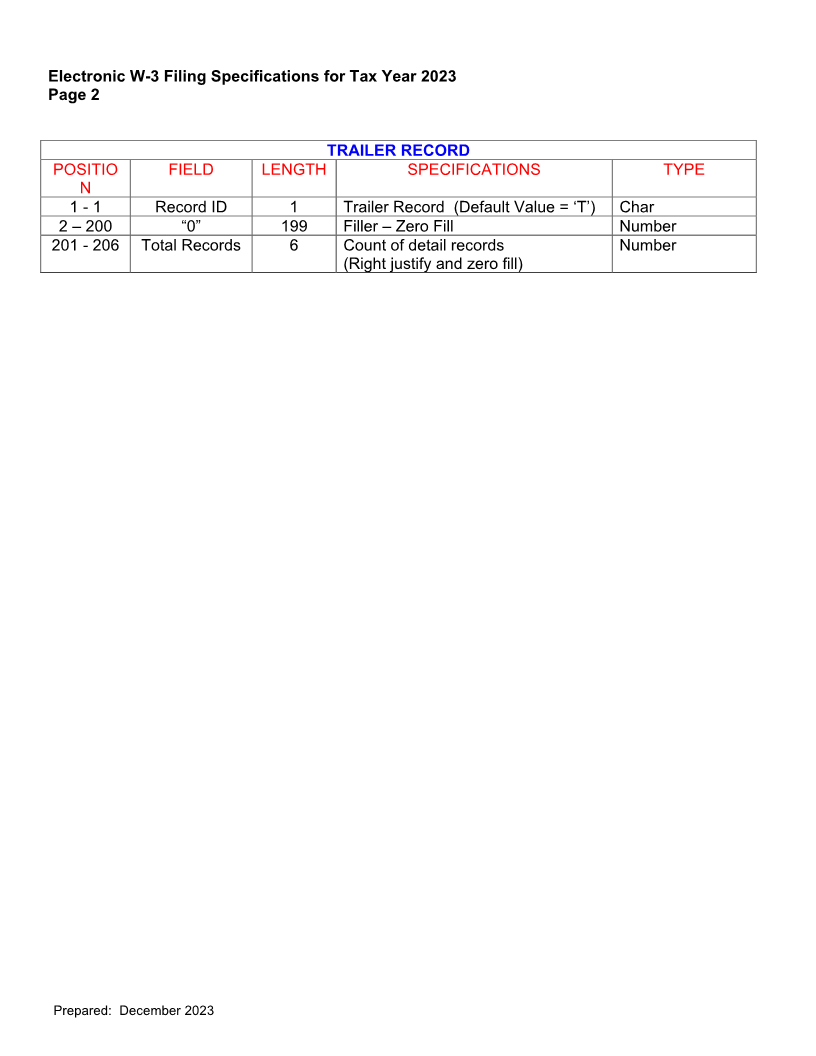

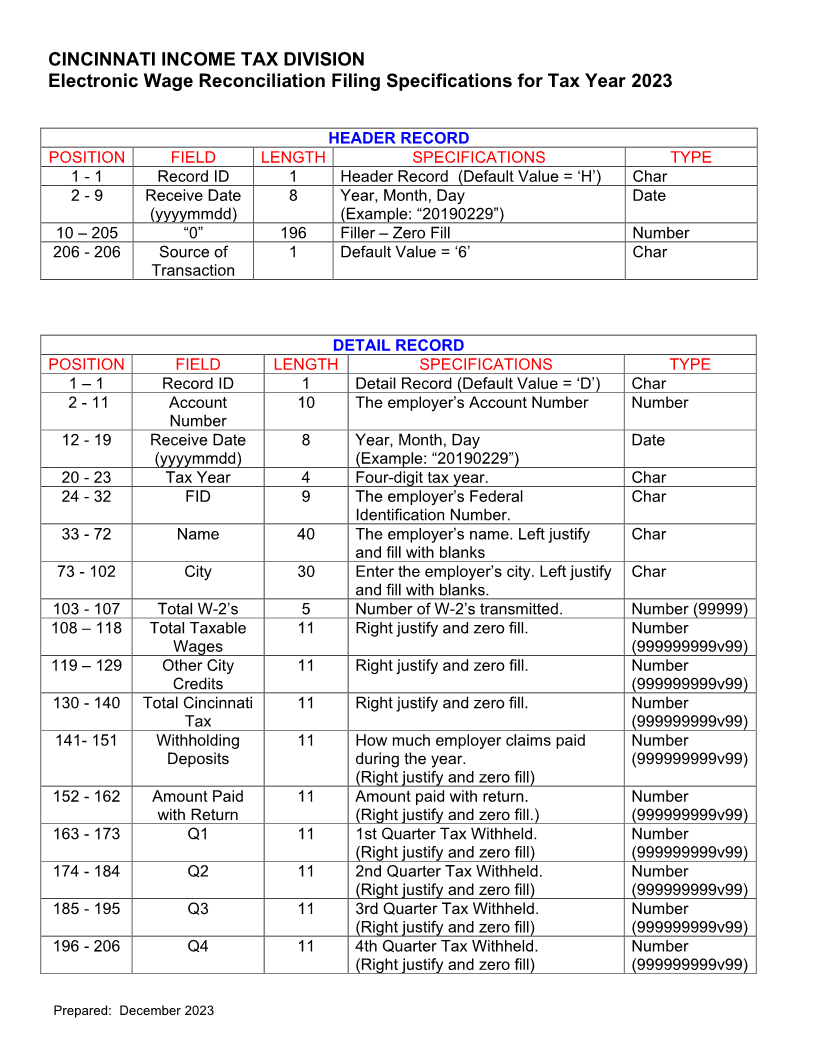

CINCINNATI INCOME TAX DIVISION Electronic Wage Reconciliation Filing Specifications for Tax Year 2023 HEADER RECORD POSITION FIELD LENGTH SPECIFICATIONS TYPE 1 - 1 Record ID 1 Header Record (Default Value = ‘H’) Char 2 - 9 Receive Date 8 Year, Month, Day Date (yyyymmdd) (Example: “20190229 ”) 10 205– “0” 196 Filler –Zero Fill Number 206 - 206 Source of 1 Default Value = ‘6’ Char Transaction DETAIL RECORD POSITION FIELD LENGTH SPECIFICATIONS TYPE 1 1– Record ID 1 Detail Record (Default Value = ‘D’) Char 2 - 11 Account 10 The employer’s Account Number Number Number 12 - 19 Receive Date 8 Year, Month, Day Date (yyyymmdd) (Example: “20190229 ”) 20 - 23 Tax Year 4 Four-digit tax year. Char 24 - 32 FID 9 The employer’s Federal Char Identification Number. 33 - 72 Name 40 The employer’s name. Left justify Char and fill with blanks 73 - 102 City 30 Enter the employer’s city. Left justify Char and fill with blanks. 103 - 107 Total W-2’s 5 Number of W-2’s transmitted. Number (99999) 108 118– Total Taxable 11 Right justify and zero fill. Number Wages (999999999v99) 119 129 – Other City 11 Right justify and zero fill. Number Credits (999999999v99) 130 - 140 Total Cincinnati 11 Right justify and zero fill. Number Tax (999999999v99) 141- 151 Withholding 11 How much employer claims paid Number Deposits during the year. (999999999v99) (Right justify and zero fill) 152 - 162 Amount Paid 11 Amount paid with return. Number with Return (Right justify and zero fill.) (999999999v99) 163 - 173 Q1 11 1st Quarter Tax Withheld. Number (Right justify and zero fill) (999999999v99) 174 - 184 Q2 11 2nd Quarter Tax Withheld. Number (Right justify and zero fill) (999999999v99) 185 - 195 Q3 11 3rd Quarter Tax Withheld. Number (Right justify and zero fill) (999999999v99) 196 - 206 Q4 11 4th Quarter Tax Withheld. Number (Right justify and zero fill) (999999999v99) Prepared: December 2023