Enlarge image

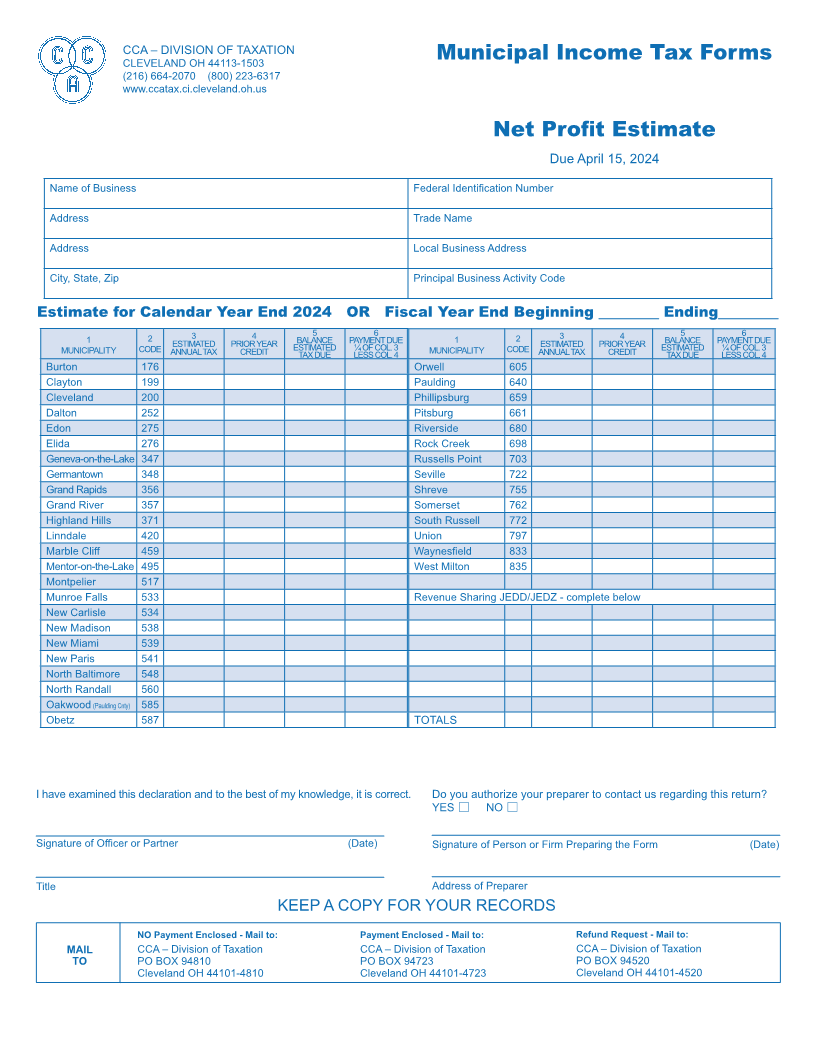

CCA – DIVISION OF TAXATION

CLEVELAND OH 44113-1503 Municipal Income Tax Forms

(216) 664-2070 (800) 223-6317

www.ccatax.ci.cleveland.oh.us

Net Profit Estimate

Due April 15, 2024

Name of Business Federal Identification Number

Address Trade Name

Address Local Business Address

City, State, Zip Principal Business Activity Code

Estimate for Calendar Year End 2024 OR Fiscal Year End Beginning Ending

1 2 3 4 5 6 2 3 4 5 6

MUNICIPALITY CODE ESTIMATED PRIOR YEAR BALANCE PAYMENT DUE 1 ESTIMATED PRIOR YEAR BALANCE PAYMENT DUE

ANNUAL TAX CREDIT ESTIMATED ¼ OF COL. 3 MUNICIPALITY CODE ANNUAL TAX CREDIT ESTIMATED ¼ OF COL. 3

TAX DUE LESS COL. 4 TAX DUE LESS COL. 4

Burton 176 Orwell 605

Clayton 199 Paulding 640

Cleveland 200 Phillipsburg 659

Dalton 252 Pitsburg 661

Edon 275 Riverside 680

Elida 276 Rock Creek 698

Geneva-on-the-Lake 347 Russells Point 703

Germantown 348 Seville 722

Grand Rapids 356 Shreve 755

Grand River 357 Somerset 762

Highland Hills 371 South Russell 772

Linndale 420 Union 797

Marble Cliff 459 Waynesfield 833

Mentor-on-the-Lake 495 West Milton 835

Montpelier 517

Munroe Falls 533 Revenue Sharing JEDD/JEDZ - complete below

New Carlisle 534

New Madison 538

New Miami 539

New Paris 541

North Baltimore 548

North Randall 560

Oakwood (Paulding Cnty) 585

Obetz 587 TOTALS

I have examined this declaration and to the best of my knowledge, it is correct. Do you authorize your preparer to contact us regarding this return?

YES NO

@ @

Signature of Officer or Partner (Date) Signature of Person or Firm Preparing the Form (Date)

Title Address of Preparer

KEEP A COPY FOR YOUR RECORDS

NO Payment Enclosed - Mail to: Payment Enclosed - Mail to: Refund Request - Mail to:

MAIL CCA – Division of Taxation CCA – Division of Taxation CCA – Division of Taxation

TO PO BOX 94810 PO BOX 94723 PO BOX 94520

Cleveland OH 44101-4810 Cleveland OH 44101-4723 Cleveland OH 44101-4520