Enlarge image

DRAFT

Do not file draft forms. Although we do not expect this draft to change

significantly before we publish the final version, we will not post the final

version until after year-end.

Enlarge image |

DRAFT

Do not file draft forms. Although we do not expect this draft to change

significantly before we publish the final version, we will not post the final

version until after year-end.

|

Enlarge image |

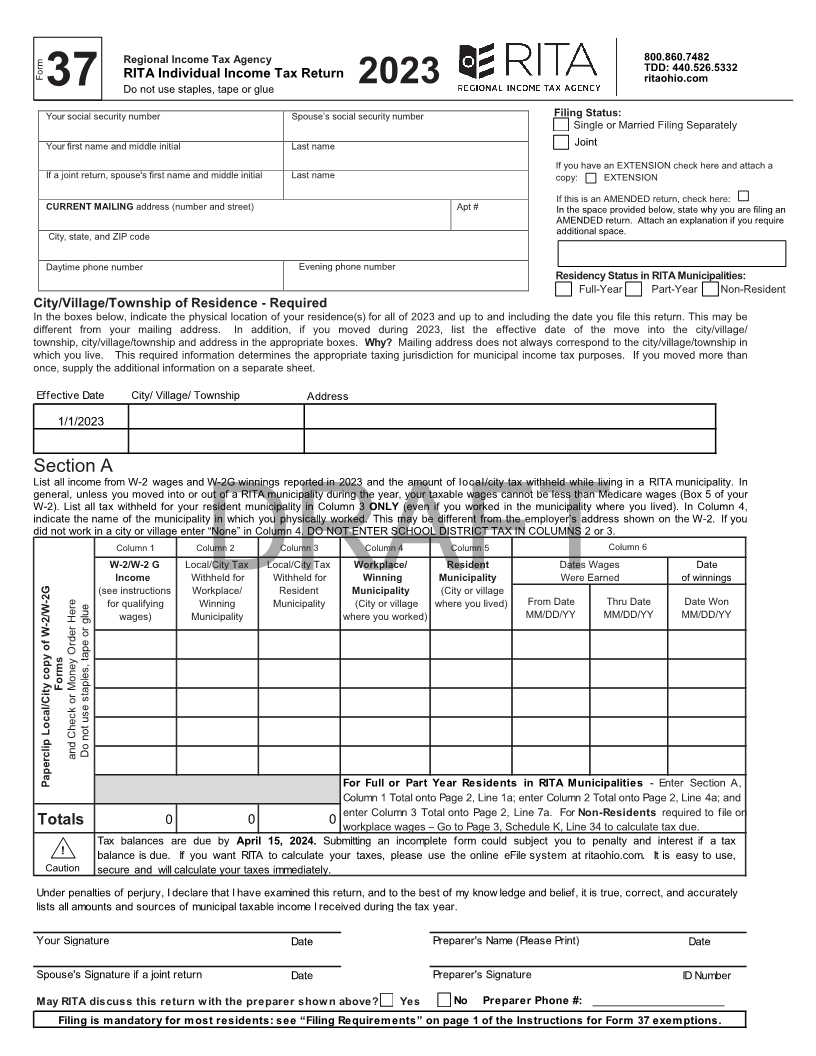

Regional Income Tax Agency 800.860.7482

Form TDD: 440.526.5332

RITA Individual Income Tax Return ritaohio.com

Do not use staples, tape or glue 2023

37

Your social security number Spouse’s social security number Filing Status:

Single or Married Filing Separately

Your first name and middle initial Last name Joint

If you have an EXTENSION check here and attach a

If a joint return, spouse's first name and middle initial Last name copy: EXTENSION

If this is an AMENDED return, check here:

CURRENT MAILING address (number and street) Apt # In the space provided below, state why you are filing an

AMENDED return. Attach an explanation if you require

City, state, and ZIP code additional space.

Daytime phone number Evening phone number

Residency Status in RITA Municipalities:

Full-Year Part-Year Non-Resident

City/Village/Township of Residence - Required

In the boxes below, indicate the physical location of your residence(s) for all of 2023 and up to and including the date you file this return. This may be

different from your mailing address. In addition, if you moved during 2023, list the effective date of the move into the city/village/

township, city/village/township and address in the appropriate boxes. Why? Mailing address does not always correspond to the city/village/township in

which you live. This required information determines the appropriate taxing jurisdiction for municipal income tax purposes. If you moved more than

once, supply the additional information on a separate sheet.

Effective Date City/ Village/ Township Address

1/1/2023

Section A

List all income from W-2 wages and W-2G winnings reported in 2023 and the amount of local/city tax withheld while living in a RITA municipality. In

general, unless you moved into or out of a RITA municipality during the year, your taxable wages cannot be less than Medicare wages (Box 5 of your

W-2). List all tax withheld for your resident municipality in Column 3 ONLY (even if you worked in the municipality where you lived). In Column 4,

indicate the name of the municipality in which you physically worked. This may be different from the employer’s address shown on the W-2. If you

did not work in a city or village enter “None” in Column 4. DO NOT ENTER SCHOOL DISTRICT TAX IN COLUMNS 2 or 3.

Column 1 Column 2 Column 3 Column 4 Column 5 Column 6

W-2/W-2 G Local/City Tax Local/City Tax Workplace/ Resident Dates Wages Date

Income Withheld for Withheld for Winning Municipality Were Earned of winnings

(see instructions Workplace/ Resident Municipality (City or village

for qualifying WinningDRAFTMunicipality (City or village where you lived) From Date Thru Date Date Won

wages) Municipality where you worked) MM/DD/YY MM/DD/YY MM/DD/YY

Forms

and Check or Money Order Here Do not use staples, tape or glue

Paperclip Local/City copy of W-2/W-2G For Full or Part Year Residents in RITA Municipalities - Enter Section A,

Column 1 Total onto Page 2, Line 1a; enter Column 2 Total onto Page 2, Line 4a; and

enter Column 3 Total onto Page 2, Line 7a. For Non-Residents required to file on

0 0 0

Totals workplace wages – Go to Page 3, Schedule K, Line 34 to calculate tax due.

Tax balances are due by April 51 , 202 .4 Submitting an incomplete form could subject you to penalty and interest if a tax

! balance is due. If you want RITA to calculate your taxes, please use the online eFile system at ritaohio.com. It is easy to use,

Caution secure and w ill calculate your taxes immediately.

Under penalties of perjury, I declare that I have examined this return, and to the best of my know ledge and belief, it is true, correct, and accurately

lists all amounts and sources of municipal taxable income I received during the tax year.

Your Signature Date Preparer's Name (Please Print) Date

Spouse's Signature if a joint return Date Preparer's Signature ID Number

May RITA discuss this return with the preparer shown above? Yes No Preparer Phone #: ______________________

Filing is mandatory for most residents: see “Filing Requirements” on page 1 of the Instructions for Form 37 exemptions.

|

Enlarge image |

Form 37 (2023) Page 2

Section B

For NON 1 a Total W-2/W-2G income from Page 1, Section A, Column 1. 1a

W-2/ b Total self-employment, rental, partnership, and (if applicable)

Schedule S-Corp. income as well as any other taxable income from Page

income 3, Schedule J, Line 29, Column 7. If less than zero, enter -0-. 1b

see Pages

3-5 before 2 Total taxable income. Add Lines 1a and 1b. 2

starting 3 Multiply Line 2 by the tax rate of your resident municipality from the tax table.

Section B.

Enter the tax rate of your resident municipality here: 3

4 a Tax withheld for all municipalities other than your municipality of residence

Withheld from Page 1, Section A, Column 2. Do not enter estimated tax payments. 4a

taxes b Direct payments from Page 3, Schedule K, Line 37. Do not enter tax

shown on withheld from your wages and/or estimated tax payments on this line. 4b

your W-2

forms are 5 a Add Lines 4a and 4b. 5a

reported on b Total tentative credit from Credit Rate Worksheet, Column E located at the

either Line bottom of this page. Your resident municipality’s credit rate: _ 5b

4a or 7a.

c Enter the smaller of Line 5a or Line 5b. 5c

If your 6 Multiply Line 5c by the credit factor of your resident municipality from

resident the tax table. Your resident municipality’s credit factor: 6

city/village

has a Credit 7 a Tax withheld for your resident municipality from Page 1, Section A,

Rate of 0%; Column 3. Do not enter estimated tax payments (see instructions). 7a

enter -0- on b Tax paid by your partnership/S-Corp./trust to YOUR RESIDENT municipality(from Worksheet R) 7b

Line 5b, 5c

and Line 6 8 Total credits allowable. (Add Lines 6, 7a, and 7b.) 8

and go to

Line 7a. You 9 Subtract Line 8 from Line 3. 9

do not need 10 Tax on non-withheld wages from Page 3, Schedule K, Line 34. 10

to complete

the Credit 11 Tax on Schedule J Income from Page 3, Line 33, Column 7. 11

Rate 12 TAX DUE RITA BEFORE ESTIMATED PAYMENTS. Add Lines 9, 10 and 11. If less than

Worksheet.

zero, enter-0- and file Form 10A (see instructions). 12

Refunds: 13 2023 Estimated Tax Payments made to RITA. Do not enter tax

To avoid withheld from your W-2s. Only include payments made for the

delays in 2023 tax year. 13

processing

your refund, 14 Credit carried forward from 2022. 14

mail your

return to the 15 TOTAL CREDITS AND ESTIMATED PAYMENTS. Add Lines 13 and 14. 15

PO BOX

address 16 Balance Due. If Line 15 is less than Line 12, subtract Line 15 from Line

listed in the 12. If the amount is $10 or less, enter -0-. 16

lower right

17 If Line 15 is GREATER than 12, subtract Line 12 from Line 15 and enter

hand corner DRAFTOVERPAYMENT. 17

of this page.

18 Amount you want credited to your 202 4estimated tax. 18

Refunds of

tax withheld 19 Amount to be refunded. You may not split an overpayment

from your between a refund and a credit. Amounts $10 or less will not be 19

wages must refunded. Allow 90 days for your refund.

be applied

for on Form 20 a Enter202 4estimated tax in full (see instructions). Estimates are

10A. due 4/15/24 , 6/15/2 ,49/15/2 and4 1/15/2 . 5 20a

Download b Enter first quarter estimate (1/4 of Line 20a). 20b

Form 10A at

ritaohio.com 21 Subtract Line 18 from Line 20b. 21

22 TOTAL DUEbyApril 15, 2024. Add Lines 16 and 21. 22

Estimated Taxes(Line 20a): If your estimated tax liability is $200 or more, you are required to make quarterly payments of

the anticipated tax due. If your estimated tax payments are not 90% of the tax due or not equal to or greater than your prior year s’total tax liability,

you may be subject to penalty and interest. You may use the amount on Line 12 as your estimate or use Workshee t 1 in the instructions to calculate

your estimate. Note: If Line 20a is left blank, RITA will calculate your estimate. Use Form 32 EST-EXT to pay 6/15/24, 9/15/2 4and 1/15/2 5estimates.

Credit Rate Worksheet (enter each wage separately): Mail your return with W-2s and

A B C D E a copy of your federal schedules to:

Wages/Income Credit Rate Maximum credit Workplace tax Tentative Credit With payment made payable to RITA:

earned outside of for resident municipality (multiply Column withheld/paid Enter lesser of

resident municipality from tax table A by Column B) Columns C or D Regional Income Tax Agency

PO Box 6600

Cleveland, OH 44101-2004

Without payment:

Regional Income Tax Agency

PO Box 94801

Cleveland, OH 44101-4801

Refund with an amount on Line 19:

Enter amount from WORKSHEET L, Row 17, Column 7 Regional Income Tax Agency

PO Box 89409

Total Tentative Credit: Enter on Section B, Line 5b, above. Cleveland, OH 44101-6409

|

Enlarge image |

Page 3 Form 37 (2023)

Note: Separate sub schedules for Schedule J have been provided for Partnership/S-Corp./Trust reporting.

Go to Schedule P if pass-through income/loss was earned in any NON RESIDENT, TAXING MUNICIPALITIES.

Go to Worksheet R if you are a RITA Municipality Resident and you need to calculate the tax paid by the partnership to your RITA RESIDENT MUNICIPALITY.

SUMMARY OF NON W-2 INCOME Note: Special Rules may apply for S-Corp. distributions.

SCHEDULE J (For Columns 3-6, Enter City/Village/Township Where Earned) See RITA Municipalities at ritaohio.com.

Please see Pages 5-6 of the

Instructions. COLUMN 1 COLUMN 2 COLUMN 3 COLUMN 4 COLUMN 5 COLUMN 6 COLUMN 7

RESIDENT NON-TAXING

Print the name of each MUNICIPALITY LOCATION LOCATION 3 LOCATION 4 LOCATION 5 LOCATION 6 TOTAL

location (city/

village/township) where 11 13 14 15 16

income/ loss was earned in NON-TAXING

the appropriate boxes.

21 22 23 24 25 26

Income/Loss From Federal

23. SCHEDULE C Attached

Income/Loss From Federal 31 32 33 34 35 36

SCHEDULE E, Part I

24. Attached

Other Taxable Income/Loss 41 42 43 44 45 46

Attach Schedule(s) and/or

25. Form(s)

51 52 RESIDENTS of RITA MUNICIPALITIES ONLY:

Partnership/S-Corp./Trust GO TO SCHEDULE P for PASS-THROUGH income/loss from a non-resident

Income/Loss

26. From SCHEDULE E Attached taxing municipality and enter the total from Schedule P, Column 7, Line 26d HERE .

61 62 63 64 65 66

CURRENT YEAR WORKPLACE

INCOME/LOSS

27. (Total Lines 23-26)

71

ENTER PRIOR YEAR LOSS CARRYFORWARD for your

PRIOR YEAR RESIDENT MUNICIPALITY HERE

28. LOSS CARRYFORWARD ( )

NET RESIDENT TAXABLE

INCOME FOR LINE 29; ADD COLUMN 7, LINES 26-28,

ENTER ON PAGE 2, SECTION B, Line 1b.

29. (Total Column 7, Lines 26-28)

ENTER WORKPLACE LOSS 73 74 75 76

Calculate tax due on WORKPLACE INCOME:

30. LESS WORKPLACE LOSS CARRYFORWARD CARRYFORWARD HERE. ( ) ( ) ( ) ( )

83 84 85 86

NET TAXABLE WORKPLACE INCOME

31. (Line 27 minus Line 30)

FOR EACH RITA MUNICIPALITY LISTED IN FOR LINE 33 BELOW: ADD

COLUMNS 3-6 - ENTER THE TAX RATES. COLUMNS 3-6, ENTER ON

Note: If Line 31 is less than zero, do NOT PAGE 2, SECTION B,

32. enter tax rate. LINE 11.

DRAFT

MUNICIPAL TAX DUE (each RITA

MUNICIPALITY)

Note: If amounts in Columns 3-6 are $10

or less, enter -0-. Do NOT include NON-

33. RITA Municipalities.

Note: If you are a resident of a RITA municipality – please go to Page 4 for WORKSHEET L to allocate income/loss and calculate potential credit for your

resident municipality.

SCHEDULE K To complete Schedule K, see page 5 of the instructions. If additional space is needed, use a separate sheet.

34. W-2 WAGES EARNED IN A RITA MUNICIPALITY OTHER THAN YOUR RESIDENCE MUNICIPALITY FROM WHICH

NO MUNICIPAL INCOME TAX WAS WITHHELD BY EMPLOYER. Complete lines below.

Tax Rate

Wages Municipality (see instructions) Tax Due

Add Tax Due Column, enter total here AND on Page 2, Section B, Line 10. 34. ______________

35. W-2 WAGES EARNED IN A NON-RITA TAXING MUNICIPALITY FROM WHICH NO MUNICIPAL INCOME TAX

WAS WITHHELD BY EMPLOYER. ONLY USE THIS SECTION IF YOU HAVE FILED AND PAID THE TAX DUE TO

YOUR WORKPLACE MUNICIPALITY. PROOF OF PAYMENT MAY BE REQUIRED. Complete lines below.

Tax Rate

Wages Municipality (see instructions) Tax Due

Add Tax Due Column, enter total here. 35. ______________

ENTER the amount from WORKSHEET L, Row 14, Column 7. 36. ______________

Add Lines 34-36. Enter total on Page 2, Section B, Line 4b. 37. ______________

|

Enlarge image |

Form 37 (2023 ) Page 4

WORKSHEET L RITA RESIDENTS ONLY Use this to allocate income/loss and calculate potential credit for resident municipality.

INCOME/LOSS ALLOCATION

Print the name of each location COLUMN 1 COLUMN 2 COLUMN 3 COLUMN 4 COLUMN 5 COLUMN 6 COLUMN 7

(city/village/township) RESIDENT NON-TAXING LOCATION 3 LOCATION 4 LOCATION 5 LOCATION 6 TOTAL

listed from SCHEDULE J, MUNICIPALITY LOCATION

COLUMNS 1-6

Please see Pages 5-6 of the

Instructions. NON-TAXING

Enter CURRENT YEAR

W. WORKPLACE INCOME From

SCHEDULE J, Line 27.

Enter CURRENT YEAR, NON-

RESIDENT PASS THROUGH

INCOME From SCHEDULE P. For

Column 2 - enter GAIN from

P. Schedule P, Line 5, COLUMN 7.

For Columns 3-6, enter GAIN from

Schedule P, Line 4 or LOSS from

Schedule P, Line 26d.

NET TAXABLE WORKPLACE

INCOME - Current Year Workplace

T. Income/Loss AND Non-Resident Pass-

Through Income (ADD Rows W and P).

1. Columns 1-6: If ROW T is again,

enter in each column and total across.

2. Columns 1-6: If ROW T is aloss,

enter in each column and total across.

3. PRIOR YEAR LOSS CARRY FORWARD

From SCHEDULE J, Line 28.

4. TOTAL LOSSES (ADD Rows 2 and 3).

Compute GAIN Percentage :

Divide each amount in Row 1, Columns

5. 1-6 by the total in Row 1, Column 7 and % % % % % %

enter the percentage.

Allocate Total Loss by GAIN

6. Percentage: Multiply the total loss

from Row 4, Column 7 by the

percentage(s) in Row 5.

Subtract Row 6 from Row 1. Note: If Pass-

Through Income included in ROW 7,

7. Column 1, GO TO WORKSHEET R. If less

than zero, enter -0-. DRAFT

Enter NET TAXABLE WORKPLACE INCOME

8. From Schedule J, Line 31. This amount cannot be

less than zero.

9. Add the amount in Row P to the amount in Row 8

and enter total. If amount is less than zero, enter -0-.

10. Enter the lesser of Row 7 or Row 9.

If Row 8 multiplied by the workplace tax rate is $10 or

11. less, divide Row W by Row T and then multiply the

result by Row 10. Otherwise, enter -0-.

12. Subtract Row 11 from Row 10. If amount is less than

zero, enter -0-. Enter amount from

Row 14, Col 7 below

13. For Columns 3-6, enter tax rate for workplace Rows 13- on Page 3,

14:

municipality listed. Calculate Schedule K, Line 36

the tax

14. Multiply Row 12 by Row 13. due on

Non-W2

workplace

income

15. If amount on Row 14 is greater than zero, enter the

amount from Row 12. Rows 16-

17: Get

Enter amount from

16. municipality. Multiply Row 15 by the Credit Rate of the resident credit f or Row 17, Col 7 below

the tax

paid in on Page 2, Credit

The resident municipality's credit rate: ________ Row 14, Rate Worksheet

Column 7

17. Enter the lesser of Row 14 or Row 16 above.

|

Enlarge image |

Page 5 Form 37 (2023)

Note: For RESIDENTS of RITA MUNICIPALITIES ONLY, separate sub schedules for Schedule J have been provided for Partnership/S-Corp./Trust reporting.

USE Schedule P if pass-through income/loss was earned in any NON RESIDENT, TAXING MUNICIPALITIES.

USE Worksheet R if you are a RITA Municipality Resident and you need to calculate the tax paid by the partnership to your RITA RESIDENT MUNICIPALITY.

FOR RITA RESIDENTS ONLY

SCHEDULE P PASS-THROUGH INCOME/LOSS for TAXING MUNICIPALITIES OTHER THAN YOUR Note: Special Rules may apply for S-Corp. distributions.

RITA RESIDENT MUNICIPALITY See RITA Municipalities at ritaohio.com.

Print the name of each location COLUMN 3 COLUMN 4 COLUMN 5 COLUMN 6 COLUMN 7

(city/village/township) NON-RESIDENT, COMPLETE THE LOCATION 3 LOCATION 4 LOCATION 5 LOCATION 6 TOTAL

TAXING MUNICIPALITIES ONLY where ENTIRE

income/loss was earned in the SCHEDULE P 17 18 19 20

appropriate boxes. BEFORE

Please see Pages 5-6 of the ENTERING THE

Instructions. TOTALS ON

SCHEDULE J AND 27 28 29 30

26a PARTNERSHIP INCOME/LOSS From WORKSHEET L.

Federal SCHEDULE E Attached

37 38 39 40

26b S-CORP INCOME/LOSS From Federal

SCHEDULE E Attached

47 48 49 50

26c TRUST INCOME/LOSS From Federal

SCHEDULE E Attached

57 58 59 60 80

Add Lines 26a-26c down. For each total

26d in Columns 3-6: If amount is a loss ,

enter on Worksheet L, Row P. If amount is

a gain , proceed to Line 1 below.

1. FOR EACH MUNICIPALITY LISTED IN ENTER TOTAL

COLUMNS 3-6 - ENTER THE TAX RATES. % % % % ABOVE IN

COLUMN 7, LINE 26

If Line 26d is a GAIN, multiply Line 26d ON SCHEDULE J.

2. by Line 1 to calculate potential tax due on

current year non-resident pass-through

income.

67 68 69 70

Enter the tax paid by your Partnership/S-

3. Corp./Trust to each MUNICIPALITY on the

taxpayer's distributive share.

If Line 3 is less than Line 2, divide Line 3 by ENTER EACH SCHEDULE P ADD ROW 5 TOTA L

4. Line 1 to calculate the income eligible for LINE 4 TOTAL ON BELOW TO

credit. Otherwise, enter the amount from WORKSHEET L, ROW P, COLUMN 2, ROW P

Line 26d. COLUMNS 3-6 ON WORKSHEET L.

5. Subtract Line 4 from Line 26d. ADD total

across to Column 7. DRAFT

Note: Special Rules may apply for S-Corp.

RITA RESIDENTS with PASS-THROUGH INCOME in YOUR RITA RESIDENT MUNICIPALITY distributions.

WORKSHEET R (Use this to calculate credit for tax paid by the entity to your RITA RESIDENT MUNICIPALITY) See RITA Municipalities at ritaohio.com.

COLUMN 2

Use this worksheet to calculate the Compute GAIN

allowed partnership payment made to COLUMN 1 Percentage: Note: Pass-through

your RITA RESIDENT MUNICIPALITY FROM SCHEDULE Divide each amount in Rows income earned in your

J, LINES 23-26 1-4 by Row 5, Column 1 and COLUMN 3 COLUMN 4 COLUMN 5 RITA Resident

COLUMN 1 ONLY enter the percentage Municipality is separated

If GAIN in Schedule J, Line 23 in its own schedule to

prevent you from

1. ENTER HERE % calculating workplace tax

If GAIN in Schedule J, Line 24 on this income in

Schedule J. Take the

2. ENTER HERE % lesser of the calculation

If GAIN in Schedule J, Line 25 on Worksheet R (Column

3) compared to the actual

3. ENTER HERE % partnership payments

If GAIN in Schedule J, Line 26 (Column 4) and enter

4. ENTER HERE % directly on Page 2, Line

7b.

ADD ROWS 1-4. TOTAL GAINS

5. RESIDENT MUNICIPALITY Enter BELOW ENTER the lesser of

Partnership Payments Column 3, Row 7 OR

Multiply Row 7, made to your RITA Column 4, Row 7

6. Enter from Worksheet L, Row 7, Column 1 by Tax Rate Resident Municipality BELOW AND ON

Column 1 ONLY (total gain offset Enter Tax Rate for for Resident on the taxpayer's Page 2, LINE 7B.

by allocated loss) Resident Municipality Municipality distributive share.

100

Multiply Row 6, Column 1 above by

7. the Gain Percentage from Row 4,

Column 2.

|