Enlarge image

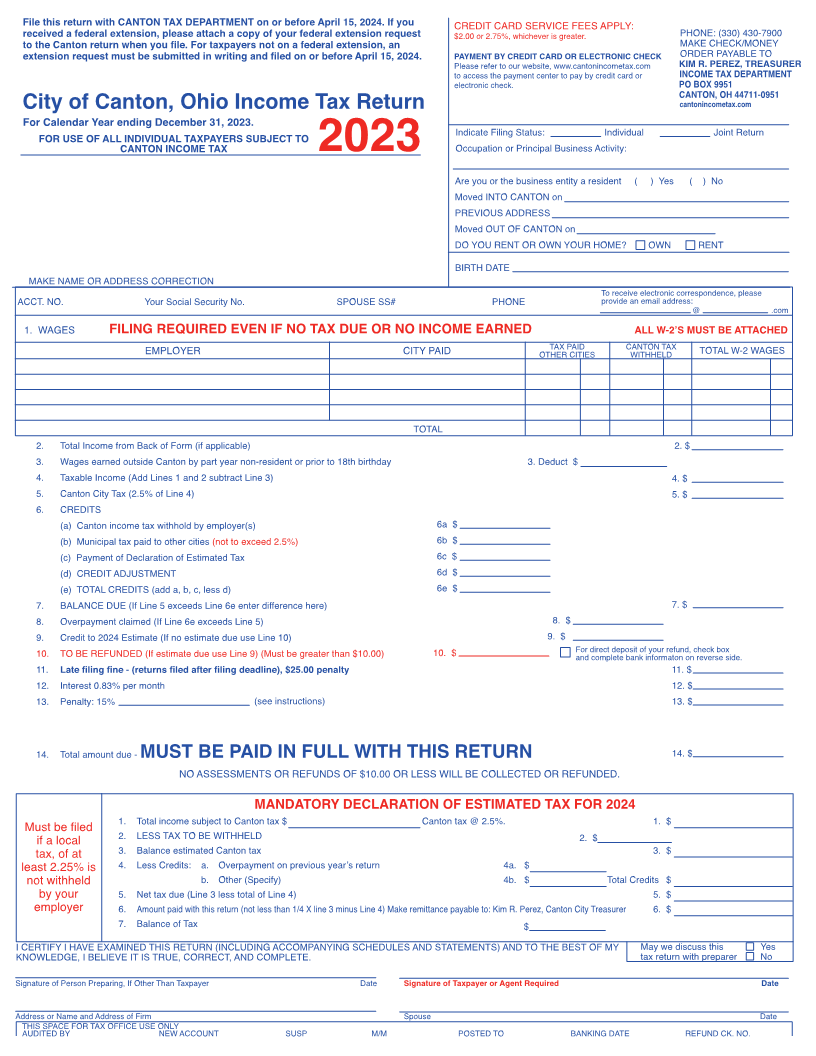

File this return with CANTON TAX DEPARTMENT on or before April 15, 2024. If you CREDIT CARD SERVICE FEES APPLY: PHONE: (330) 430-7900

received a federal extension, please attach a copy of your federal extension request $2.00 or 2.75%, whichever is greater.

MAKE CHECK/MONEY

April 15, 2024. PAYMENT BY CREDIT CARD OR ELECTRONIC CHECK ORDER PAYABLE TO

Please refer to our website, www.cantonincometax.com KIM R. PEREZ, TREASURER

to access the payment center to pay by credit card or INCOME TAX DEPARTMENT

electronic check. PO BOX 9951

CANTON, OH 44711-0951

cantonincometax.com

City of Canton, Ohio Income Tax Return

For Calendar Year ending December 31, 2023.

Indicate Filing Status: Individual Joint Return

FOR USE OF ALL INDIVIDUAL TAXPAYERS SUBJECT TO

CANTON INCOME TAX Occupation or Principal Business Activity:

2023

Are you or the business entity a resident ( ) Yes ( ) No

Moved INTO CANTON on

PREVIOUS ADDRESS

Moved OUT OF CANTON on

DO YOU RENT OR OWN YOUR HOME? OWN RENT

BIRTH DATE

MAKE NAME OR ADDRESS CORRECTION

To receive electronic correspondence, please

ACCT. NO. Your Social Security No. SPOUSE SS# PHONE provide an email address:

@ .com

1. WAGES FILING REQUIRED EVEN IF NO TAX DUE OR NO INCOME EARNED ALL W-2’S MUST BE ATTACHED

EMPLOYER CITY PAID TAX PAID CANTON TAX TOTAL W-2 WAGES

OTHER CITIES WITHHELD

TOTAL

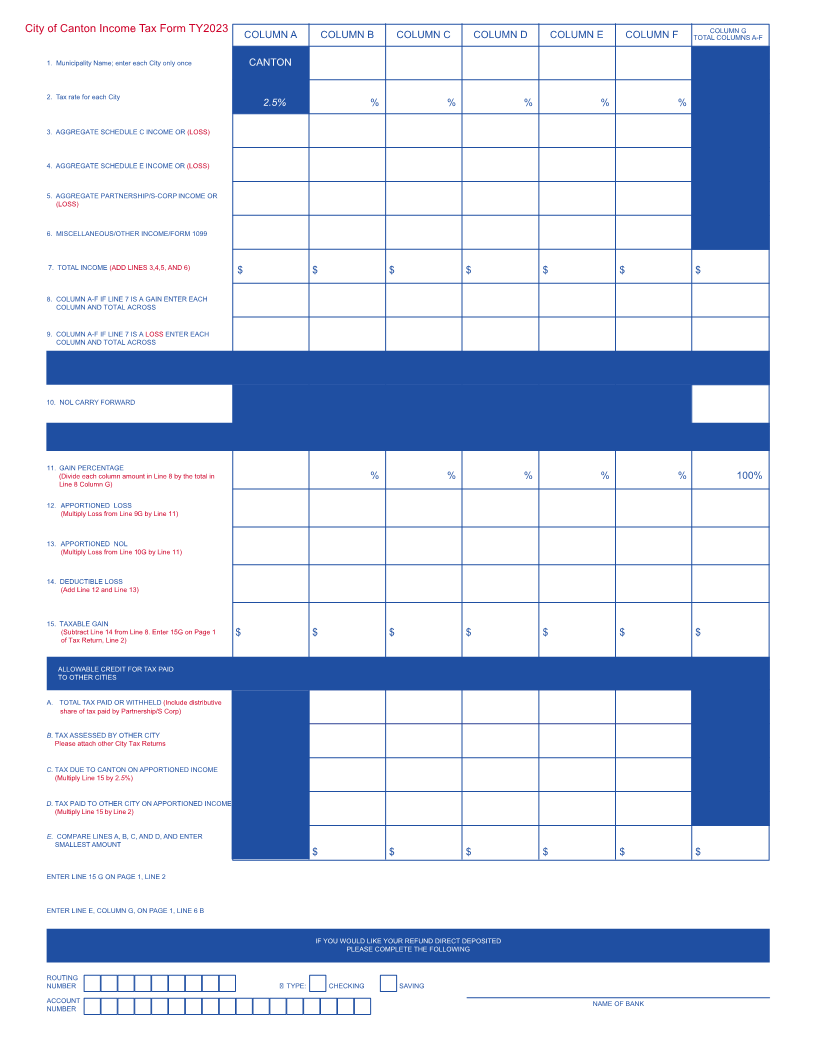

2. Total Income from Back of Form (if applicable) 2. $

3. Wages earned outside Canton by part year non-resident or prior to 18th birthday 3. Deduct $

4. Taxable Income (Add Lines 1 and 2 subtract Line 3) 4. $

5. Canton City Tax (2.5% of Line 4) 5. $

6. CREDITS

(a) Canton income tax withhold by employer(s) 6a $

(b) Municipal tax paid to other cities (not to exceed 2.5%) 6b $

(c) Payment of Declaration of Estimated Tax 6c $

(d) CREDIT ADJUSTMENT 6d $

(e) TOTAL CREDITS (add a, b, c, less d) 6e $

7. BALANCE DUE (If Line 5 exceeds Line 6e enter difference here) 7. $

8. Overpayment claimed (If Line 6e exceeds Line 5) 8. $

9. Credit to 2024 Estimate (If no estimate due use Line 10) 9. $

10. TO BE REFUNDED (If estimate due use Line 9) (Must be greater than $10.00) 10. $ For direct deposit of your refund, check box

and complete bank informaton on reverse side.

11. 11. $

12. Interest 0.83% per month 12. $

13. Penalty: 15% (see instructions) 13. $

14. Total amount due - MUST BE PAID IN FULL WITH THIS RETURN 14. $

NO ASSESSMENTS OR REFUNDS OF $10.00 OR LESS WILL BE COLLECTED OR REFUNDED.

MANDATORY DECLARATION OF ESTIMATED TAX FOR 2024

1. Total income subject to Canton tax $ Canton tax @ 2.5%. 1. $

if a local 2. LESS TAX TO BE WITHHELD 2. $

tax, of at 3. Balance estimated Canton tax 3. $

least 2.25% is 4. Less Credits: a. Overpayment on previous year’s return 4a. $

not withheld b. Other (Specify) 4b. $ Total Credits $

by your 5. Net tax due (Line 3 less total of Line 4) 5. $

employer 6. Amount paid with this return (not less than 1/4 X line 3 minus Line 4) Make remittance payable to: Kim R. Perez, Canton City Treasurer 6. $

7. Balance of Tax $

I CERTIFY I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY May we discuss this Yes

KNOWLEDGE, I BELIEVE IT IS TRUE, CORRECT, AND COMPLETE. tax return with preparer No

Signature of Person Preparing, If Other Than Taxpayer Date Signature of Taxpayer or Agent Required Date

Address or Name and Address of Firm Spouse Date

THIS SPACE FOR TAX OFFICE USE ONLY

AUDITED BY NEW ACCOUNT SUSP M/M POSTED TO BANKING DATE REFUND CK. NO.