Enlarge image

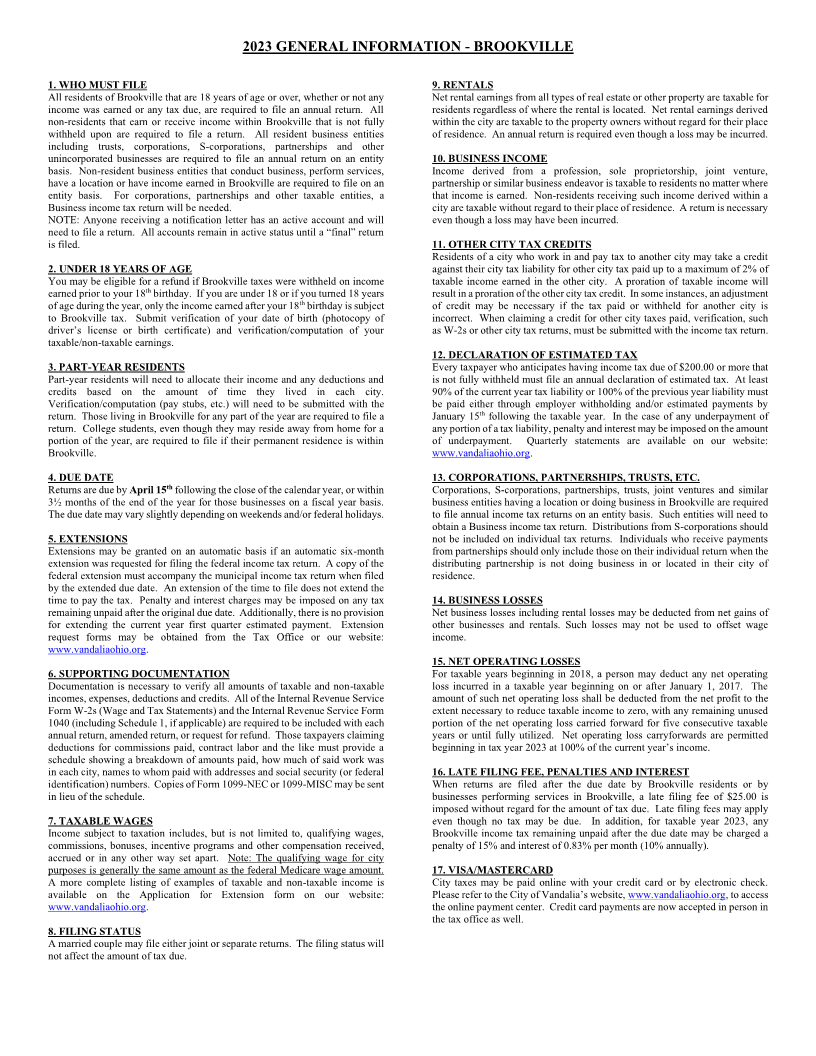

2023 GENERAL INFORMATION - BROOKVILLE

1. WHO MUST FILE 9. RENTALS

All residents of Brookville that are 18 years of age or over, whether or not any Net rental earnings from all types of real estate or other property are taxable for

income was earned or any tax due, are required to file an annual return. All residents regardless of where the rental is located. Net rental earnings derived

non-residents that earn or receive income within Brookville that is not fully within the city are taxable to the property owners without regard for their place

withheld upon are required to file a return. All resident business entities of residence. An annual return is required even though a loss may be incurred.

including trusts, corporations, S-corporations, partnerships and other

unincorporated businesses are required to file an annual return on an entity 10. BUSINESS INCOME

basis. Non-resident business entities that conduct business, perform services, Income derived from a profession, sole proprietorship, joint venture,

have a location or have income earned in Brookville are required to file on an partnership or similar business endeavor is taxable to residents no matter where

entity basis. For corporations, partnerships and other taxable entities, a that income is earned. Non-residents receiving such income derived within a

Business income tax return will be needed. city are taxable without regard to their place of residence. A return is necessary

NOTE: Anyone receiving a notification letter has an active account and will even though a loss may have been incurred.

need to file a return. All accounts remain in active status until a “final” return

is filed. 11. OTHER CITY TAX CREDITS

Residents of a city who work in and pay tax to another city may take a credit

2. UNDER 18 YEARS OF AGE against their city tax liability for other city tax paid up to a maximum of 2% of

You may be eligible for a refund if Brookville taxes were withheld on income taxable income earned in the other city. A proration of taxable income will

earned prior to your 18 thbirthday. If you are under 18 or if you turned 18 years result in a proration of the other city tax credit. In some instances, an adjustment

of age during the year, only the income earned after your 18 th birthday is subject of credit may be necessary if the tax paid or withheld for another city is

to Brookville tax. Submit verification of your date of birth (photocopy of incorrect. When claiming a credit for other city taxes paid, verification, such

driver’s license or birth certificate) and verification/computation of your as W-2s or other city tax returns, must be submitted with the income tax return.

taxable/non-taxable earnings.

12. DECLARATION OF ESTIMATED TAX

3. PART-YEAR RESIDENTS Every taxpayer who anticipates having income tax due of $200.00 or more that

Part-year residents will need to allocate their income and any deductions and is not fully withheld must file an annual declaration of estimated tax. At least

credits based on the amount of time they lived in each city. 90% of the current year tax liability or 100% of the previous year liability must

Verification/computation (pay stubs, etc.) will need to be submitted with the be paid either through employer withholding and/or estimated payments by

return. Those living in Brookville for any part of the year are required to file a January 15 thfollowing the taxable year. In the case of any underpayment of

return. College students, even though they may reside away from home for a any portion of a tax liability, penalty and interest may be imposed on the amount

portion of the year, are required to file if their permanent residence is within of underpayment. Quarterly statements are available on our website:

Brookville. www.vandaliaohio.org.

4. DUE DATE 13. CORPORATIONS, PARTNERSHIPS, TRUSTS, ETC.

Returns are due by April 15th following the close of the calendar year, or within Corporations, S-corporations, partnerships, trusts, joint ventures and similar

3½ months of the end of the year for those businesses on a fiscal year basis. business entities having a location or doing business in Brookville are required

The due date may vary slightly depending on weekends and/or federal holidays. to file annual income tax returns on an entity basis. Such entities will need to

obtain a Business income tax return. Distributions from S-corporations should

5. EXTENSIONS not be included on individual tax returns. Individuals who receive payments

Extensions may be granted on an automatic basis if an automatic six-month from partnerships should only include those on their individual return when the

extension was requested for filing the federal income tax return. A copy of the distributing partnership is not doing business in or located in their city of

federal extension must accompany the municipal income tax return when filed residence.

by the extended due date. An extension of the time to file does not extend the

time to pay the tax. Penalty and interest charges may be imposed on any tax 14. BUSINESS LOSSES

remaining unpaid after the original due date. Additionally, there is no provision Net business losses including rental losses may be deducted from net gains of

for extending the current year first quarter estimated payment. Extension other businesses and rentals. Such losses may not be used to offset wage

request forms may be obtained from the Tax Office or our website: income.

www.vandaliaohio.org.

15. NET OPERATING LOSSES

6. SUPPORTING DOCUMENTATION For taxable years beginning in 2018, a person may deduct any net operating

Documentation is necessary to verify all amounts of taxable and non-taxable loss incurred in a taxable year beginning on or after January 1, 2017. The

incomes, expenses, deductions and credits. All of the Internal Revenue Service amount of such net operating loss shall be deducted from the net profit to the

Form W-2s (Wage and Tax Statements) and the Internal Revenue Service Form extent necessary to reduce taxable income to zero, with any remaining unused

1040 (including Schedule 1, if applicable) are required to be included with each portion of the net operating loss carried forward for five consecutive taxable

annual return, amended return, or request for refund. Those taxpayers claiming years or until fully utilized. Net operating loss carryforwards are permitted

deductions for commissions paid, contract labor and the like must provide a beginning in tax year 2023 at 100% of the current year’s income.

schedule showing a breakdown of amounts paid, how much of said work was

in each city, names to whom paid with addresses and social security (or federal 16. LATE FILING FEE, PENALTIES AND INTEREST

identification) numbers. Copies of Form 1099-NEC or 1099-MISC may be sent When returns are filed after the due date by Brookville residents or by

in lieu of the schedule. businesses performing services in Brookville, a late filing fee of $25.00 is

imposed without regard for the amount of tax due. Late filing fees may apply

7. TAXABLE WAGES even though no tax may be due. In addition, for taxable year 2023, any

Income subject to taxation includes, but is not limited to, qualifying wages, Brookville income tax remaining unpaid after the due date may be charged a

commissions, bonuses, incentive programs and other compensation received, penalty of 15% and interest of 0.83% per month (10% annually).

accrued or in any other way set apart. Note: The qualifying wage for city

purposes is generally the same amount as the federal Medicare wage amount. 17. VISA/MASTERCARD

A more complete listing of examples of taxable and non-taxable income is City taxes may be paid online with your credit card or by electronic check.

available on the Application for Extension form on our website: Please refer to the City of Vandalia’s website, www.vandaliaohio.org, to access

www.vandaliaohio.org. the online payment center. Credit card payments are now accepted in person in

the tax office as well.

8. FILING STATUS

A married couple may file either joint or separate returns. The filing status will

not affect the amount of tax due.