Enlarge image

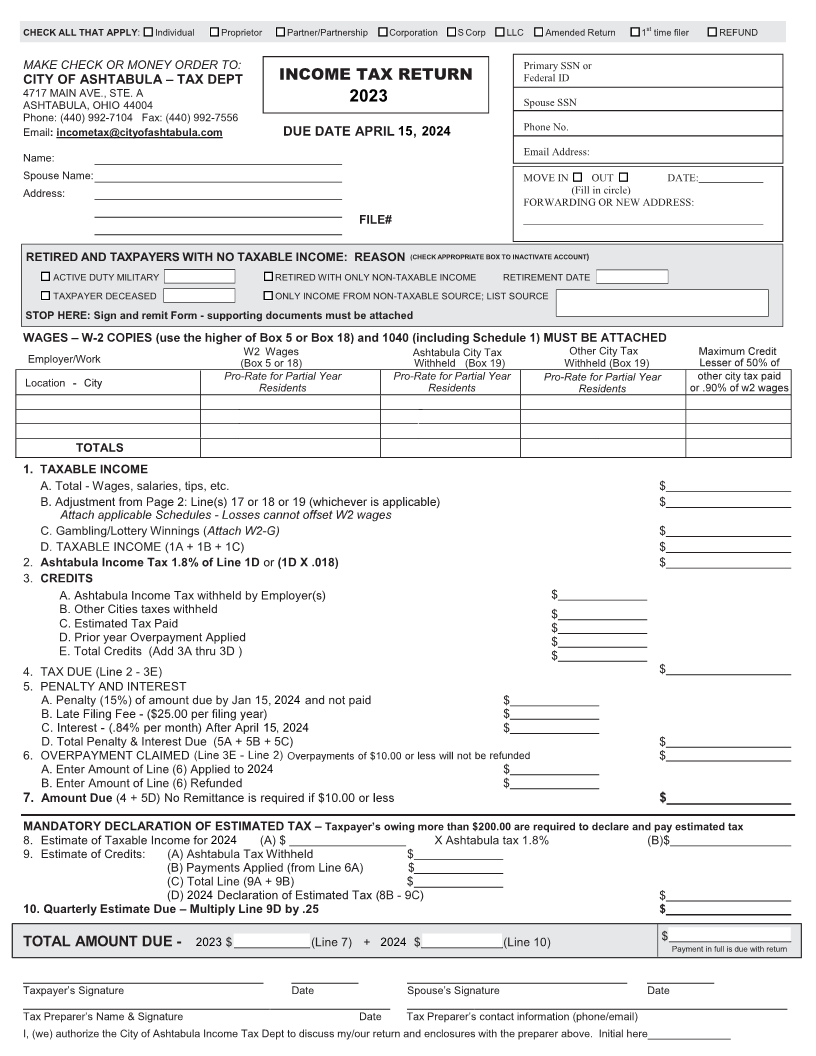

CHECK ALL THAT APPLY: Individual Proprietor Partner/Partnership Corporation S Corp LLC Amended Return 1 time filer st REFUND

MAKE CHECK OR MONEY ORDER TO: Primary SSN or

CITY OF ASHTABULA TAX DEPT – INCOME TAX RETURN Federal ID

4717 MAIN AVE., STE. A 2023

ASHTABULA, OHIO 44004 Spouse SSN

Phone: (440) 992-7104 Fax: (440) 992-7556

Email: incometax@cityofashtabula.com DUE DATE APRIL 15, 2024 Phone No.

Name: Email Address:

Spouse Name: MOVE IN OUT DATE:

Address: (Fill in circle)

FORWARDING OR NEW ADDRESS:

FILE#

RETIRED AND TAXPAYERS WITH NO TAXABLE INCOME: REASON (CHECK APPROPRIATE BOX TO INACTIVATE ACCOUNT)

ACTIVE DUTY MILITARY RETIRED WITH ONLY NON-TAXABLE INCOME RETIREMENT DATE

TAXPAYER DECEASED ONLY INCOME FROM NON-TAXABLE SOURCE; LIST SOURCE

STOP HERE: Sign and remit Form - supporting documents must be attached

W2 Wages Ashtabula City Tax Other City Tax

Employer/Work (Box 5 or 18) Withheld (Box 19) Withheld (Box 19)

Pro-Rate for Partial Year Pro-Rate for Partial Year Pro-Rate for Partial Year

Location Residents Residents Residents

TOTALS

1. TAXABLE INCOME

A. Total - Wages, salaries, tips, etc. $

$

C. Gambling/Lottery Winnings ( $

D. + $

2. Ashtabula Income Tax 1.8% of Line 1D (1D X .018)or $

3. CREDITS

A. Ashtabula Income Tax withheld by Employer $

B. Other Cities taxes withheld $

C. Es timated Tax Pai d $

D. Pr ior year Over payment Appl ied $

E. Total Credits (Add 3A thru 3D ) $

4. TAX DUE (Line 2 - 3E) $

5. PENALTY AND INTEREST

A. Penalty (15%) of amount due by Jan 15, 2024 and not paid $

$

15 2024 $

D. Total Penalty & Interest Due (5A + 5B + 5C) $

6. OVERPAYMENT CLAIMED $

A. Enter Amount of Line (6) Applied to 2024 $

B. En te Amount o Li ne (6) unded $

7. Amount Due $

MANDATORY DECLARATION OF ESTIMATED TAX – Taxpayer’s owing more than $200.00 are required to declare and pay estimated tax

8. Estimate of Taxable Income for 2024 (A) $ X Ashtabula tax 1.8% (B)$

9. Estimate of Credits: (A) Ashtabula Tax Withheld $

(B) Payments Applied (from Line A) $

(C) Total Line ( A + B) $

(D) 2024 $

10. Quarterly Estimate Due Multiply Line 9D by .25– $

$

TOTAL AMOUNT DUE - 2023 $ (Line 7) + 2024 $ (Line 10) Payment in full is due with return

____________________________________ __________ _________________________________ __________

Taxpayer’s Signature Date Spouse’s Signature Date

_______________________________________________________ _________________________________________________________

Tax Preparer’s Name & Signature Date Tax Preparer’s contact information (phone/email)

I, (we) authorize the City of Ashtabula Income Tax Dept to discuss my/our return and enclosures with the preparer above. Initial here______________