Enlarge image

Instructions for Form NC-5X, Amended Withholding Return

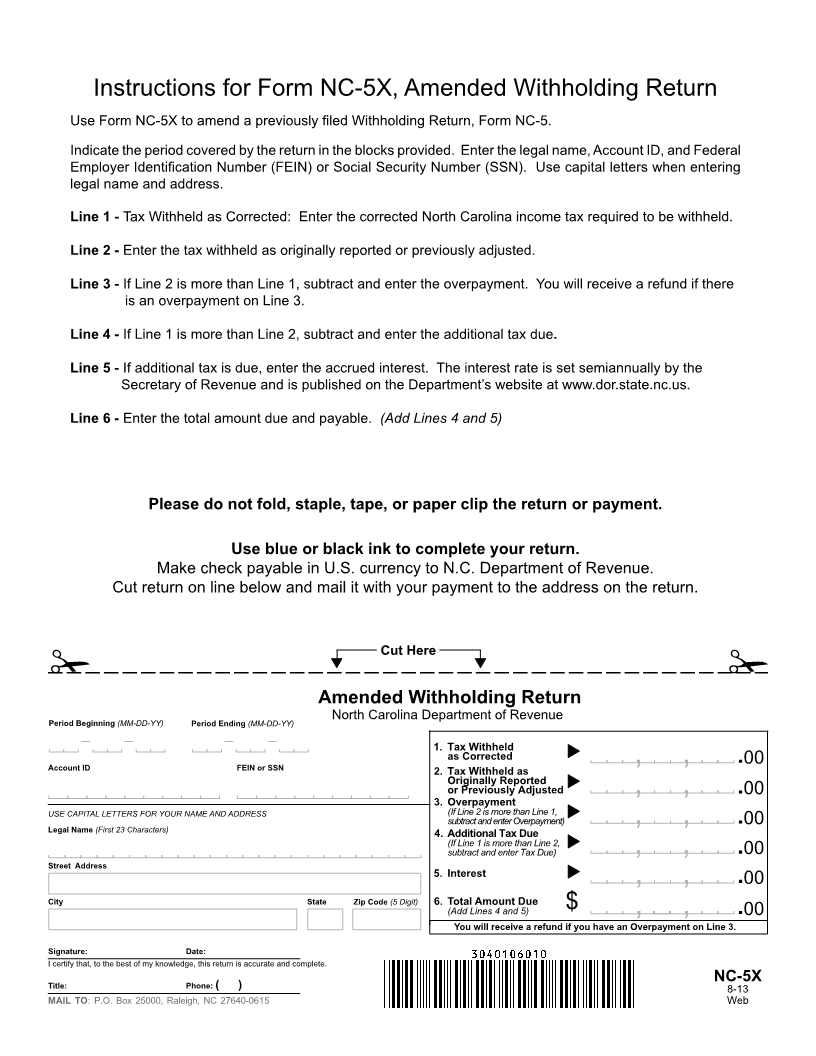

Use Form NC-5X to amend a previously filed Withholding Return, Form NC-5.

Indicate the period covered by the return in the blocks provided. Enter the legal name, Account ID, and Federal

Employer Identification Number (FEIN) or Social Security Number (SSN). Use capital letters when entering

legal name and address.

Line 1 - Tax Withheld as Corrected: Enter the corrected North Carolina income tax required to be withheld.

Line 2 - Enter the tax withheld as originally reported or previously adjusted.

Line 3 - If Line 2 is more than Line 1, subtract and enter the overpayment. You will receive a refund if there

is an overpayment on Line 3.

Line 4 - If Line 1 is more than Line 2, subtract and enter the additional tax due .

Line 5 - If additional tax is due, enter the accrued interest. The interest rate is set semiannually by the

Secretary of Revenue and is published on the Department’s website at www.dor.state.nc.us.

Line 6 - Enter the total amount due and payable. (Add Lines 4 and 5)

Please do not fold, staple, tape, or paper clip the return or payment.

Use blue or black ink to complete your return.

Make check payable in U.S. currency to N.C. Department of Revenue.

Cut return on line below and mail it with your payment to the address on the return.

Cut Here

Amended Withholding Return

Period Beginning (MM-DD-YY) Period Ending (MM-DD-YY) North Carolina Department of Revenue

1. Tax Withheld

as Corrected

Account ID FEIN or SSN , , .00

2. Tax Withheld as

Originally Reported

or Previously Adjusted , , .00

3. Overpayment

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS (If Line 2 is more than Line 1,

subtract and enter Overpayment) , , 00

.

Legal Name (First 23 Characters) 4. Additional Tax Due

(If Line 1 is more than Line 2,

subtract and enter Tax Due) , , .00

Street Address

5. Interest

, , .00

City State Zip Code (5 Digit) 6. Total Amount Due

(Add Lines 4 and 5) $ 00

, , .

You will receive a refund if you have an Overpayment on Line 3.

Signature: Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Title: Phone: ( ) NC-5X

8-13

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0615 Web