- 3 -

Enlarge image

|

Gen-53 Instr. General Instructions

Web-Fill

3-20

PURPOSE OF THIS FORM

The NC Department of Revenue’s e-Business Center is a secure web-based system within our website where you can file and pay taxes, store payment

and business information for reuse, view history of online tax transactions and conduct other business with us. This form is used to grant access to a

taxpayer representative (such as an accountant or payroll company representative) to view tax history and manage payment information for a taxpayer

in the e-Business Center. Note: Representatives must first create an NCID user ID and password before submitting this form.

AUTHORITY GRANTED

The authority granted by this form is effective beginning with the period indicated in Step 3 and continues indefinitely unless revoked by the taxpayer or

taxpayer representative.

REVOKING THE AUTHORIZATION

The taxpayer can revoke the taxpayer representative authorization granted on this form at any time by contacting the Department in writing.

The taxpayer can:

• Write “Revoke” at the top of a copy of this form and sign under the original signature, or

• The taxpayer can write a letter requesting revocation and submit it to the NC Department of Revenue at PO Box 25000, Raleigh, NC 27640-0005

or fax it to 919-715-1786. The statement of revocation must be signed by the taxpayer.

If the taxpayer wants to appoint a new taxpayer representative, the taxpayer can submit a new Taxpayer Representative e-Business Center Access

Authorization to the same address. It is the responsibility of the taxpayer to advise the NC Department of Revenue if access authorization information has

changed.

A taxpayer representative can withdraw from representation by filing a statement with the NC Department of Revenue. The statement must be signed and

dated by the representative and include the name and address of the taxpayer(s) and a statement revoking the e-Business Center access authorization.

Include a copy of the original Taxpayer Representative e-Business Center Access Authorization, if available.

DEFINITIONS

Taxpayer – The business which authorizes the taxpayer representative to view its tax history and manage its payment information in the e-Business

Center.

Taxpayer Representative - A third party individual such as an attorney, an accountant, or a payroll company representative that is hired by a taxpayer

to represent it on tax matters that might include filing tax returns and paying the tax and viewing copies of tax returns. The taxpayer representative is

independent of the taxpayer.

Taxpayer Representative’s Company Name – The company that employs the taxpayer representative, if applicable.

View Tax History - This access allows you to view returns and/or payments made online using the e-Business Center.

Manage Payment Information – This access allows you to save and update payment information in the e-Business Center for online payment of tax.

The payment types include bank draft, and Mastercard and Visa credit/ debit card.

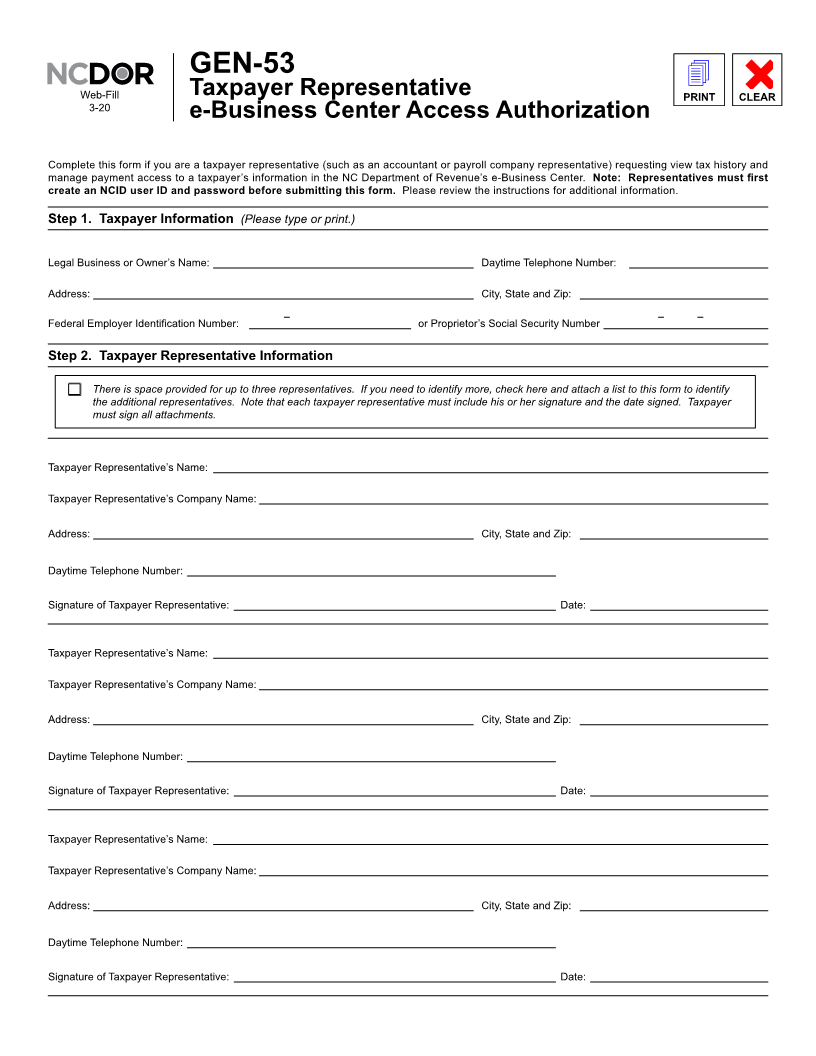

STEP 1: TAXPAYER INFORMATION INSTRUCTIONS

• Enter the taxpayer business’ legal name, or the owner’s name if the business is a sole proprietorship, telephone number and address.

• Federal Employer Identification Number or Social Security Number.

- If the business is a corporation, provide the Federal Employer Identification Number.

- If the business is a sole proprietorship, provide the owner’s Social Security Number.

STEP 2: TAXPAYER REPRESENTATIVE INFORMATION

• Enter the taxpayer representative’s name, taxpayer representative’s company name, address and telephone number. Note: Only individuals may

be named as representatives.

• The taxpayer representative signs and dates form here.

• There is space provided on the form for up to three representatives. If you need to identify more, check the box and attach a list to the form to

identify additional representatives. Note that each taxpayer representative must include their signature and the date signed.

• All representatives must first create an NCID user ID and password before submitting this form. If you submit Form GEN-53 without first registering

for an NCID, the form cannot be processed and will be returned to you. Instructions for creating an NCID are available on the Department’s website

at www.ncdor.gov.

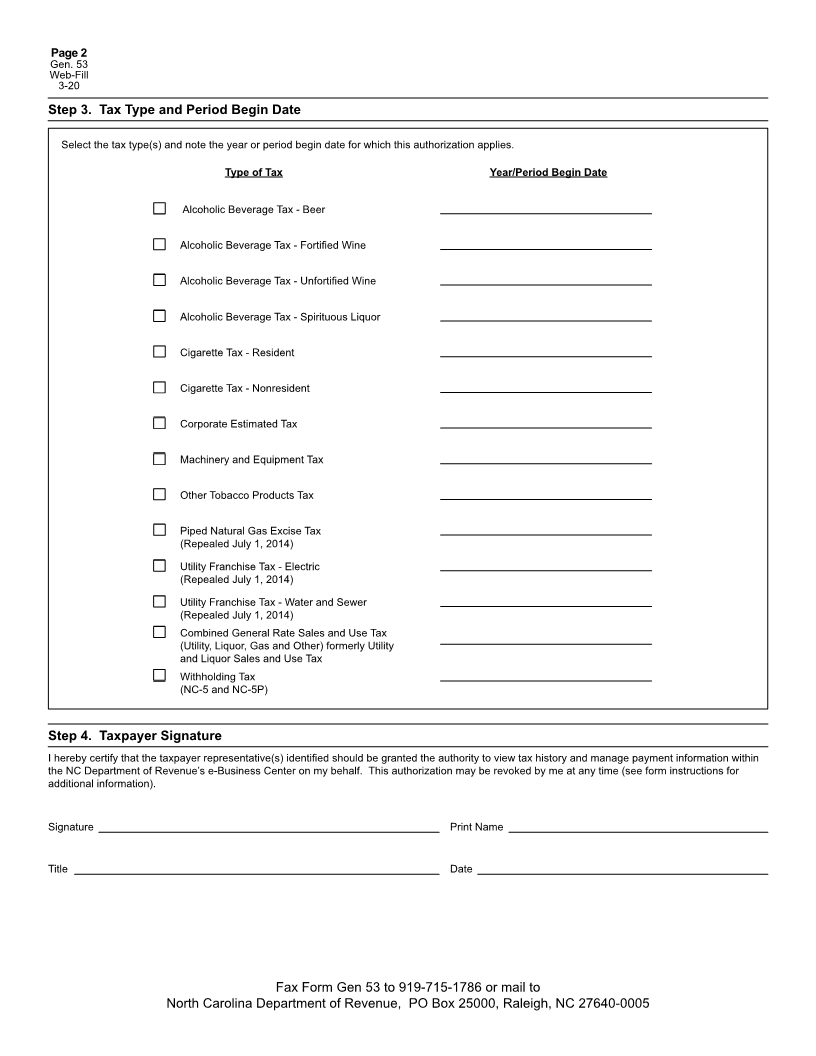

STEP 3: TAX TYPE AND PERIOD BEGIN DATE

Enter the tax type(s) and the period begin date(s) associated with that tax type for which the taxpayer representative is being granted access. For example,

if you are a monthly withholding taxpayer and you are granting access to a taxpayer representative beginning with the February 01, 2009 period, select the

withholding tax type and enter 02-01-09 (Format: mm-dd-yy) in the period begin date field.

STEP 4: TAXPAYER SIGNATURE

The taxpayer signs here to grant view tax history and manage payment information in the Department’s e-Business Center to the taxpayer representative.

• If the taxpayer is a sole proprietorship, the owner must sign.

• If the taxpayer is a corporation, an authorized officer must sign.

• If the taxpayer is a partnership or a limited liability company (LLC), an authorized partner or member must sign.

• Taxpayers must sign all attachments, if any.

|